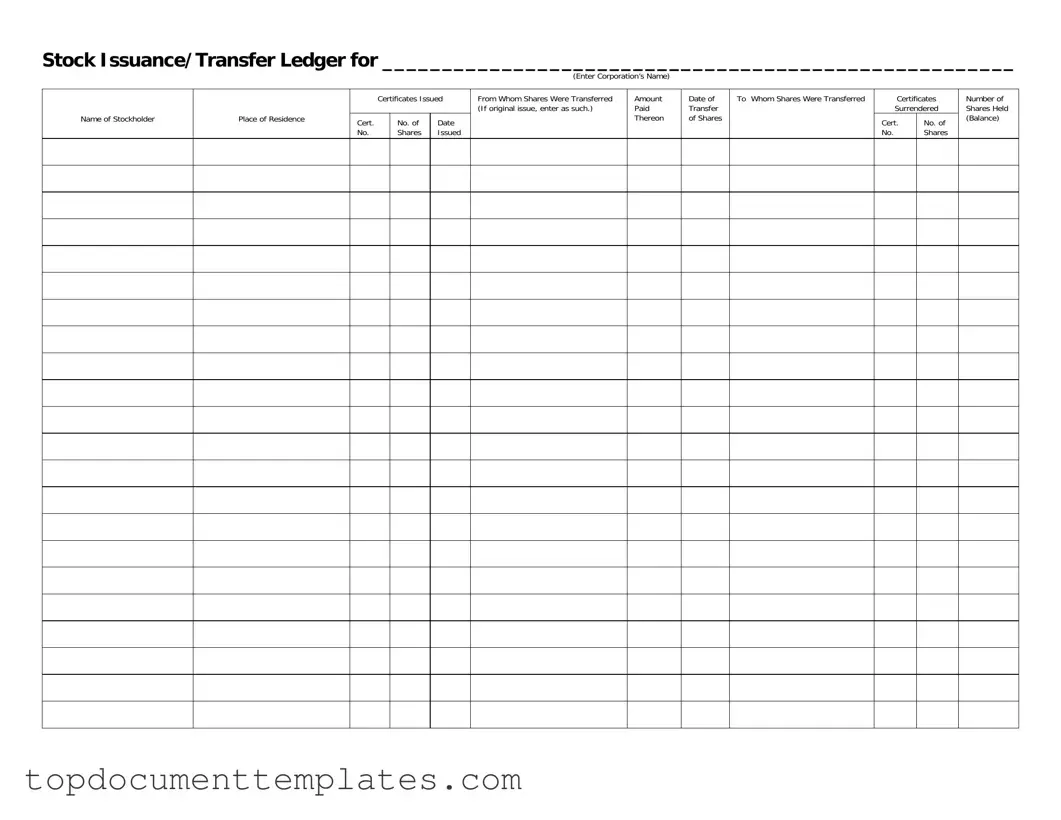

Blank Stock Transfer Ledger PDF Form

The Stock Transfer Ledger form plays a crucial role in maintaining accurate records of stock transactions within a corporation. This essential document provides a structured way to track the issuance and transfer of shares among stockholders. Each entry on the form includes vital information such as the name of the corporation, the stockholder's details, and the certificates issued. It captures the certificate number, the date shares were issued, and the number of shares involved in each transaction. Additionally, it notes the party from whom shares were transferred, ensuring clarity in ownership. If the shares are part of an original issue, that fact is recorded explicitly. The form also includes the amount paid for the shares and the date of transfer, which are critical for maintaining transparency in financial dealings. Furthermore, it documents the recipient of the shares and the certificates surrendered, allowing for a clear understanding of the current ownership status. Finally, it provides a balance of the number of shares held, ensuring that all transactions are accounted for and that the ledger remains up to date.

Similar forms

The Stock Transfer Ledger form serves as a key document in tracking stock ownership and transfers. It shares similarities with several other important documents in corporate finance. Here’s a list of six documents that are comparable to the Stock Transfer Ledger form:

- Shareholder Register: This document records the details of all shareholders, including their names, addresses, and the number of shares they own. Like the Stock Transfer Ledger, it helps maintain accurate ownership records.

- Stock Certificate: A physical document that represents ownership of shares. It includes information such as the shareholder's name and the number of shares, similar to the Stock Transfer Ledger's focus on shares issued and transferred.

- Stock Purchase Agreement: This contract outlines the terms of a stock sale, including the number of shares and the purchase price. It complements the Stock Transfer Ledger by detailing the conditions under which shares are transferred.

- Dividend Distribution Record: This document tracks the distribution of dividends to shareholders. It relates to the Stock Transfer Ledger by showing how ownership impacts dividend payments.

- Transfer Agent Records: Transfer agents maintain records of stock transactions and ownership. They provide essential data that supports the accuracy of the Stock Transfer Ledger.

Dnd Character Sheet: This form is essential for players in Dungeons and Dragons, encapsulating details such as abilities, skills, and spells in a way that enhances gameplay. For a streamlined experience, you can access a printable version at OnlineLawDocs.com.

- Annual Report: This comprehensive report includes financial statements and ownership information. It parallels the Stock Transfer Ledger by summarizing shareholder equity and stock transactions over the year.

Guidelines on Writing Stock Transfer Ledger

Once you have gathered all necessary information about the stock transfer, you can proceed to fill out the Stock Transfer Ledger form. Ensure that all details are accurate to facilitate a smooth transfer process.

- Begin by entering the corporation’s name at the top of the form where indicated.

- In the section for the name of the stockholder, write the full name of the individual or entity transferring the shares.

- Next, provide the place of residence of the stockholder. This should include the city and state.

- In the "Certificates Issued" section, note the number of certificates being transferred.

- Record the certificate number for each certificate being transferred in the "Cert. No." column.

- Indicate the date on which the certificates were issued in the "Date" column.

- In the "No. Shares Issued" section, write the total number of shares that were originally issued.

- In the "From Whom Shares Were Transferred" section, specify the name of the person or entity from whom the shares are being transferred. If this is the original issue, simply write "original issue."

- Document the amount paid for the shares in the "Amount Paid Thereon" section.

- In the "Date of Transfer of Shares" section, enter the date on which the transfer is taking place.

- Provide the name of the individual or entity to whom the shares are being transferred in the "To Whom Shares Were Transferred" section.

- In the "Certificates Surrendered" section, note the certificate number of any certificates being surrendered as part of the transfer.

- Record the number of shares being transferred in the "No. Shares" column.

- Finally, in the "Number of Shares Held (Balance)" section, indicate the remaining shares held by the stockholder after the transfer.

Form Data

| Fact Name | Description |

|---|---|

| Purpose | The Stock Transfer Ledger form is used to track the issuance and transfer of stock shares within a corporation. |

| Corporation Name | The form requires the corporation's name to identify the entity managing the stock transactions. |

| Stockholder Information | It collects the name and place of residence of each stockholder involved in the transaction. |

| Certificates Issued | Details about the stock certificates issued are recorded, including certificate numbers and dates. |

| Transfer Details | Information about the transfer of shares, including the amount paid and the date of transfer, is documented. |

| Original Issue Notation | If the shares are an original issue, this must be noted on the form to clarify the transaction type. |

| Surrendered Certificates | The form includes a section for noting any certificates that have been surrendered during the transfer process. |

| Balance of Shares | It tracks the number of shares held after the transfer, ensuring accurate record-keeping. |

| Governing Law | The use of this form may be governed by state-specific laws, such as the Delaware General Corporation Law for corporations incorporated in Delaware. |

Other PDF Documents

High School Transcript - It's crucial for students to keep track of their academic progress reflected in the transcript.

CBP Declaration Form 6059B - Travelers should keep the form and any receipts handy for customs officials.

A Last Will and Testament is a legal document that outlines your wishes for how your assets should be distributed after your death. It also allows you to appoint guardians for any minor children and to designate an executor to manage your estate. Understanding this form is crucial for ensuring that your desires are fulfilled and your loved ones are taken care of. For more information, you can visit https://documentonline.org/blank-last-will-and-testament/.

Roof Warrenty - The warranty does not cover damages from strange weather patterns or natural disasters like floods or earthquakes.