Valid Operating Agreement Form for Texas State

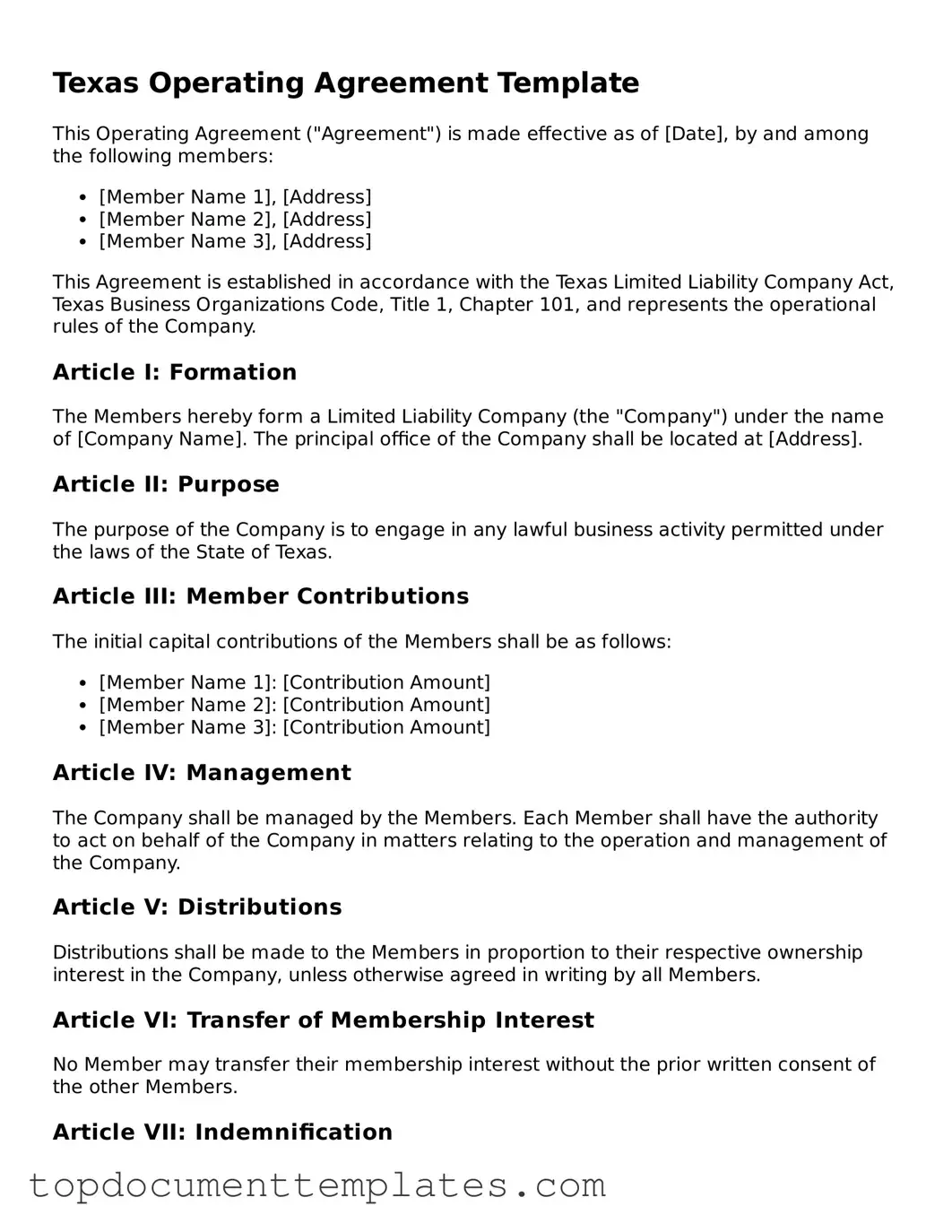

The Texas Operating Agreement form serves as a vital document for limited liability companies (LLCs) operating within the state. This form outlines the internal workings of the company, detailing the rights and responsibilities of its members. It typically includes essential elements such as the management structure, profit distribution, and procedures for adding or removing members. Additionally, the agreement may address decision-making processes, dispute resolution methods, and provisions for the dissolution of the company. By establishing clear guidelines, the Texas Operating Agreement helps to minimize misunderstandings and conflicts among members, fostering a collaborative environment for business operations. Understanding the key components of this form is crucial for anyone looking to form or manage an LLC in Texas, as it lays the groundwork for effective governance and operational success.

Similar forms

-

Partnership Agreement: This document outlines the roles and responsibilities of each partner in a business. Like an Operating Agreement, it details how profits and losses are shared and how decisions are made.

-

Bylaws: Bylaws govern the internal management of a corporation. Similar to an Operating Agreement, they establish rules for meetings, voting, and the roles of officers.

-

Shareholder Agreement: This document is used by corporations to define the rights and obligations of shareholders. It parallels an Operating Agreement by addressing how shares are transferred and how disputes are resolved.

-

LLC Membership Agreement: This agreement is specific to limited liability companies and outlines the rights of members. It is akin to an Operating Agreement in that it specifies member contributions and how profits are distributed.

Guidelines on Writing Texas Operating Agreement

Filling out the Texas Operating Agreement form is an essential step in establishing the structure and rules for your business. This document outlines the management and operational procedures for your company. Once you have completed the form, you will be ready to move forward with your business plans.

- Begin by downloading the Texas Operating Agreement form from a reliable source or your state's official website.

- Enter the name of your LLC at the top of the form. Ensure that the name matches what you registered with the state.

- Fill in the principal office address of your LLC. This is where official correspondence will be sent.

- Identify the members of the LLC. List each member's name and their respective ownership percentages.

- Outline the management structure. Indicate whether the LLC will be member-managed or manager-managed.

- Specify the purpose of the LLC. Briefly describe the business activities that the company will engage in.

- Detail the capital contributions of each member. This includes any cash, property, or services contributed to the LLC.

- Include the distribution of profits and losses. Clearly state how profits and losses will be allocated among members.

- Address any additional provisions. This can include rules for adding new members, transferring ownership, or resolving disputes.

- Have all members review the agreement for accuracy. Make any necessary corrections before finalizing the document.

- Sign and date the form. Each member should sign to indicate their agreement to the terms outlined.

After completing the Texas Operating Agreement form, keep a copy for your records. You may also want to provide copies to all members involved in the LLC. This document will serve as a foundational guideline for your business operations moving forward.

File Information

| Fact Name | Details |

|---|---|

| Definition | The Texas Operating Agreement outlines the management structure and operational procedures of a limited liability company (LLC) in Texas. |

| Governing Law | The agreement is governed by the Texas Business Organizations Code. |

| Purpose | It serves to clarify the roles and responsibilities of members and managers within the LLC. |

| Membership | Members can be individuals or other entities, and their rights and obligations are detailed in the agreement. |

| Flexibility | The agreement allows for flexibility in management structures, including member-managed or manager-managed options. |

| Amendments | Members can amend the operating agreement as needed, provided all parties agree to the changes. |

| Dispute Resolution | It often includes provisions for resolving disputes among members, promoting amicable solutions. |

| Tax Treatment | The agreement can outline the tax treatment of the LLC, affecting how profits and losses are reported. |

| Not Mandatory | While not required by Texas law, having an operating agreement is highly recommended for clarity and protection. |

Other Popular Operating Agreement State Forms

How to Write an Operating Agreement - It often includes information about capital contributions from members.

What Does an Operating Agreement Look Like for an Llc - This document defines the roles and responsibilities of members.