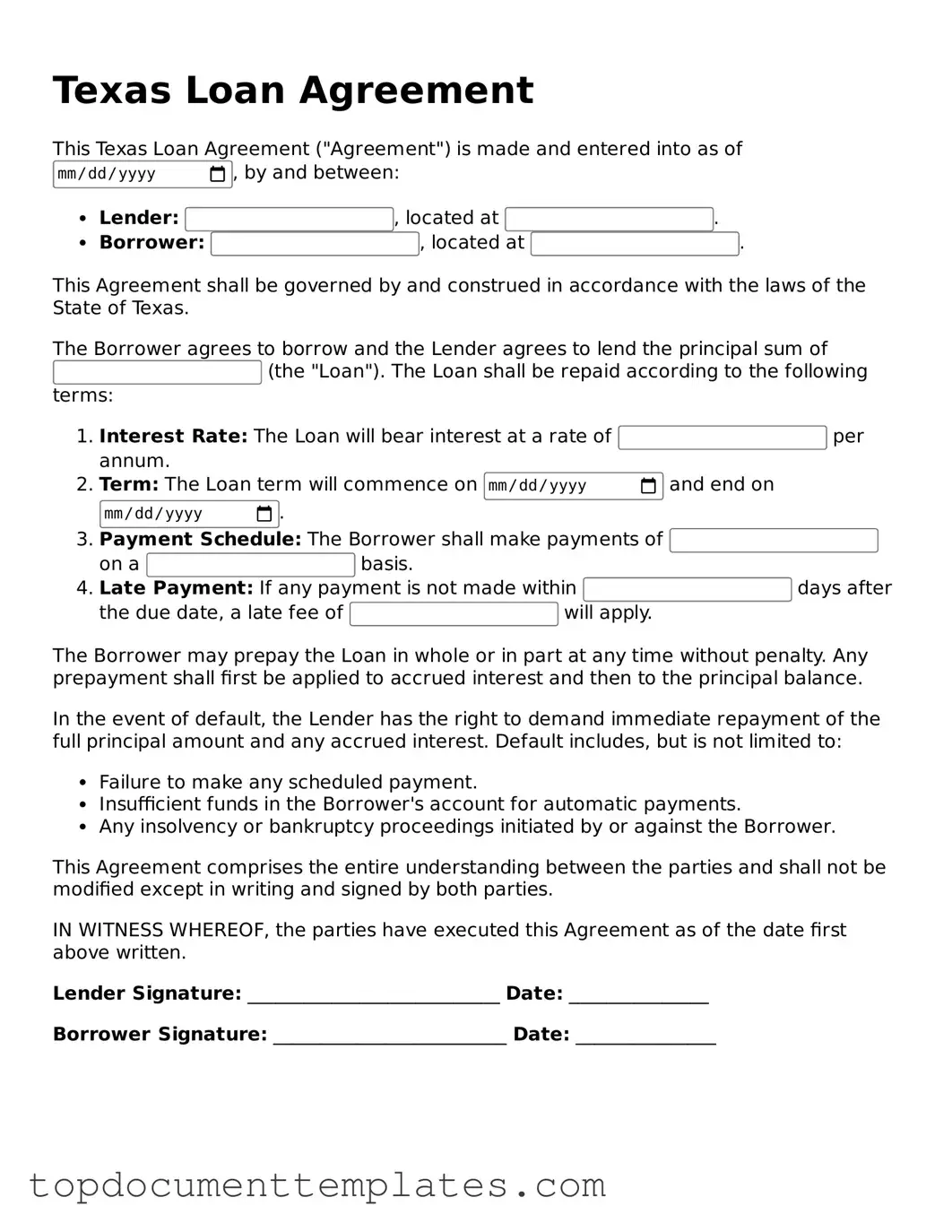

Valid Loan Agreement Form for Texas State

In the state of Texas, a Loan Agreement form serves as a crucial document that outlines the terms and conditions of a loan between a lender and a borrower. This form typically includes key components such as the loan amount, interest rate, repayment schedule, and any applicable fees. It also details the rights and responsibilities of both parties, ensuring that each understands their obligations throughout the loan period. Additionally, the agreement may specify collateral requirements, which provide security for the lender in case the borrower defaults on the loan. Understanding these elements is essential for both lenders and borrowers, as they help to create a transparent and legally binding arrangement. By clearly defining the expectations and terms, the Loan Agreement form minimizes the potential for misunderstandings and disputes, fostering a more secure lending environment in Texas.

Similar forms

Promissory Note: A promissory note is a written promise to pay a specified amount of money at a certain time. Like a loan agreement, it outlines the terms of repayment, including interest rates and payment schedules.

Mortgage Agreement: This document secures a loan with real property. Similar to a loan agreement, it details the terms of the loan, but it also includes information about the property being used as collateral.

Credit Agreement: A credit agreement governs the terms under which a borrower can access credit. It shares similarities with a loan agreement, particularly in outlining repayment terms and interest rates.

Lease Agreement: A lease agreement allows a tenant to use property owned by another party. Both documents establish terms for use and payment, although a lease typically pertains to rental arrangements rather than loans.

Personal Guarantee: This document involves a third party agreeing to be responsible for the loan if the primary borrower defaults. It parallels a loan agreement by detailing obligations and terms of liability.

- Lease Agreement: While primarily used for renting property, a lease agreement shares features like payment terms and conditions, similar to what you find in a Loan Agreement. For a comprehensive template, you can refer to the documentonline.org/blank-lease-agreement/.

Debt Settlement Agreement: This document outlines the terms under which a debtor agrees to pay off a debt for less than the full amount owed. Similar to a loan agreement, it includes payment terms and conditions.

Forbearance Agreement: A forbearance agreement allows a borrower to temporarily reduce or pause payments. Like a loan agreement, it specifies terms and conditions, but it focuses on modifications to existing loan terms.

Guidelines on Writing Texas Loan Agreement

Completing the Texas Loan Agreement form requires careful attention to detail. By following the steps outlined below, you will ensure that all necessary information is accurately provided. This will help facilitate the loan process smoothly.

- Begin by obtaining the Texas Loan Agreement form from a reliable source.

- Read through the entire form to understand the sections and information required.

- Fill in the date at the top of the form.

- Enter the names and contact information of both the lender and the borrower in the designated sections.

- Specify the loan amount clearly, ensuring it matches any supporting documentation.

- Indicate the interest rate and any applicable fees associated with the loan.

- Outline the repayment terms, including the duration of the loan and payment schedule.

- Include any collateral details if the loan is secured by an asset.

- Review the terms and conditions section carefully, making sure all parties understand their obligations.

- Sign and date the form where indicated. Ensure both the lender and borrower sign.

- Make copies of the completed form for both parties' records.

Once the form is filled out, both parties should keep a copy for their records. It is advisable to review the agreement periodically to ensure compliance with its terms.

File Information

| Fact Name | Details |

|---|---|

| Purpose | The Texas Loan Agreement form is used to outline the terms and conditions of a loan between a lender and a borrower. |

| Governing Law | This agreement is governed by the laws of the State of Texas. |

| Parties Involved | The form requires identification of both the lender and the borrower, including their legal names and addresses. |

| Loan Amount | The total amount of the loan must be clearly stated in the agreement. |

| Interest Rate | The form specifies the interest rate applicable to the loan, which must comply with Texas usury laws. |

| Repayment Terms | Details regarding the repayment schedule, including due dates and payment methods, are outlined in the agreement. |

| Default Provisions | The agreement includes provisions outlining what constitutes a default and the remedies available to the lender. |

| Signatures | Both parties must sign the agreement to make it legally binding, along with the date of signing. |

Other Popular Loan Agreement State Forms

Promissory Note Template Illinois - Outlines the process for resolving disputes related to the loan.

For those looking to navigate the legal landscape effectively, understanding the California General Power of Attorney requirements is crucial. This document empowers individuals to authorize another party to make important decisions, ensuring that their wishes are honored in times of need.

Promissory Note Template California Word - A Loan Agreement ensures compliance with relevant laws regarding lending.

Georgia Promissory Note - This document outlines the repayment schedule for borrowed funds.