Valid Deed in Lieu of Foreclosure Form for Texas State

In the state of Texas, homeowners facing financial difficulties may find themselves exploring various options to avoid foreclosure. One such option is the Deed in Lieu of Foreclosure, a legal process that allows property owners to voluntarily transfer their property back to the lender, thereby alleviating the burden of an impending foreclosure. This form serves as a crucial document in this process, outlining the terms and conditions under which the transfer occurs. It typically includes details about the property, the parties involved, and any outstanding debts. By utilizing this form, homeowners can potentially mitigate the negative impact on their credit score, while lenders can expedite the recovery of their assets without the lengthy and costly foreclosure process. Understanding the implications of the Deed in Lieu of Foreclosure is essential for homeowners seeking a dignified exit from their mortgage obligations, as it can provide a pathway to financial recovery and peace of mind.

Similar forms

The Deed in Lieu of Foreclosure is a significant legal document in the realm of real estate, particularly when a homeowner is facing foreclosure. However, several other documents share similarities with it, often serving related purposes in the process of transferring property or resolving debt. Here are ten such documents:

- Short Sale Agreement: This document allows a homeowner to sell their property for less than the amount owed on the mortgage, with the lender's consent. Like a Deed in Lieu, it aims to avoid foreclosure.

- Loan Modification Agreement: This agreement changes the terms of an existing loan, often to make payments more manageable. Both documents serve to help the homeowner retain their property while addressing financial difficulties.

- Forebearance Agreement: In this document, the lender agrees to temporarily postpone foreclosure proceedings. It provides a reprieve similar to a Deed in Lieu, allowing the homeowner time to recover financially.

- Quitclaim Deed: This document transfers ownership of property without any warranties. While it is often used between family members, it can serve a similar purpose in transferring property ownership as a Deed in Lieu.

- Warranty Deed: A warranty deed guarantees that the grantor holds clear title to the property. Like a Deed in Lieu, it is a formal document that transfers ownership, though it offers more protection to the buyer.

- Assignment of Mortgage: This document transfers the mortgage from one lender to another. While it doesn’t directly resolve foreclosure, it can be part of a strategy to avoid it, similar to a Deed in Lieu.

- Release of Lien: This document removes a lien from the property, often after a debt has been satisfied. It parallels a Deed in Lieu by clearing the homeowner's financial obligations related to the property.

- Property Settlement Agreement: Often used in divorce proceedings, this document divides property between parties. It can resemble a Deed in Lieu in terms of transferring ownership and resolving financial disputes.

- Deed of Trust: This document secures a loan with real estate as collateral. While it serves a different purpose, both documents involve the transfer of property rights under specific conditions.

- Cracker Barrel Employment Process: Applicants for Cracker Barrel must complete a Background Check form to provide necessary information for accurate assessments. For more details, visit OnlineLawDocs.com.

- Power of Attorney: This legal document allows one person to act on behalf of another in legal matters. In some cases, it can facilitate the execution of a Deed in Lieu, as it grants authority to manage property transactions.

Understanding these documents can empower homeowners to make informed decisions when facing financial challenges. Each plays a unique role in property transactions and can provide alternative pathways to foreclosure, fostering a sense of urgency in seeking assistance.

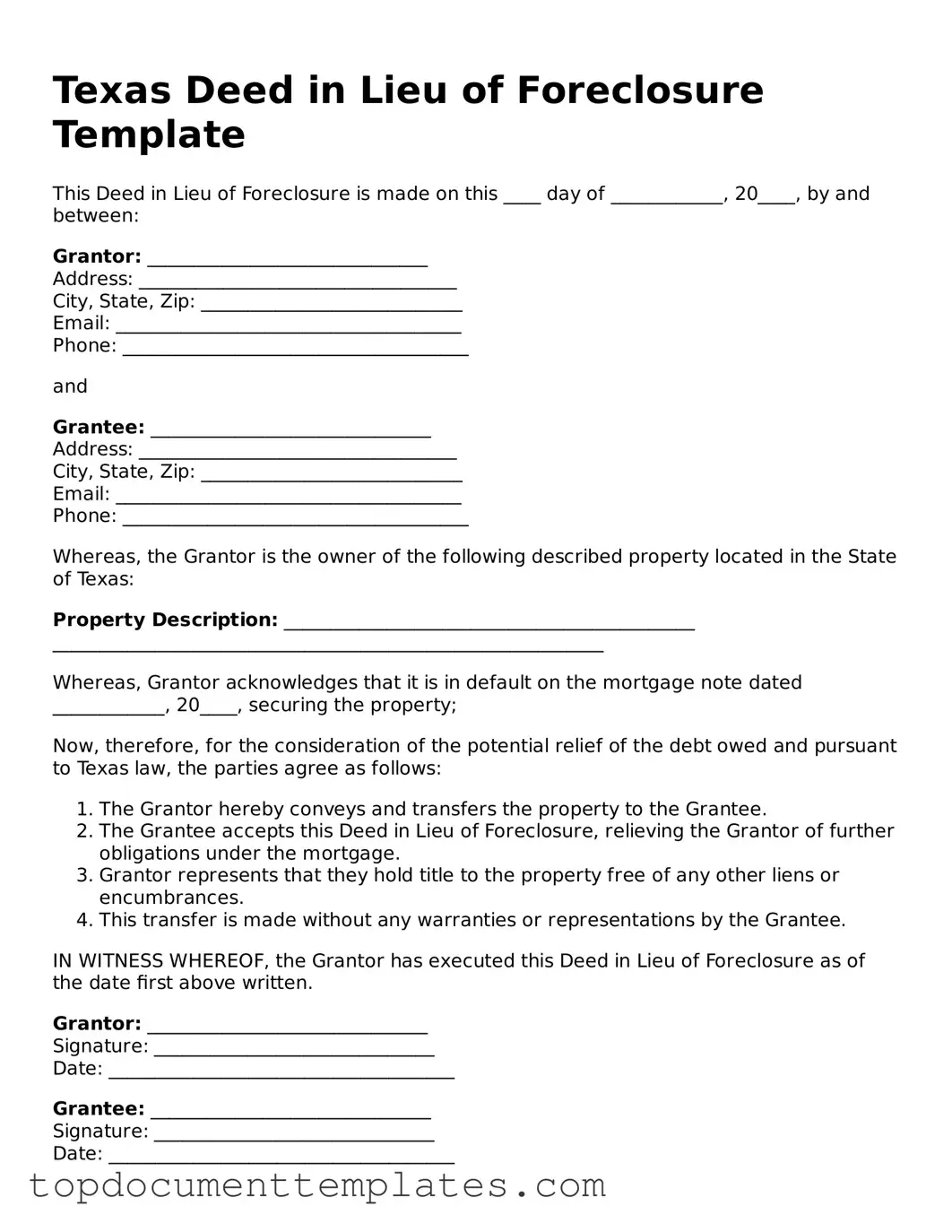

Guidelines on Writing Texas Deed in Lieu of Foreclosure

After completing the Texas Deed in Lieu of Foreclosure form, you will need to submit it to the appropriate parties, typically the lender and the county clerk. Ensure all required signatures are obtained before submission to avoid delays in processing.

- Obtain the Texas Deed in Lieu of Foreclosure form from a reliable source or your lender.

- Fill in the date at the top of the form.

- Provide the name of the property owner(s) in the designated section.

- List the address of the property being transferred.

- Include the legal description of the property. This can often be found on your mortgage documents or property tax statements.

- Identify the lender by providing their name and address.

- State the reason for the deed in lieu of foreclosure. Be clear and concise.

- Sign and date the form in the appropriate section. Ensure all owners sign if there are multiple owners.

- Have the signatures notarized to validate the document.

- Make copies of the completed form for your records.

- Submit the original form to the lender and file a copy with the county clerk's office.

File Information

| Fact Name | Description |

|---|---|

| Definition | A Deed in Lieu of Foreclosure is a legal document where a borrower voluntarily transfers property ownership to the lender to avoid foreclosure. |

| Governing Law | In Texas, the Deed in Lieu of Foreclosure is governed by the Texas Property Code. |

| Eligibility | Homeowners facing financial hardship may qualify for a Deed in Lieu, provided they have no other liens on the property. |

| Benefits | This option can help borrowers avoid the lengthy foreclosure process and minimize damage to their credit score. |

| Process | The process typically involves negotiation with the lender, completion of the deed, and submission of necessary documents. |

| Tax Implications | Borrowers may face tax consequences, as the IRS may consider forgiven debt as taxable income. |

| Impact on Credit | While a Deed in Lieu is less damaging than foreclosure, it can still negatively affect a borrower’s credit score. |

| Alternatives | Alternatives include loan modification, short sale, or filing for bankruptcy, each with its own implications. |

| Legal Assistance | Consulting with a legal advisor is recommended to understand rights and obligations before proceeding. |

Other Popular Deed in Lieu of Foreclosure State Forms

The Loan Servicer Might Agree to Put the Foreclosure on Hold to Give You Some Time to Sell Your Home - The transaction can take place as a part of pre-emptive measures before formally entering into foreclosure proceedings.

The IRS W-9 form is a document used by individuals and businesses to provide their taxpayer identification information to others, typically for tax reporting purposes. This form is essential for freelancers, contractors, and service providers who need to report their earnings to the IRS. By completing the W-9, individuals and entities ensure compliance with tax laws while facilitating clear communication of financial information. For those needing a template, it can be found at documentonline.org/blank-irs-w-9/.

California Voluntary Foreclosure Deed - Homeowners may need to complete a financial hardship affidavit to demonstrate their inability to continue payments.

Georgia Foreclosure Laws - A deed in lieu may involve negotiation of terms regarding any personal property left in the home.

Sample Deed in Lieu of Foreclosure - The homeowner's credit report will reflect the deed transfer but may be less damaging than a foreclosure entry.