Official Single-Member Operating Agreement Template

When establishing a single-member limited liability company (LLC), an operating agreement serves as a crucial document that outlines the management structure and operational guidelines for the business. This agreement is particularly important for sole proprietors who wish to enjoy the benefits of limited liability while maintaining clear control over their enterprise. A well-crafted single-member operating agreement typically includes essential elements such as the member's identity, the purpose of the LLC, and the procedure for making decisions. Additionally, it addresses financial matters, including how profits and losses will be distributed, as well as provisions for handling potential changes in ownership or management. By defining these aspects, the agreement not only provides clarity and direction but also helps to reinforce the separation between personal and business assets, thus protecting the member from personal liability in the event of legal issues. Ultimately, a single-member operating agreement is a foundational document that enhances the legitimacy of the LLC and fosters a structured approach to business operations.

Similar forms

- Partnership Agreement: This document outlines the terms and conditions between two or more partners in a business. Similar to the Single-Member Operating Agreement, it defines roles, responsibilities, and profit-sharing arrangements.

- Multi-Member Operating Agreement: This is akin to the Single-Member Operating Agreement but designed for businesses with multiple owners. It covers management structure, decision-making processes, and member contributions.

- Bylaws: Bylaws govern the internal management of a corporation. Like the Single-Member Operating Agreement, they establish rules for governance and operations, ensuring clarity in roles and procedures.

- Shareholder Agreement: This document is similar in that it outlines the rights and obligations of shareholders. It addresses issues like voting rights and dividend distribution, paralleling the operational guidelines in the Single-Member Operating Agreement.

- Joint Venture Agreement: A joint venture agreement outlines the terms between parties collaborating on a specific project. It shares similarities with the Single-Member Operating Agreement in defining contributions and responsibilities of each party.

- Franchise Agreement: This document governs the relationship between a franchisor and franchisee. It specifies operational standards and practices, much like how a Single-Member Operating Agreement defines the management of a single-member LLC.

- Employment Agreement: An employment agreement details the terms of employment between an employer and employee. It shares the focus on defining roles and responsibilities, akin to the clarity provided in a Single-Member Operating Agreement.

- Non-Disclosure Agreement (NDA): An NDA protects confidential information shared between parties. While it serves a different purpose, it similarly emphasizes the importance of clear agreements in business relationships.

- Operating Agreement Form: The New York Operating Agreement form is essential for defining the roles and responsibilities of members in an LLC. It's important for business owners to understand this form to navigate the complexities of LLC operations effectively. For more information, visit https://documentonline.org/blank-new-york-operating-agreement/.

- Business Plan: A business plan outlines a company’s goals and strategies. Like the Single-Member Operating Agreement, it serves as a foundational document guiding the direction and operations of the business.

Guidelines on Writing Single-Member Operating Agreement

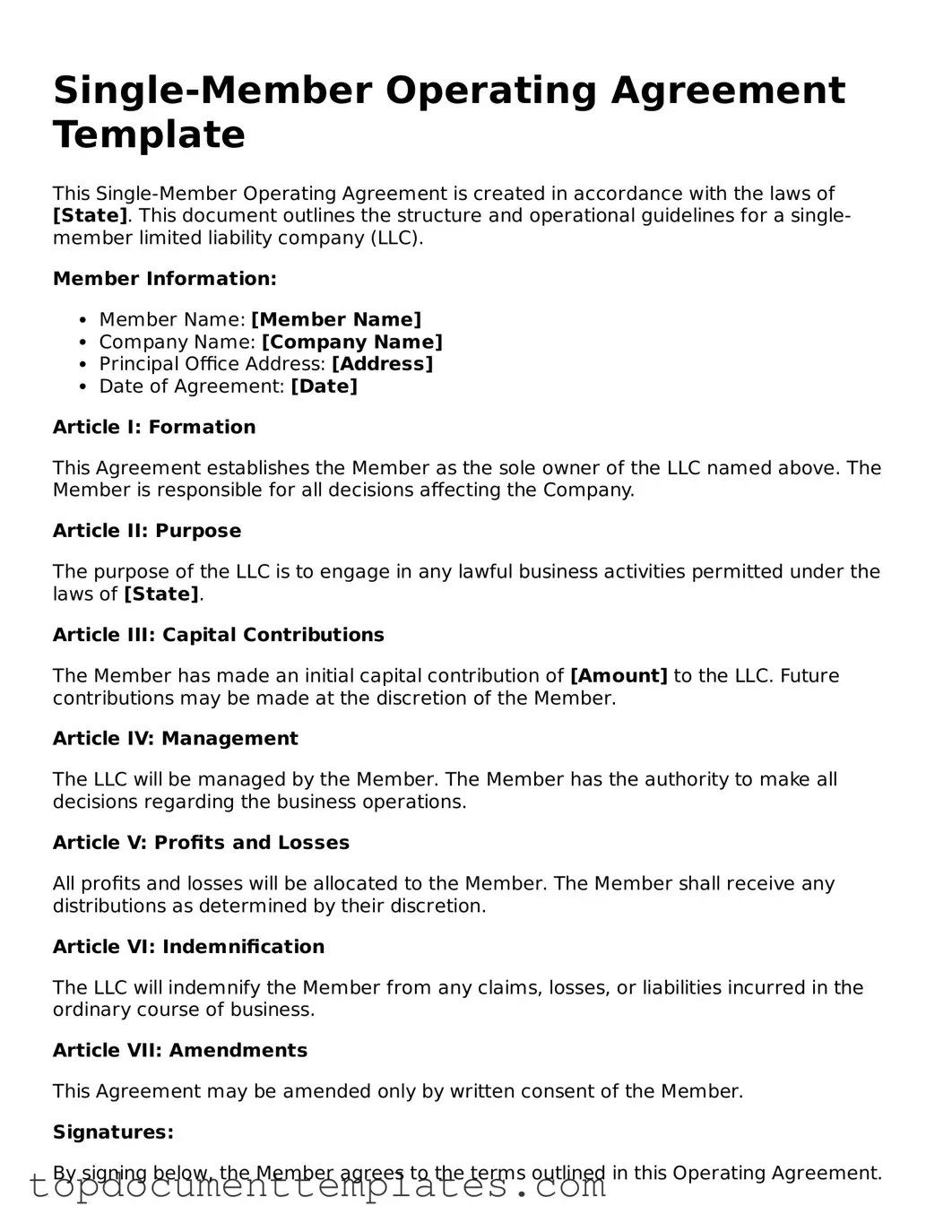

After obtaining the Single-Member Operating Agreement form, the next steps involve accurately completing the document to reflect the necessary details of the business structure. This process is essential for establishing clear guidelines and responsibilities for the single-member entity.

- Begin by entering the name of the business in the designated field. Ensure that the name matches the name registered with the state.

- Provide the principal address of the business. This should be a physical address where the business operates.

- Identify the sole member by entering their full legal name. This person is the sole owner of the business.

- Include the date of formation of the business. This is typically the date when the business was officially registered.

- Specify the purpose of the business. A brief description of the business activities will suffice.

- Detail the management structure. Indicate that the member will manage the business unless otherwise stated.

- Outline the financial arrangements. This includes how profits and losses will be distributed to the member.

- Include any additional provisions that may be relevant to the operation of the business. This can cover topics such as amendments to the agreement or dispute resolution procedures.

- Finally, sign and date the document. The signature should be that of the sole member, affirming their agreement to the terms outlined.

File Information

| Fact Name | Description |

|---|---|

| Definition | A Single-Member Operating Agreement is a document that outlines the management structure and operational procedures for a single-member limited liability company (LLC). |

| Purpose | This agreement serves to establish the rights and responsibilities of the single member, providing clarity and legal protection. |

| Governing Law | The agreement is governed by state-specific LLC laws, which vary by jurisdiction. For example, in Delaware, it follows the Delaware Limited Liability Company Act. |

| Flexibility | Single-member LLCs enjoy flexibility in structuring their operating agreements, allowing the member to tailor the document to meet specific needs. |

| Asset Protection | Having an operating agreement helps protect the member's personal assets from business liabilities, reinforcing the separation between personal and business finances. |

| Tax Treatment | A single-member LLC is typically treated as a disregarded entity for tax purposes, meaning income is reported on the member's personal tax return, simplifying the tax process. |