Valid Promissory Note Form for Texas State

The Texas Promissory Note form serves as a crucial financial instrument in lending transactions within the state, facilitating the borrowing and repayment of money between parties. This legally binding document outlines the terms of the loan, including the principal amount borrowed, the interest rate, and the repayment schedule. It often includes provisions related to late fees, default conditions, and the rights of both the lender and borrower in the event of non-payment. Additionally, the form may specify whether the loan is secured or unsecured, impacting the lender's recourse in case of default. Understanding the nuances of this form is essential for both individuals and businesses engaged in financial agreements, as it ensures clarity and protection for all parties involved. By adhering to Texas law, the Promissory Note not only formalizes the transaction but also provides a framework for resolving disputes should they arise.

Similar forms

- Loan Agreement: Similar to a promissory note, a loan agreement outlines the terms of borrowing money. It details the amount borrowed, interest rates, repayment schedule, and any collateral involved. While a promissory note is often simpler, both documents serve to formalize a lender-borrower relationship.

Articles of Incorporation: The https://documentonline.org/blank-new-york-articles-of-incorporation form is essential for establishing a corporation, outlining crucial components such as name and purpose.

- Mortgage: A mortgage is a specific type of loan agreement used to secure financing for real estate. Like a promissory note, it includes repayment terms and interest rates. However, a mortgage also involves the property itself as collateral, making it a bit more complex.

- Installment Agreement: This document allows a borrower to repay a debt in regular installments over time. Similar to a promissory note, it specifies the payment amounts and due dates. The key difference is that installment agreements are often used for larger purchases, like cars or appliances.

- IOU (I Owe You): An IOU is an informal acknowledgment of a debt. While it lacks the detailed structure of a promissory note, it serves a similar purpose in recognizing that one party owes money to another. Both documents signify a financial obligation, though an IOU is generally less formal.

- Credit Agreement: This document outlines the terms under which credit is extended to a borrower. Like a promissory note, it includes details about the amount of credit, interest rates, and repayment terms. Credit agreements are typically used in business contexts, but they share the fundamental purpose of establishing a borrowing arrangement.

Guidelines on Writing Texas Promissory Note

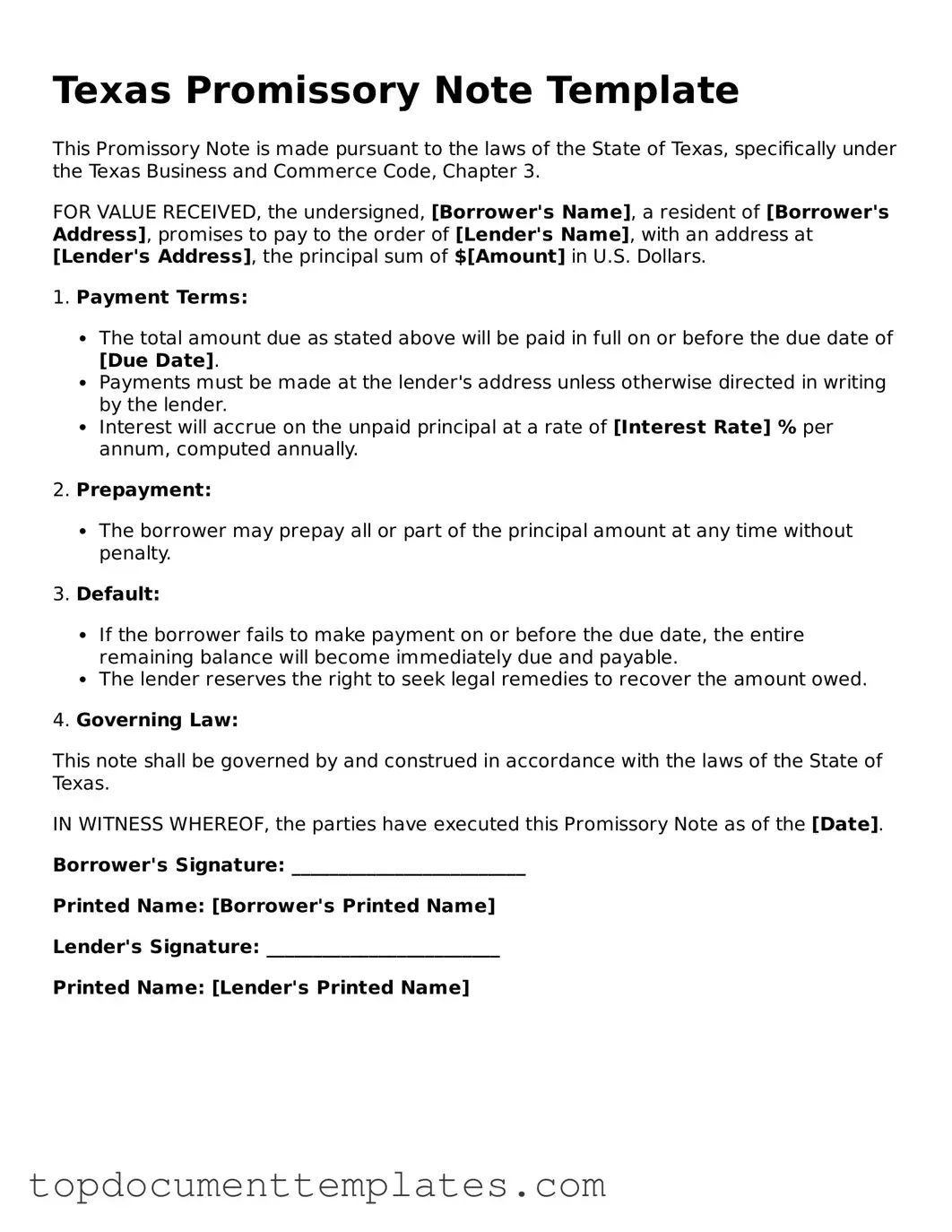

Filling out the Texas Promissory Note form is a straightforward process that requires attention to detail. Once you have completed the form, you will be ready to proceed with the next steps, which may include signing the document and ensuring all parties involved understand the terms outlined.

- Begin by entering the date at the top of the form. This is the date when the note is created.

- Next, fill in the name and address of the borrower. This identifies the individual or entity responsible for repaying the loan.

- Then, provide the name and address of the lender. This is the person or organization lending the money.

- Specify the principal amount being borrowed. This is the total amount that the borrower agrees to repay.

- Indicate the interest rate. This should be clearly stated as an annual percentage rate.

- Set the repayment terms. Include details about when payments are due and the frequency of payments, such as monthly or quarterly.

- Outline any late fees or penalties for missed payments. This ensures both parties are aware of the consequences of non-compliance.

- Include any additional terms or conditions that are relevant to the loan agreement.

- Finally, both the borrower and lender should sign and date the form to make it legally binding.

File Information

| Fact Name | Description |

|---|---|

| Definition | A Texas Promissory Note is a written promise to pay a specified amount of money to a designated person or entity at a future date. |

| Governing Law | The Texas Promissory Note is governed by the Texas Business and Commerce Code, specifically Chapter 3, which covers negotiable instruments. |

| Parties Involved | Typically, there are two main parties: the borrower (maker) who promises to pay, and the lender (payee) who receives the payment. |

| Interest Rate | The note may specify an interest rate, which can be fixed or variable, and must comply with Texas usury laws. |

| Payment Terms | Payment terms should clearly outline when payments are due, including any grace periods and late fees. |

| Secured vs. Unsecured | A Texas Promissory Note can be secured by collateral or unsecured, depending on the agreement between the parties. |

| Amendments | Any amendments to the note must be made in writing and signed by both parties to be enforceable. |

| Default Consequences | If the borrower defaults, the lender may have the right to pursue legal action to recover the owed amount. |

| Notarization | While notarization is not required, having the note notarized can provide additional legal protection and authenticity. |

Other Popular Promissory Note State Forms

Georgia Promissory Note - Many individuals use this document to establish trust and clarity in financial transactions.

For those looking to prepare for unforeseen medical situations, understanding the importance of a comprehensive Living Will document can be vital. This legal instrument enables you to express your healthcare preferences clearly, ensuring your wishes are respected when you are unable to communicate. To learn more about creating a Living Will, visit how to draft a Living Will effectively.

Create Promissory Note - Each Promissory Note is unique, customized to the specific loan situation.