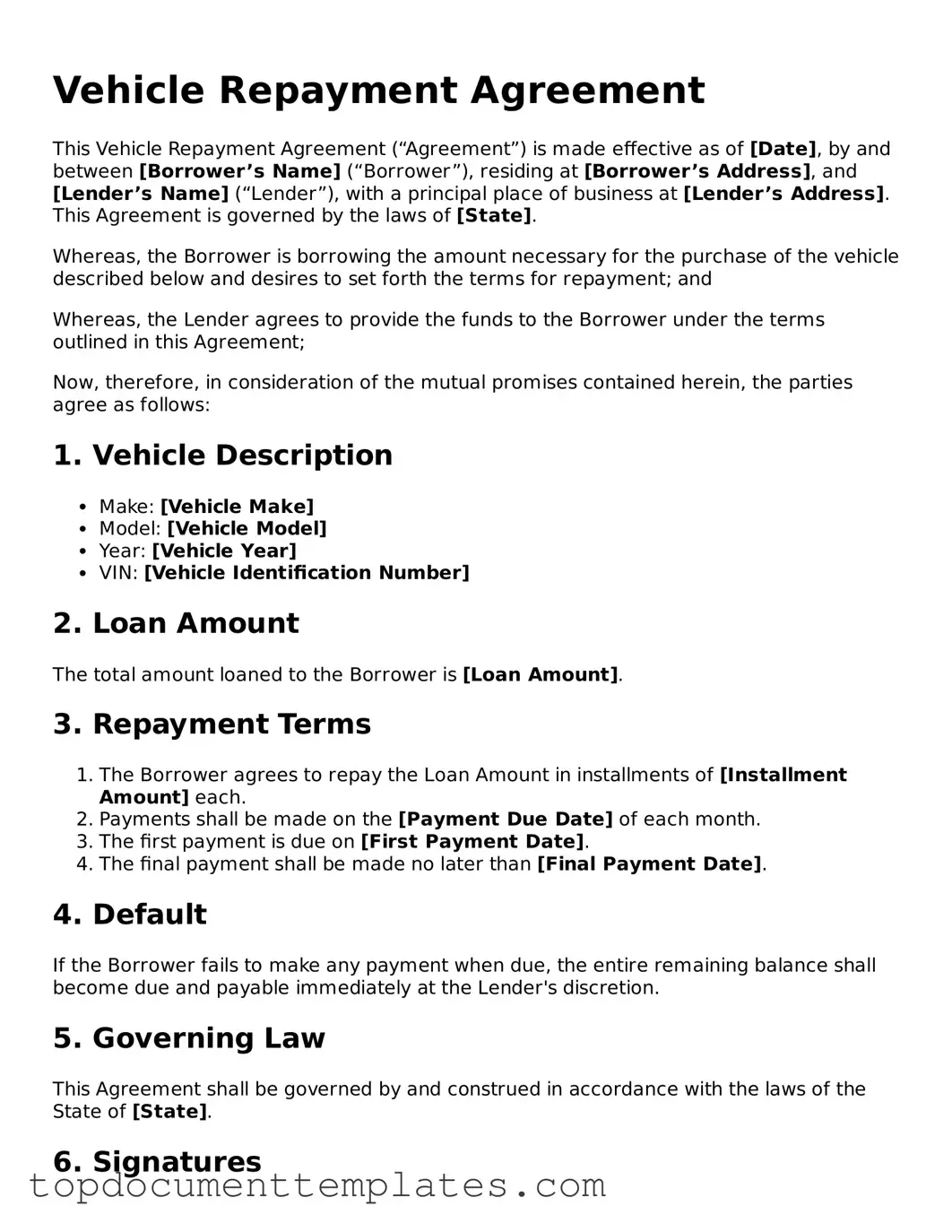

Official Vehicle Repayment Agreement Template

The Vehicle Repayment Agreement form serves as a crucial document in the realm of vehicle financing and loan agreements. This form outlines the terms and conditions under which a borrower agrees to repay a loan taken out for the purchase of a vehicle. Key aspects include the total amount financed, the interest rate, and the repayment schedule. Additionally, it specifies any fees associated with late payments and the consequences of defaulting on the loan. The agreement also typically includes information about the vehicle itself, such as its make, model, and identification number. By detailing these elements, the form aims to protect both the lender's and borrower's interests, ensuring clarity and understanding of the obligations involved in the repayment process. This document is essential for fostering transparent communication between the parties and can serve as a reference in case of disputes or misunderstandings in the future.

Similar forms

The Vehicle Repayment Agreement form shares similarities with several other documents commonly used in financial transactions and agreements. Below is a list of seven documents that have comparable features and functions:

- Loan Agreement: Like the Vehicle Repayment Agreement, a loan agreement outlines the terms of borrowing money. It specifies repayment schedules, interest rates, and consequences for defaulting on payments.

- Lease Agreement: This document governs the rental of a vehicle, detailing the terms of use, payment obligations, and conditions for returning the vehicle. Both agreements focus on the responsibilities of the parties involved.

- Promissory Note: A promissory note serves as a written promise to pay a specific amount of money at a designated time. Similar to a Vehicle Repayment Agreement, it includes payment terms and conditions.

- Investment Letter of Intent: Before making an investment commitment, review our informative Investment Letter of Intent resources to understand the key terms and ensure a mutual agreement.

- Sales Contract: When purchasing a vehicle, a sales contract outlines the purchase price, payment method, and any warranties. This document shares the same goal of establishing clear financial obligations.

- Credit Agreement: This document details the terms under which credit is extended to a borrower. Like the Vehicle Repayment Agreement, it specifies repayment terms and interest rates.

- Security Agreement: A security agreement provides collateral for a loan. It is similar in that it protects the lender's interests, just as a Vehicle Repayment Agreement does in the context of vehicle financing.

- Debt Settlement Agreement: This document outlines the terms under which a debtor agrees to pay a reduced amount to settle a debt. Both agreements aim to clarify payment terms and prevent misunderstandings.

Guidelines on Writing Vehicle Repayment Agreement

After obtaining the Vehicle Repayment Agreement form, it is essential to complete it accurately to ensure the repayment process proceeds smoothly. Follow these steps carefully to fill out the form correctly.

- Begin by entering your full name in the designated field at the top of the form.

- Next, provide your current address, including city, state, and zip code.

- In the following section, enter your contact information, including your phone number and email address.

- Fill in the details of the vehicle, such as the make, model, year, and Vehicle Identification Number (VIN).

- Indicate the total amount owed on the vehicle and the proposed repayment amount.

- Specify the repayment schedule, including the frequency of payments (weekly, bi-weekly, or monthly) and the start date.

- Sign and date the form at the bottom, confirming your agreement to the terms outlined.

Once the form is completed, ensure that you keep a copy for your records. Submit the form to the appropriate party as instructed, and monitor the repayment process closely.

File Information

| Fact Name | Description |

|---|---|

| Purpose | The Vehicle Repayment Agreement form is designed to outline the terms and conditions under which a borrower agrees to repay a loan for a vehicle. |

| Governing Laws | In many states, the agreement is governed by the Uniform Commercial Code (UCC), along with specific state laws related to consumer credit and vehicle financing. |

| Essential Components | This form typically includes details such as the loan amount, interest rate, repayment schedule, and any penalties for late payments. |

| Signatures Required | Both the borrower and lender must sign the agreement to make it legally binding, ensuring both parties are aware of their obligations. |

| Importance of Clarity | Clear terms in the Vehicle Repayment Agreement help prevent misunderstandings and disputes, protecting the rights of both the borrower and the lender. |

Consider Other Forms

Constating Documents - They signify a commitment to operate in compliance with state laws and regulations.

When seeking to gain admission into a sorority, it is essential to have a supportive document like a recommendation letter, which you can learn more about at TopTemplates.info. This letter not only outlines the qualifications of a potential member but also provides a personal touch that enhances the application.

Imm1294 - Disclosures to law enforcement may be made for identity verification purposes.