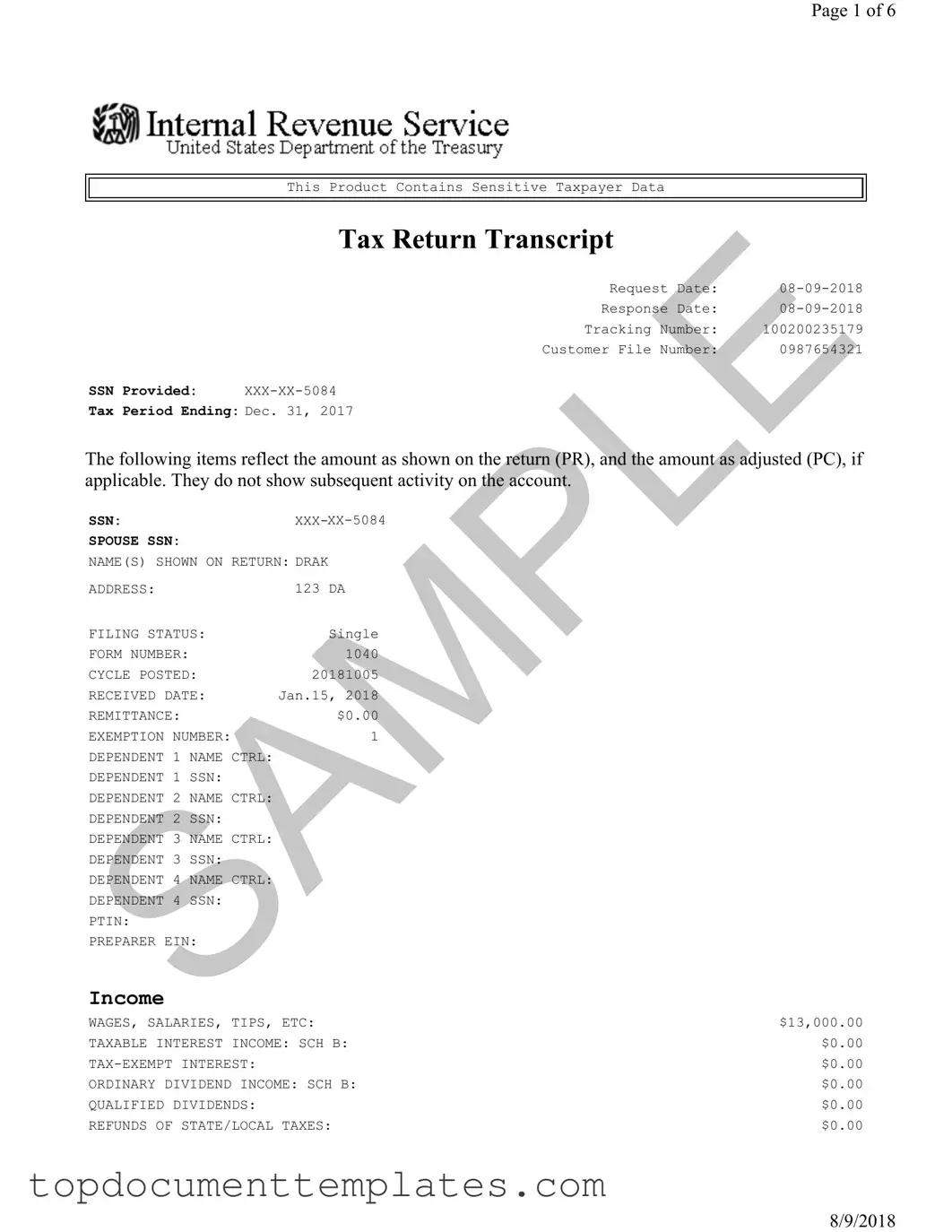

Blank Sample Tax Return Transcript PDF Form

The Sample Tax Return Transcript form serves as a vital document for individuals seeking to understand their tax filings and financial obligations. This form provides a comprehensive overview of a taxpayer's financial information, including income sources, deductions, and tax credits for a specific tax period. For instance, it includes details such as wages, salaries, and any business income or losses, along with adjustments that may affect the taxpayer’s overall income. The transcript also highlights the taxpayer's filing status, exemptions, and the total tax liability, enabling individuals to assess their tax situation accurately. Additionally, it records any payments made, refunds due, or amounts owed, presenting a clear picture of the taxpayer's financial standing. Understanding this form is crucial, as it not only aids in personal financial planning but also serves as a reference for various applications, such as loan approvals or financial aid requests. By breaking down complex tax data into digestible information, the Sample Tax Return Transcript form plays an essential role in promoting financial literacy and responsibility among taxpayers.

Similar forms

- Tax Return Transcript: This document summarizes the tax return as filed, similar to the Sample Tax Return Transcript, but it is an official IRS document that can be used to verify income and tax filing status.

- Account Transcript: This document provides a detailed history of a taxpayer's account, including any payments made, adjustments, and penalties. It complements the Sample Tax Return Transcript by offering additional context on account activity.

- Record of Account: This combines information from both the tax return and account transcripts. It offers a comprehensive view of the taxpayer's history with the IRS, including any adjustments made to the original return.

- Wage and Income Transcript: This document lists all income reported to the IRS, including wages, interest, and dividends. It can be used to cross-check the income reported on the Sample Tax Return Transcript.

- Form 1040: This is the actual tax return form used by individuals to report their income. The Sample Tax Return Transcript is derived from this form, reflecting the information submitted to the IRS.

- Form 1099: This form reports various types of income other than wages. It can provide details that supplement the income information found in the Sample Tax Return Transcript.

- Form W-2: This form reports wages paid to employees and the taxes withheld. It serves as a source document for income reported in the Sample Tax Return Transcript.

- Schedule C: This form is used to report income or loss from a business. If applicable, it provides detailed information that supports the business income reported in the Sample Tax Return Transcript.

- Form 8862: This is used to claim the Earned Income Tax Credit after it has been disallowed in a previous year. It can be relevant if the taxpayer is applying for credits that affect the amounts shown in the Sample Tax Return Transcript.

Guidelines on Writing Sample Tax Return Transcript

Completing the Sample Tax Return Transcript form is essential for maintaining accurate records of your tax information. It’s a straightforward process, but attention to detail is crucial. Follow these steps to ensure you fill out the form correctly.

- Start by entering the Request Date at the top of the form. This should be the date you are filling out the form.

- Next, fill in the Response Date, which is typically the same date as the request date.

- Record the Tracking Number provided on the form. This helps in tracking your request.

- Input your Customer File Number, which is unique to your tax records.

- Provide your Social Security Number (SSN). Make sure to keep this information secure.

- Fill in the Tax Period Ending date. This is usually December 31 of the tax year you are reporting.

- List your name and your spouse’s name (if applicable) as shown on the return.

- Enter your Address where you receive mail.

- Indicate your Filing Status (e.g., Single, Married Filing Jointly).

- Fill in the Form Number used for your tax return, typically 1040.

- Record the Cycle Posted date. This indicates when your return was processed.

- Note the Received Date of your tax return.

- Input the Remittance amount, if applicable.

- List your Exemption Number and any dependents, including their names and SSNs.

- Complete the income section by filling in amounts for wages, salaries, tips, and any other income sources.

- Fill in any adjustments to income, such as educator expenses or self-employment tax deductions.

- Complete the tax and credits section, including standard deductions and any applicable credits.

- Record the total tax liability and payments made, such as federal income tax withheld.

- Finally, indicate any amount owed or refund due.

After filling out the form, double-check all entries for accuracy. This will help avoid any delays or issues with your tax records. Once confirmed, keep a copy for your records and submit it as required.

Form Data

| Fact Name | Description |

|---|---|

| Tax Period Ending | The tax return transcript reflects the tax period ending on December 31, 2017. |

| Filing Status | The individual filing status is listed as Single, which can affect tax rates and deductions. |

| Total Income | The total income reported on this transcript is $15,500. This figure includes various income sources. |

| Adjusted Gross Income | The adjusted gross income (AGI) is calculated at $15,323, taking into account certain adjustments. |

| Tax Liability | The total tax liability is $1,103, which reflects the overall tax obligation before any payments or credits. |

| Refund or Amount Owed | The transcript indicates an amount owed of $103, which may require further action to settle with the IRS. |

Other PDF Documents

Facial Consent Form - The consent form is a necessary step before any facial application.

Roof Inspection Template - The document can be crucial during real estate transactions for potential buyers.

Texas Temporary Tag - Understanding the Texas Temporary Tag form can streamline the vehicle registration process considerably.