Valid Gift Deed Form for Texas State

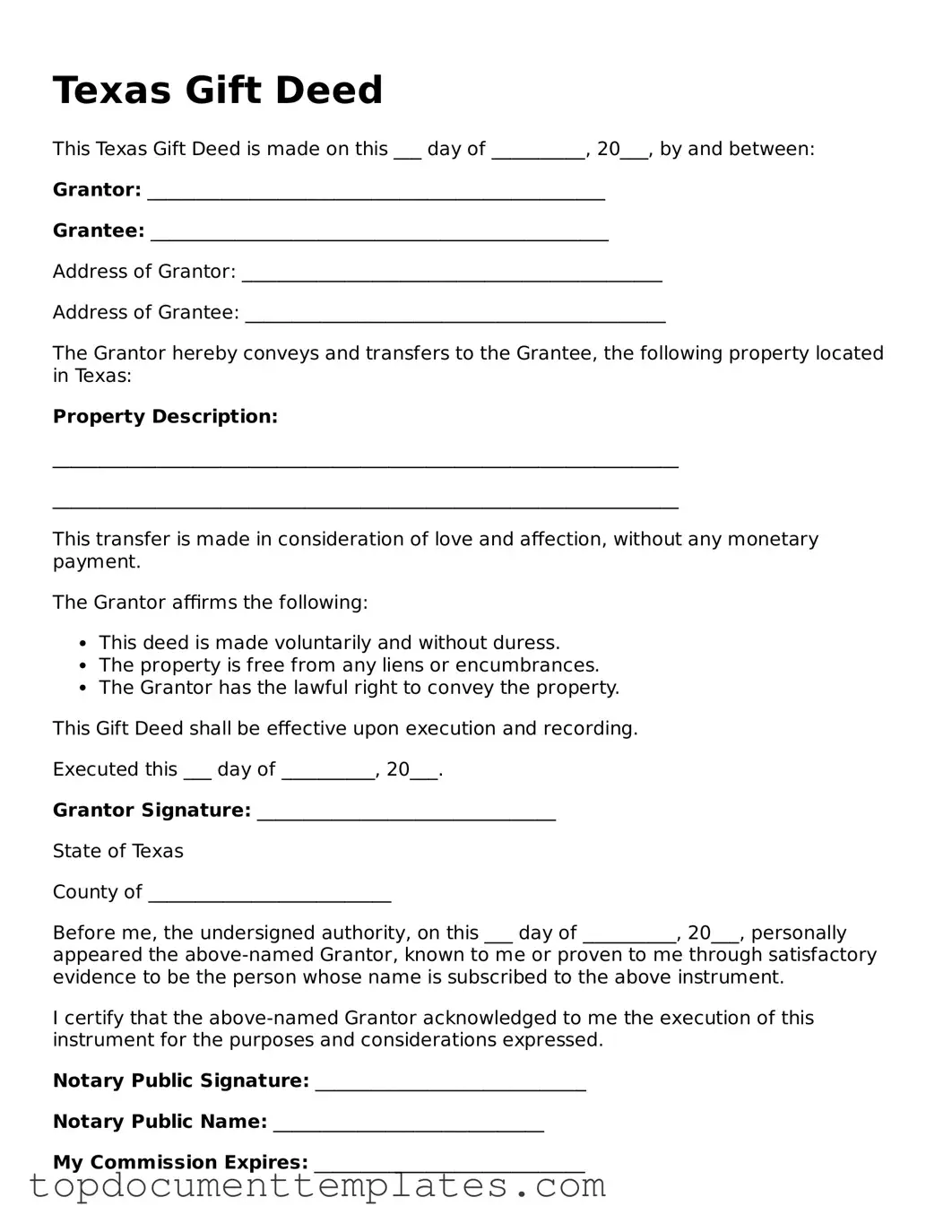

The Texas Gift Deed form is an important legal document that allows individuals to transfer property ownership without any monetary exchange. This form is particularly useful for those wishing to give property as a gift to family members or friends. By using this deed, the giver can ensure that the transfer is legally recognized, thereby avoiding potential disputes in the future. The form typically requires essential information, including the names of the giver and recipient, a description of the property, and the date of the transfer. Additionally, the deed must be signed in the presence of a notary public to validate the transaction. It’s crucial to understand that while the Texas Gift Deed simplifies the process of gifting property, it also carries certain implications, such as tax considerations and the impact on the recipient's future ownership rights. With this understanding, individuals can navigate the gift-giving process more effectively and ensure that their intentions are clearly documented.

Similar forms

- Will: A will outlines how a person's assets will be distributed after their death. Like a gift deed, it transfers ownership, but it takes effect only upon death rather than immediately.

- Trust Agreement: A trust agreement allows a person to place their assets in the care of a trustee for the benefit of others. Similar to a gift deed, it involves the transfer of property, but it often includes specific conditions and terms for the beneficiaries.

- Sale Deed: A sale deed is a legal document that transfers ownership of property in exchange for payment. Both documents serve to transfer property, but a sale deed requires consideration, while a gift deed does not.

- Lease Agreement: A lease agreement allows one party to use another's property for a specified time in exchange for rent. While a gift deed transfers ownership, a lease agreement grants temporary use without transferring ownership.

-

Cracker Barrel Background Check Form: This form is essential for applicants as it consents to background verifications necessary for employment. Accurate information is vital, including personal details and past employment history, aligning with fair hiring practices. More information can be found at OnlineLawDocs.com.

- Partition Deed: A partition deed divides shared property among co-owners. Like a gift deed, it formalizes the transfer of ownership, but it specifically addresses the division of jointly owned property.

- Power of Attorney: A power of attorney grants someone the authority to act on another's behalf. Similar to a gift deed, it involves the transfer of rights, but it does not transfer ownership of property.

- Quitclaim Deed: A quitclaim deed transfers any interest one party has in a property without guaranteeing that interest is valid. Both documents transfer property, but a quitclaim deed does not ensure clear title.

- Deed of Trust: A deed of trust secures a loan with real estate as collateral. Similar to a gift deed, it involves property transfer, but it serves to protect a lender's interest rather than gift ownership.

- Mortgage Agreement: A mortgage agreement allows a borrower to use property as collateral for a loan. Like a gift deed, it involves property transfer, but it creates a debt obligation rather than a gift.

Guidelines on Writing Texas Gift Deed

Once you have the Texas Gift Deed form in hand, you’re ready to begin the process of transferring property as a gift. This deed serves as a formal document to ensure that the transfer is recognized legally. Completing the form accurately is essential to avoid any future disputes or complications.

- Begin by entering the date at the top of the form. This should reflect the date on which the gift is being made.

- Next, identify the grantor (the person giving the gift). Provide their full name and address. Make sure to include any middle names or initials to avoid confusion.

- Then, identify the grantee (the person receiving the gift). Similarly, provide their full name and address, ensuring accuracy in the details.

- In the designated section, describe the property being gifted. Include the legal description of the property, which can typically be found on the property’s deed or tax records. This description is crucial for clarity.

- Next, indicate the consideration for the transfer. In a gift deed, this is often stated as "for love and affection" or similar wording, as no monetary exchange is involved.

- After that, both the grantor and grantee should sign the document. Ensure that the signatures are dated appropriately.

- Finally, the deed must be notarized. Find a notary public to witness the signatures and stamp the document. This step is vital for the deed to be legally binding.

With the form completed and notarized, you can now file it with the county clerk’s office where the property is located. This filing will officially record the transfer of ownership, making it recognized by the state. Remember to keep a copy of the filed deed for your records.

File Information

| Fact Name | Description |

|---|---|

| Definition | A Texas Gift Deed is a legal document used to transfer property ownership as a gift without any exchange of money. |

| Governing Law | The Texas Gift Deed is governed by the Texas Property Code, specifically Section 5.021 and related provisions. |

| Requirements | The deed must be in writing, signed by the donor (the person giving the gift), and must include a description of the property. |

| Consideration | No monetary consideration is required for a gift deed, which distinguishes it from a sale or exchange of property. |

| Recording | To ensure the transfer is legally recognized, the deed should be recorded with the county clerk's office where the property is located. |

| Tax Implications | Gift deeds may have tax implications for both the donor and the recipient, including potential gift tax responsibilities. |

| Revocation | A gift deed can be revoked before it is executed and delivered, but once delivered, it typically cannot be undone. |

| Legal Advice | It is advisable to seek legal counsel before executing a gift deed to ensure compliance with all legal requirements and to understand the implications. |

Other Popular Gift Deed State Forms

Gift Deed Georgia - It may be beneficial to have the Gift Deed reviewed by a legal expert to ensure no details are overlooked.

The IRS W-9 form is a document used by individuals and businesses to provide their taxpayer identification information to others, typically for tax reporting purposes. This form is essential for freelancers, contractors, and service providers who need to report their earnings to the IRS. By completing the W-9, individuals and entities ensure compliance with tax laws while facilitating clear communication of financial information. For those needing to access this form, you can find it at documentonline.org/blank-irs-w-9.

How to Transfer Property Title to Family Member in California - The Gift Deed must clearly state the donor's intent to make a gift and the acceptance by the recipient.