Official Transfer-on-Death Deed Template

The Transfer-on-Death Deed (TODD) form serves as a valuable estate planning tool that allows individuals to designate beneficiaries for their real property. This form enables property owners to transfer their assets directly to their chosen heirs upon their passing, bypassing the often lengthy and costly probate process. By completing a TODD, individuals can maintain control over their property during their lifetime while ensuring a smooth transition of ownership after death. It is essential to understand that this deed only applies to real estate and does not affect other assets, such as bank accounts or personal belongings. Additionally, the TODD must be properly executed and recorded to be valid, which typically involves signing in front of a notary and filing with the appropriate local office. This straightforward process can provide peace of mind, knowing that loved ones will receive the property without unnecessary complications. Understanding the nuances of the Transfer-on-Death Deed form is crucial for anyone looking to simplify their estate planning and secure their legacy for future generations.

Similar forms

- Will: Like a Transfer-on-Death Deed, a will outlines how a person's assets should be distributed after their death. However, a will typically goes through probate, while a Transfer-on-Death Deed avoids this process.

- Last Will and Testament: A Last Will and Testament is essential for outlining your wishes regarding asset distribution after death and appointing guardians for minor children. For more information, you can visit https://documentonline.org/blank-last-will-and-testament/.

- Living Trust: A living trust allows for the management of assets during a person's lifetime and distribution after death. Both documents can help avoid probate, but a living trust is more comprehensive in managing assets.

- Beneficiary Designation: Similar to a Transfer-on-Death Deed, beneficiary designations on accounts (like life insurance or retirement accounts) allow assets to pass directly to named individuals without going through probate.

- Joint Tenancy: Properties held in joint tenancy automatically transfer to the surviving owner upon death. This is similar to the Transfer-on-Death Deed, which also facilitates direct transfer of property without probate.

- Payable-on-Death (POD) Accounts: These bank accounts allow the owner to designate a beneficiary who will receive the funds upon the owner’s death, similar to how a Transfer-on-Death Deed designates heirs for property.

- Life Estate Deed: A life estate deed allows a person to live in a property for their lifetime, with the property passing to another upon their death. This is somewhat similar to a Transfer-on-Death Deed in terms of transferring ownership after death.

- Community Property with Right of Survivorship: In some states, this arrangement allows spouses to own property together, with the surviving spouse automatically receiving the property upon the other’s death, similar to the Transfer-on-Death Deed.

- Revocable Trust: A revocable trust can be changed or revoked during the grantor's lifetime. It provides a way to manage assets and pass them on after death, akin to the Transfer-on-Death Deed in avoiding probate.

Transfer-on-Death Deed - Tailored for State

Guidelines on Writing Transfer-on-Death Deed

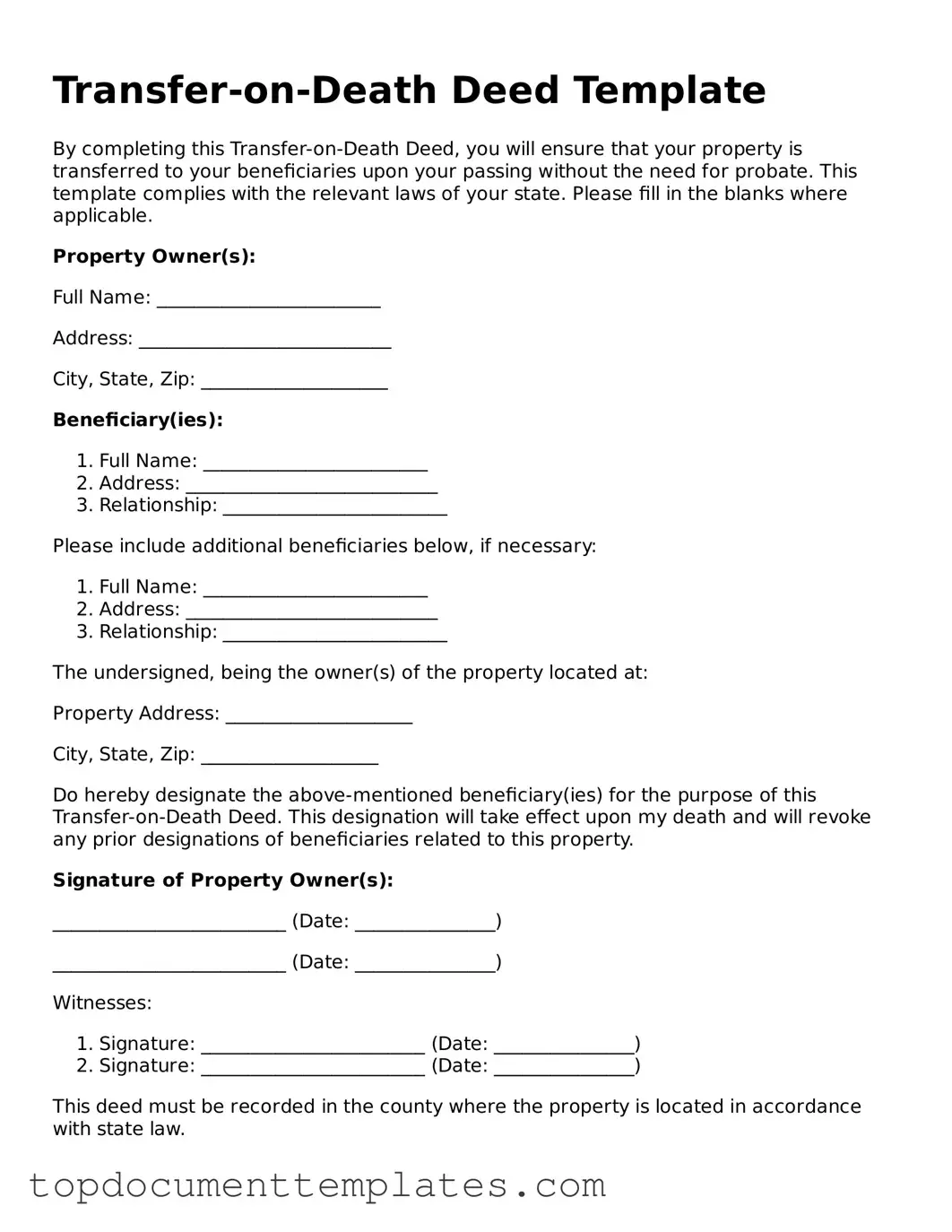

After obtaining the Transfer-on-Death Deed form, it’s important to complete it accurately to ensure a smooth transfer of property upon death. Follow these steps carefully to fill out the form correctly.

- Begin by entering your name as the owner of the property. Ensure that it matches the name on the property title.

- Provide your address, including city, state, and ZIP code.

- Next, identify the property you wish to transfer. Include the full legal description, which can typically be found on your property deed.

- List the name of the beneficiary or beneficiaries who will receive the property. This can be one person or multiple individuals.

- Include the beneficiaries' addresses, ensuring they are current and accurate.

- Sign the form in the designated area. Your signature must be notarized to validate the document.

- Lastly, make copies of the completed form for your records and for the beneficiaries.

Once the form is filled out and notarized, it needs to be filed with the appropriate local government office, such as the county recorder’s office, to become effective. This step is crucial to ensure that the transfer is legally recognized.

File Information

| Fact Name | Description |

|---|---|

| Definition | A Transfer-on-Death Deed (TOD) allows an individual to transfer real estate to beneficiaries upon their death without going through probate. |

| State-Specific Forms | Each state has its own version of the TOD deed. For example, California's form is governed by California Probate Code Section 5600-5690. |

| Revocability | The deed can be revoked or changed at any time before the owner's death, providing flexibility to the property owner. |

| Beneficiary Designation | Property owners can designate one or more beneficiaries, allowing for a straightforward transfer to loved ones. |

| No Immediate Transfer | The transfer of property does not occur until the owner's death, allowing the owner to retain full control during their lifetime. |

| Tax Implications | Property transferred via a TOD deed may not be subject to gift taxes, but estate taxes could apply upon the owner's death. |

| Filing Requirements | The deed must be recorded with the appropriate county office to be effective, ensuring the transfer is legally recognized. |

| Limitations | Not all types of property can be transferred using a TOD deed. For instance, some states may restrict its use to residential real estate. |

Find Other Types of Transfer-on-Death Deed Templates

Gift Deed Form - This document can reflect personal values regarding giving.

Utilizing an effective resource such as the OnlineLawDocs.com can greatly enhance the experience of managing your Dnd Character Sheet form, ensuring that players have access to helpful tools that streamline the process of character development and gameplay.

What Is a Deed-in-lieu of Foreclosure? - A Deed in Lieu of Foreclosure allows a homeowner to transfer property ownership to the lender to avoid foreclosure.