Valid Articles of Incorporation Form for Texas State

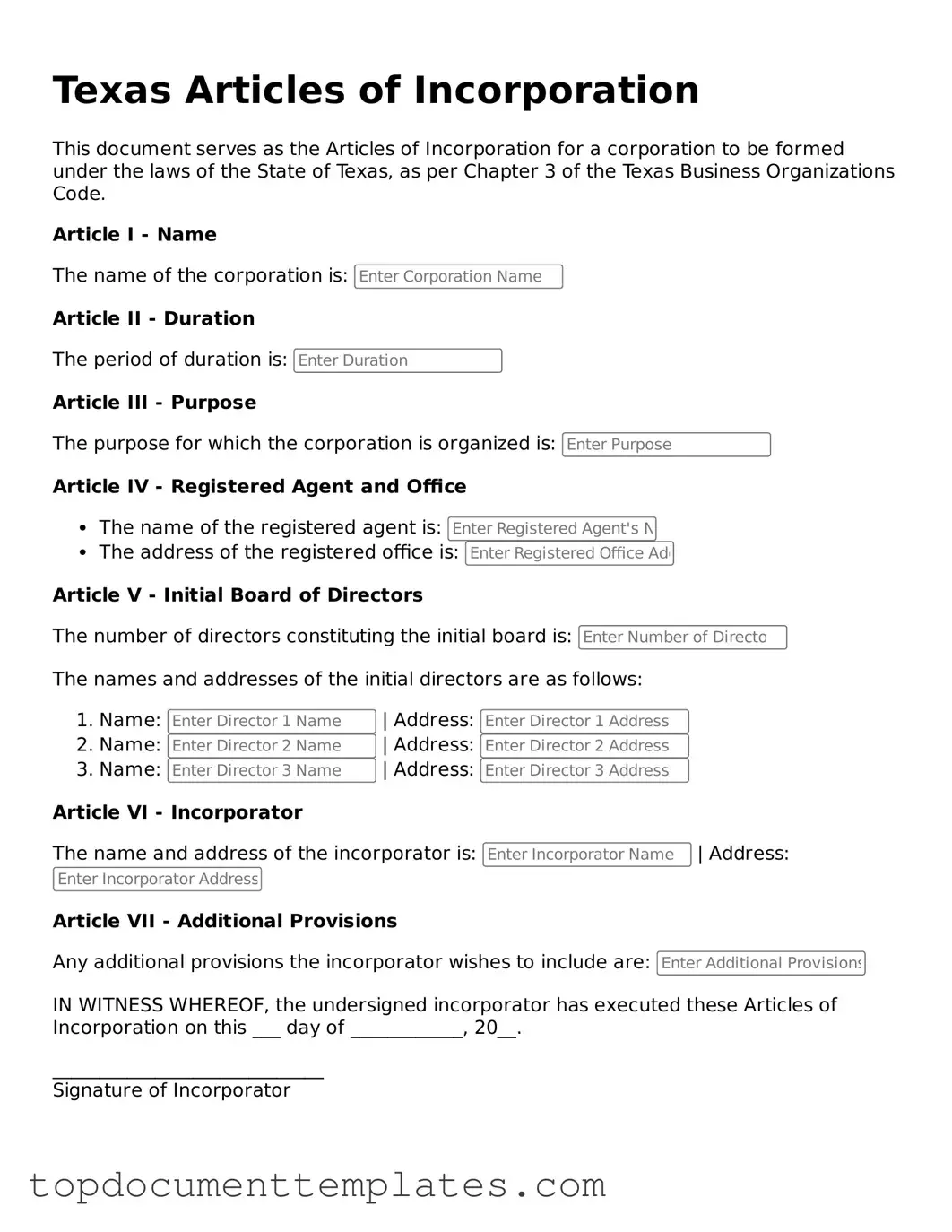

When starting a business in Texas, one of the first steps is to complete the Articles of Incorporation form. This essential document lays the groundwork for your corporation, detailing key information about your business. It includes the name of the corporation, which must be unique and comply with state regulations. The form also requires the designation of a registered agent, someone who will receive legal documents on behalf of the corporation. Additionally, it outlines the purpose of the corporation, which should clearly state what your business intends to do. Share structure is another critical aspect; you'll need to specify the number of shares your corporation is authorized to issue. Finally, the form requires the names and addresses of the initial directors, ensuring that there is a clear governance structure in place. Understanding these components is vital for a smooth incorporation process and for setting a solid foundation for your business in Texas.

Similar forms

- Bylaws: These are the rules that govern the internal management of a corporation. Like Articles of Incorporation, they are essential for defining the structure and operational procedures of the entity.

- Operating Agreement: Similar to bylaws, an operating agreement outlines the management structure and operating procedures for limited liability companies (LLCs). Both documents establish how the business will run.

Promissory Note: For borrowers and lenders alike, the essential Promissory Note form guidelines are vital for ensuring clear terms and obligations in financial transactions.

- Partnership Agreement: This document details the rights and responsibilities of partners in a partnership. Like Articles of Incorporation, it is foundational for establishing the terms of the business relationship.

- Certificate of Formation: This document serves a similar purpose to Articles of Incorporation but is used in some states for LLCs. It also officially creates the business entity.

- Business License: While not a formation document, a business license is required to operate legally. Both documents are essential for compliance with state regulations.

- Shareholder Agreement: This document outlines the rights and obligations of shareholders in a corporation. It complements the Articles of Incorporation by detailing how shares are managed.

- Annual Report: Corporations are often required to file annual reports to maintain good standing. This document provides updates on business activities and is similar in its purpose of transparency.

- Tax Registration Documents: These documents register a business for tax purposes. Like Articles of Incorporation, they are crucial for legal recognition and compliance.

- Nonprofit Incorporation Documents: For nonprofit organizations, these documents serve a similar function to Articles of Incorporation, establishing the entity's purpose and structure.

- Certificate of Good Standing: This document verifies that a business entity is compliant with state regulations. It is similar in that it confirms the entity's legal status and operational legitimacy.

Guidelines on Writing Texas Articles of Incorporation

After completing the Texas Articles of Incorporation form, it is important to review the information provided for accuracy. Once everything is correct, you will need to submit the form to the appropriate state office along with any required fees.

- Obtain the Texas Articles of Incorporation form from the Texas Secretary of State's website or your local office.

- Fill in the name of the corporation. Ensure the name complies with Texas naming requirements.

- Provide the purpose of the corporation. This should be a brief statement of what the corporation will do.

- List the registered agent's name and address. This person or entity will receive legal documents on behalf of the corporation.

- Include the initial board of directors' names and addresses. You may need to list at least one director.

- State the duration of the corporation. If it is intended to exist indefinitely, you can indicate that.

- Fill in the information about the incorporator. This is the person who is filing the form.

- Sign and date the form. The incorporator must sign the document.

- Submit the completed form to the Texas Secretary of State along with the required filing fee.

File Information

| Fact Name | Description |

|---|---|

| Purpose | The Texas Articles of Incorporation establish a corporation as a legal entity in Texas. |

| Governing Law | The Texas Business Organizations Code governs the formation and operation of corporations in Texas. |

| Required Information | Key details include the corporation's name, duration, registered agent, and purpose. |

| Filing Fee | A filing fee is required, which varies depending on the type of corporation being formed. |

| Submission Method | Articles can be submitted online, by mail, or in person to the Texas Secretary of State. |

| Approval Time | Processing times can vary, typically taking a few business days to a few weeks. |

| Amendments | Changes to the Articles of Incorporation can be made by filing an amendment with the Secretary of State. |

Other Popular Articles of Incorporation State Forms

Articles of Incorporation Georgia Template - Nonprofit organizations submit similar forms known as Articles of Incorporation for Nonprofits.

A Florida Promissory Note is a legal document that outlines a borrower's promise to repay a specified amount of money to a lender under agreed-upon terms. This form serves as a crucial tool for establishing clear expectations and responsibilities between parties involved in a loan agreement. To ensure your financial arrangements are documented properly, consider filling out the Promissory Note form by clicking the button below.

Florida Articles of Incorporation - Incorporation can provide tax benefits depending on the corporate structure chosen.