Valid Transfer-on-Death Deed Form for Texas State

In the state of Texas, estate planning can often feel overwhelming, but the Transfer-on-Death Deed (TODD) offers a streamlined solution for property owners looking to simplify the transfer of real estate upon their death. This legal document allows individuals to designate beneficiaries who will automatically inherit their property without the need for probate, making the process smoother and more efficient for loved ones. By utilizing the TODD, property owners can maintain full control over their assets during their lifetime, while also ensuring a clear path for the transfer of ownership after their passing. This deed can be particularly beneficial for those who wish to avoid the complexities and costs associated with traditional estate planning methods. Furthermore, the TODD is versatile, applicable to a range of property types, including single-family homes and vacant lots. Understanding the requirements and implications of this deed is essential for anyone considering it as part of their estate plan, as it involves specific steps and conditions that must be met to ensure its validity and effectiveness.

Similar forms

-

Last Will and Testament: Like a Transfer-on-Death Deed, a Last Will outlines how your assets will be distributed after your death. However, a will goes through probate, while a Transfer-on-Death Deed allows for direct transfer without court involvement.

- Non-disclosure Agreement: A Florida Non-disclosure Agreement form is essential for protecting confidential information and trade secrets, similar to how a TOD Deed secures property transfer. For more details, visit OnlineLawDocs.com.

-

Living Trust: A Living Trust also facilitates the transfer of assets upon death, similar to a Transfer-on-Death Deed. However, a trust can manage assets during your lifetime and may provide additional benefits like avoiding probate.

-

Beneficiary Designation: This document allows you to name beneficiaries for certain accounts, such as retirement accounts or life insurance policies. Like a Transfer-on-Death Deed, it ensures that assets pass directly to the named individuals without going through probate.

-

Payable-on-Death (POD) Accounts: A POD account allows you to designate a beneficiary who will receive the funds in the account upon your death. This is similar to a Transfer-on-Death Deed in that it bypasses probate and allows for a smooth transfer of assets.

-

Joint Tenancy with Right of Survivorship: This form of property ownership allows two or more people to own property together. Upon the death of one owner, the property automatically passes to the surviving owner(s), similar to how a Transfer-on-Death Deed works.

Guidelines on Writing Texas Transfer-on-Death Deed

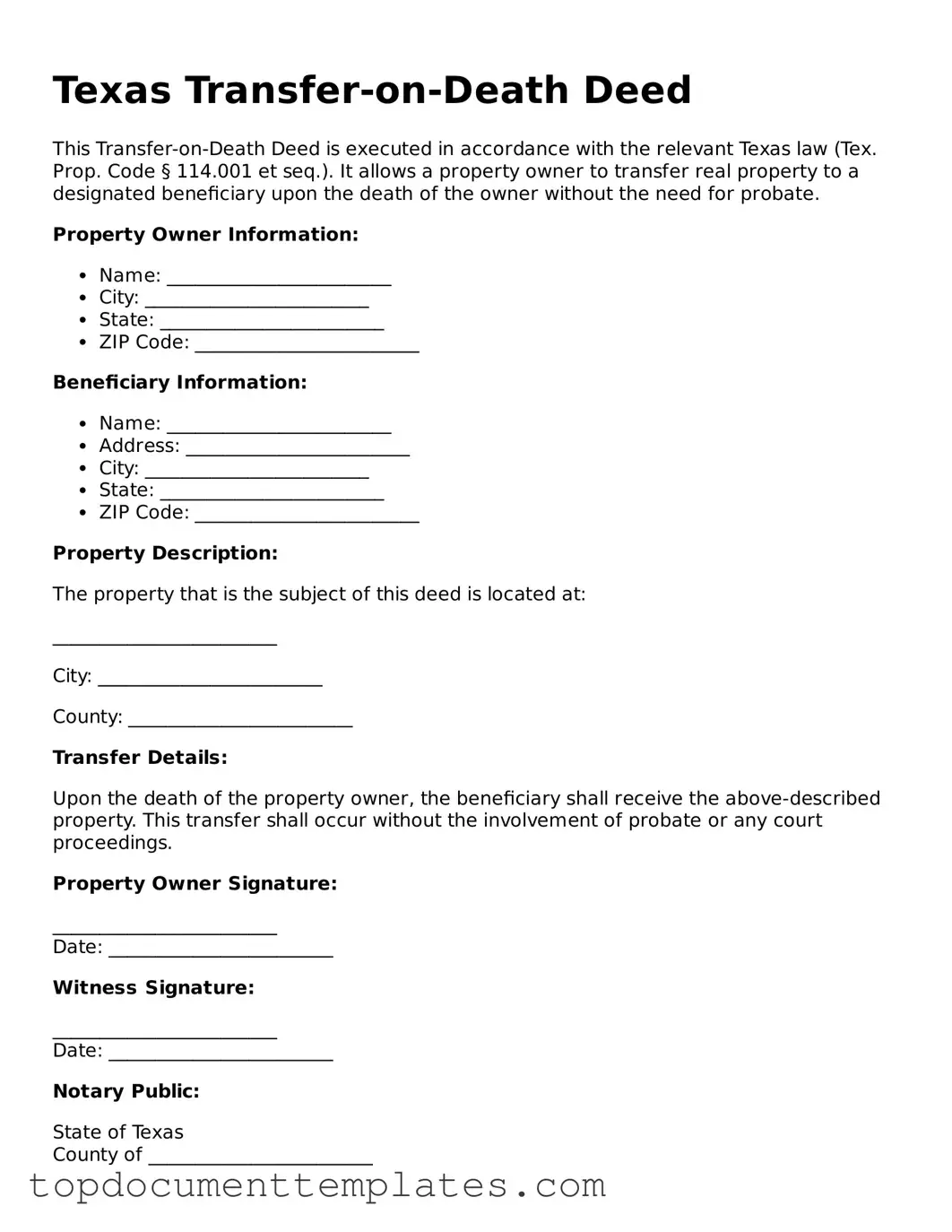

Once you have the Texas Transfer-on-Death Deed form ready, you can start filling it out. This process involves providing specific information about the property and the beneficiaries. Follow the steps below to ensure you complete the form correctly.

- Begin by writing your name as the current owner of the property at the top of the form.

- Provide your address, including the city, state, and zip code.

- Next, identify the property you want to transfer. Include the legal description of the property, which can usually be found on your property deed.

- List the name(s) of the beneficiary or beneficiaries who will receive the property after your death.

- Include the address(es) of the beneficiary or beneficiaries to ensure proper identification.

- Sign and date the form. Make sure to do this in front of a notary public to ensure it is legally binding.

- Finally, file the completed form with the county clerk’s office in the county where the property is located. Keep a copy for your records.

File Information

| Fact Name | Description |

|---|---|

| Purpose | The Texas Transfer-on-Death Deed allows property owners to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | This deed is governed by Texas Property Code, Chapter 114, which outlines the requirements and procedures for creating a valid Transfer-on-Death Deed. |

| Revocability | Property owners can revoke or change the Transfer-on-Death Deed at any time during their lifetime, ensuring flexibility in estate planning. |

| Beneficiary Designation | Multiple beneficiaries can be named, and property can be divided among them, allowing for tailored estate distribution according to the owner's wishes. |

Other Popular Transfer-on-Death Deed State Forms

How to Avoid Probate in Georgia - This deed can be a part of a larger estate plan, complementing other documents you may have.

For those seeking to understand property transfers, a well-crafted Quitclaim Deed can be crucial in facilitating the process. More insight on how to correctly use this form can be found in our guide to the Quitclaim Deed form requirements at Quitclaim Deed form requirements.

Survivorship Deed Vs Transfer on Death - Can be revoked or altered at any time before your death, ensuring flexibility in your estate planning.

How to Transfer Property After Death - Upon the owner’s death, the beneficiary typically only needs to provide a death certificate to claim the property.

Transfer on Death Deed Illinois Cost - Not all states recognize Transfer-on-Death Deeds, so it's essential to check your local laws.