Official Release of Promissory Note Template

The Release of Promissory Note form is an essential document in the realm of financial transactions, serving as a formal acknowledgment that a debt has been satisfied. When a borrower repays a loan, this form acts as proof that the lender relinquishes their claim to the amount owed. It typically includes key details such as the names of the parties involved, the original loan amount, and the date of repayment. By documenting the release, both parties can avoid potential disputes in the future. This form not only provides clarity but also offers peace of mind, ensuring that the borrower is free from any further obligations related to the loan. Additionally, the form may require signatures from both the lender and borrower, solidifying the mutual agreement and enhancing its legal standing. Understanding the significance of this document can empower individuals and businesses alike to navigate their financial responsibilities with confidence.

Similar forms

The Release of Promissory Note form is a key document in financial transactions, particularly when it comes to settling debts. However, it shares similarities with several other important documents. Here are six documents that are comparable to the Release of Promissory Note, along with explanations of how they relate:

- Loan Agreement: Like the Release of Promissory Note, a loan agreement outlines the terms of a loan, including repayment schedules and interest rates. Both documents are essential for clarifying the obligations of the borrower and the lender.

- Settlement Agreement: A settlement agreement is used to resolve disputes, often involving the payment of a sum to settle a claim. Similar to the Release of Promissory Note, it signifies that one party has fulfilled its obligations, thus releasing the other party from further claims.

- Debt Release Letter: This document formally states that a debt has been paid off or forgiven. It serves a similar purpose to the Release of Promissory Note by confirming that the borrower no longer owes any money to the lender.

Promissory Note Form: To facilitate the lending process, refer to our detailed Promissory Note form requirements to ensure clarity and security in financial transactions.

- Quitclaim Deed: A quitclaim deed transfers ownership of property without any warranties. While it’s more related to real estate, it parallels the Release of Promissory Note in that both documents signify the relinquishment of rights or claims.

- Payment Receipt: A payment receipt acknowledges that a payment has been made. It is similar to the Release of Promissory Note in that it serves as proof of a transaction, confirming that a debt has been settled.

- Contract Termination Agreement: This document ends a contract between parties, releasing them from their obligations. Like the Release of Promissory Note, it signifies the conclusion of a financial relationship and the fulfillment of contractual duties.

Understanding these documents can help clarify their roles in financial transactions and how they interact with one another. Each serves a unique purpose but ultimately contributes to the broader landscape of financial agreements and obligations.

Guidelines on Writing Release of Promissory Note

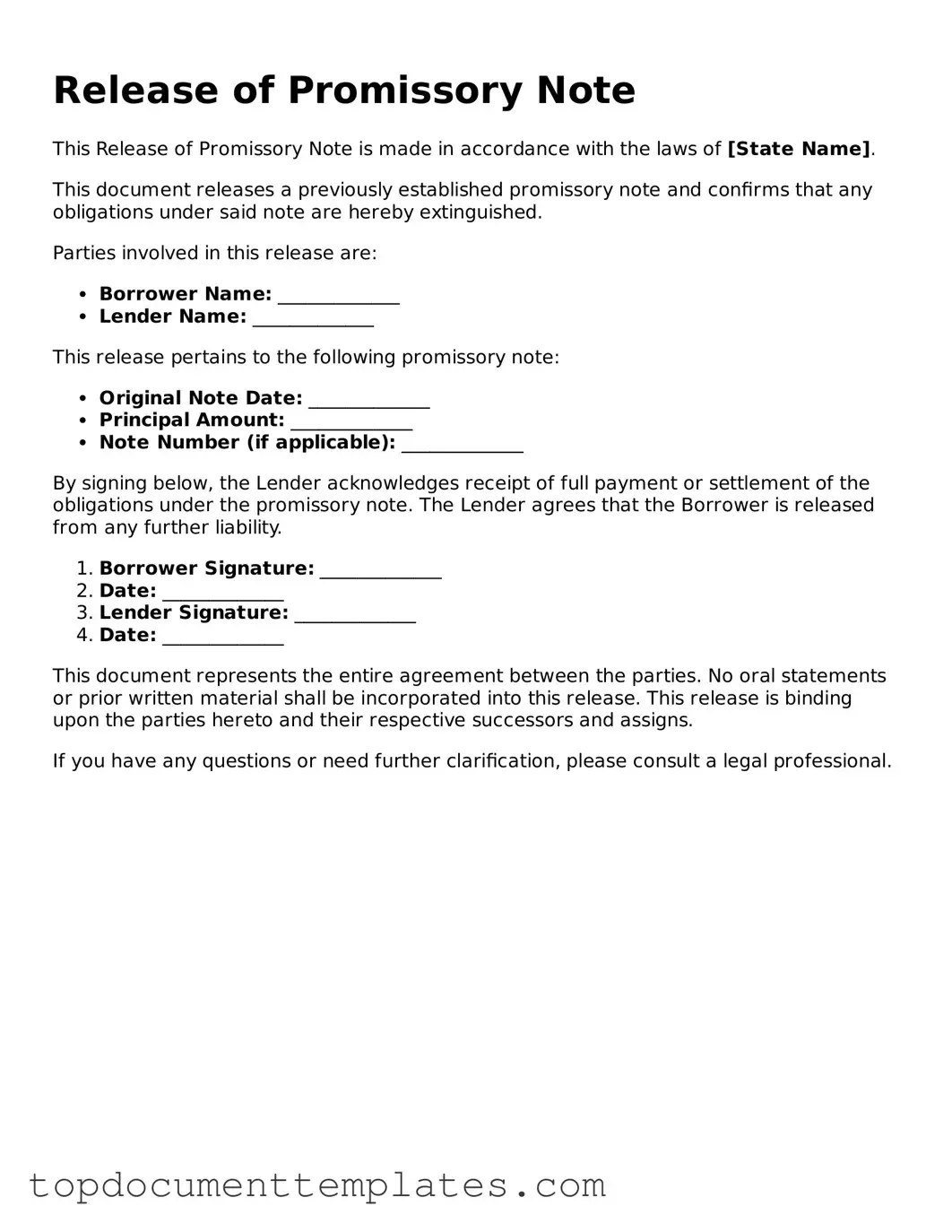

Once you have your Release of Promissory Note form ready, it's time to fill it out carefully. This form is essential for confirming that a loan obligation has been satisfied. After completing the form, you will typically need to sign it and possibly have it notarized before submitting it to the relevant parties.

- Obtain the Form: Start by downloading or printing the Release of Promissory Note form from a reliable source.

- Fill in the Date: Write the date on which you are completing the form at the top.

- Identify the Parties: Clearly state the names and addresses of both the lender and the borrower. Make sure to include any relevant identification numbers, if applicable.

- Detail the Promissory Note: Include the date of the original promissory note, the amount of the loan, and any identifying numbers associated with the note.

- State the Release: Clearly indicate that the promissory note is being released. Use language that confirms the loan obligation has been fulfilled.

- Signatures: Both the lender and borrower must sign the form. If applicable, include the signatures of witnesses or a notary public.

- Review the Form: Double-check all entries for accuracy and completeness before submitting.

- Distribute Copies: Make copies of the signed form for both parties and any other relevant stakeholders.

File Information

| Fact Name | Description |

|---|---|

| Definition | A Release of Promissory Note form is a legal document that signifies the cancellation of a promissory note, effectively releasing the borrower from their obligation to repay the debt. |

| Purpose | This form is used to formally acknowledge that the debt has been satisfied or forgiven, preventing any future claims on the note. |

| Governing Law | The governing law for promissory notes varies by state. For example, in California, the relevant laws are found in the California Commercial Code. |

| Signatories | The form typically requires signatures from both the lender and the borrower to validate the release. |

| Record Keeping | It is important to keep a copy of the signed Release of Promissory Note form for personal records and to provide proof of the release. |

| State-Specific Variations | Different states may have unique requirements for the form, including notarization or specific language that must be included. |

Find Other Types of Release of Promissory Note Templates

Promissary Note Template - The form allows both parties to negotiate terms before signing.

For those seeking a formalized arrangement for loans, utilizing a California Promissory Note form is essential, as it provides clear terms and conditions tailored to the borrowing process. Ensuring both parties are aware of their obligations, this document is crucial in establishing trust and transparency. To access a customizable version of this document, you can visit https://formcalifornia.com/editable-promissory-note-form.