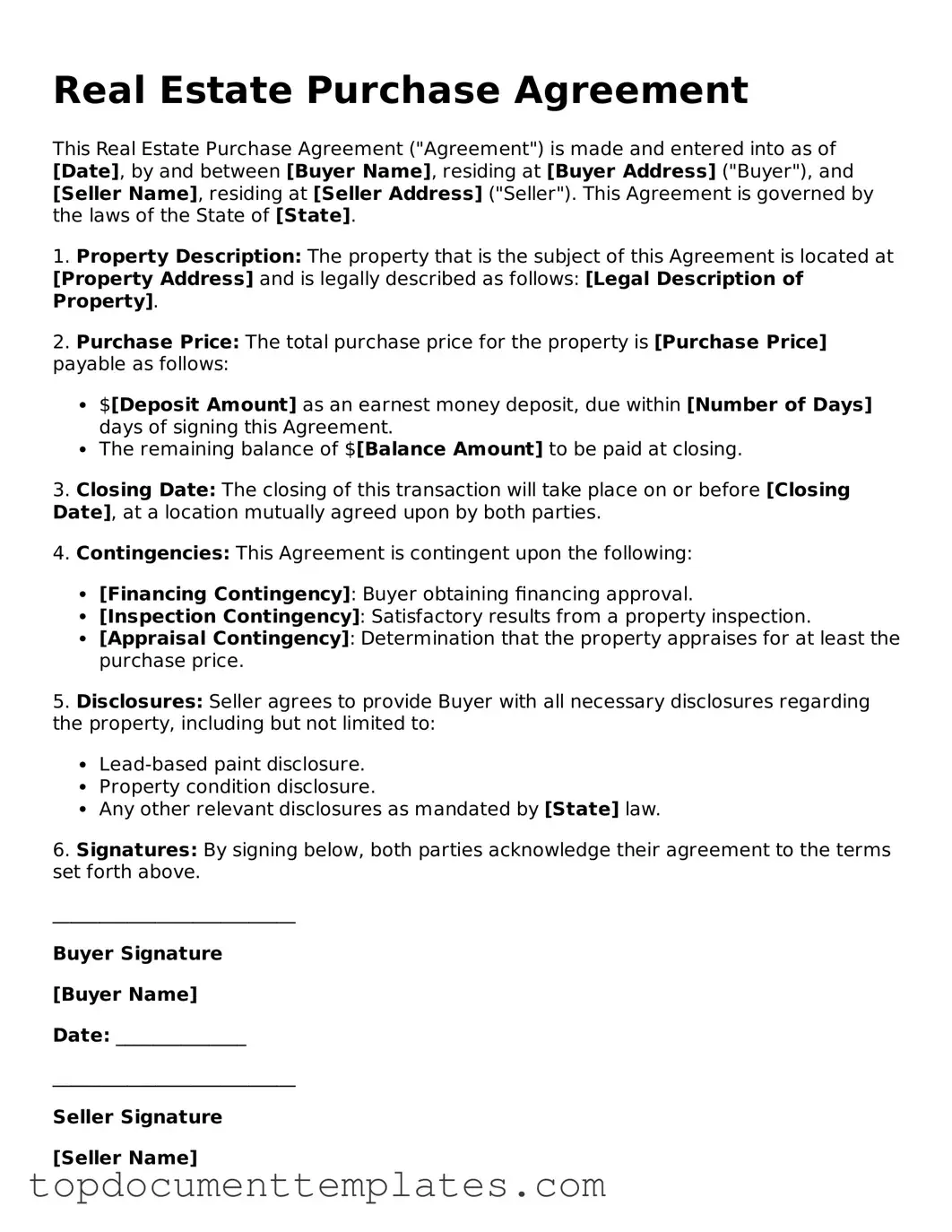

Official Real Estate Purchase Agreement Template

When navigating the exciting yet complex world of real estate transactions, understanding the Real Estate Purchase Agreement (REPA) is essential for both buyers and sellers. This crucial document serves as a roadmap for the sale of a property, outlining key elements such as the purchase price, financing details, and the closing date. It also specifies the responsibilities of both parties, ensuring that everyone is on the same page regarding contingencies, inspections, and any included fixtures or appliances. Additionally, the REPA addresses important legal considerations, such as disclosures about the property's condition and any potential liabilities. By clearly delineating these aspects, the Real Estate Purchase Agreement not only protects the interests of both the buyer and seller but also paves the way for a smooth transaction process. Whether you are a first-time homebuyer or a seasoned investor, grasping the nuances of this agreement can significantly influence the outcome of your real estate endeavors.

Similar forms

- Lease Agreement: A lease agreement outlines the terms under which a tenant can occupy a property. Like a real estate purchase agreement, it specifies the parties involved, the property description, and the financial terms, such as rent and payment schedule.

- Option to Purchase Agreement: This document gives a tenant the right to purchase the property at a later date. Similar to a purchase agreement, it includes details about the property, the purchase price, and the timeframe for exercising the option.

- Real Estate Listing Agreement: This agreement is between a property owner and a real estate agent. It details the terms under which the agent will market the property. Both documents share common elements such as property details, parties involved, and terms of sale or commission.

- Purchase and Sale Agreement: Often used interchangeably with the real estate purchase agreement, this document outlines the terms of a sale between a buyer and seller. It includes information on the property, purchase price, and conditions for the sale.

- Closing Disclosure: This document provides a detailed account of the final terms of the mortgage and closing costs. Like a purchase agreement, it is essential for finalizing the sale, ensuring that all parties understand the financial aspects of the transaction.

- Title Transfer Document: This document transfers ownership of the property from the seller to the buyer. It is similar to a purchase agreement in that it confirms the agreement between the parties and includes details about the property and the transaction.

Real Estate Purchase Agreement - Tailored for State

Real Estate Purchase Agreement Types

Guidelines on Writing Real Estate Purchase Agreement

Completing a Real Estate Purchase Agreement form is a crucial step in the property buying process. This document outlines the terms and conditions agreed upon by both the buyer and the seller. Once the form is filled out correctly, it will be ready for signatures and further processing.

- Obtain the form: Get a copy of the Real Estate Purchase Agreement. This can typically be found online or through your real estate agent.

- Fill in the date: Write the date when you are completing the agreement at the top of the form.

- Identify the parties: Enter the full names and contact information of both the buyer and the seller. Ensure that the names are spelled correctly.

- Describe the property: Provide the address and legal description of the property being purchased. This information can usually be found in the property listing or tax records.

- State the purchase price: Clearly indicate the agreed-upon purchase price for the property. Be sure to double-check this amount.

- Outline the earnest money: Specify the amount of earnest money that the buyer will deposit to show good faith. Include details about how and when this money will be paid.

- Include contingencies: List any contingencies that must be met for the sale to proceed, such as financing or inspections. Be specific about the conditions.

- Set the closing date: Indicate the anticipated closing date for the transaction. This is when the property will officially change hands.

- Review terms and conditions: Go through any additional terms or conditions that are relevant to the sale. This may include repairs or seller concessions.

- Sign the agreement: Both the buyer and seller must sign and date the agreement. Ensure that all signatures are legible.

After completing these steps, the agreement is ready for submission. It is advisable to keep a copy for your records and to consult with a real estate professional if any questions arise during the process.

File Information

| Fact Name | Description |

|---|---|

| Definition | A Real Estate Purchase Agreement is a legally binding document that outlines the terms and conditions under which a property will be sold. |

| Purpose | This agreement serves to protect both the buyer and seller by clearly detailing the obligations and rights of each party involved in the transaction. |

| Components | Typically includes the purchase price, property description, closing date, and any contingencies that must be met for the sale to proceed. |

| Contingencies | Common contingencies may involve financing, inspections, and appraisal, allowing buyers to back out under specific conditions without penalty. |

| Governing Law | The governing laws vary by state. For example, in California, the agreement is governed by the California Civil Code. |

| Signatures | Both the buyer and seller must sign the agreement for it to be legally enforceable. Witnesses may also be required in certain states. |

| Expiration | Some agreements include an expiration date for the offer, after which the seller is no longer bound to the terms unless extended. |

| Amendments | Any changes to the agreement must be documented in writing and signed by both parties to be considered valid. |

| Importance of Legal Review | It is advisable for both parties to have the agreement reviewed by a legal professional to ensure that their interests are adequately protected. |

Consider Other Forms

Bill of Sale Template for Camper - Ideal for both novice and experienced buyers and sellers.

Tod in California - Choosing to utilize a Transfer-on-Death Deed reflects proactive planning, preventing unnecessary stress on loved ones during difficult times.

Citi Bank Direct Deposit Form - Access your money as soon as it’s deposited with Citibank.