Official Quitclaim Deed Template

When it comes to transferring property ownership, understanding the Quitclaim Deed form is essential for anyone navigating real estate transactions. This legal document allows an individual, known as the grantor, to relinquish any claim to a property without guaranteeing that they hold a clear title. Unlike other types of deeds, a Quitclaim Deed does not provide any warranties or assurances about the property’s status, making it a straightforward yet sometimes risky option. It’s commonly used among family members, in divorce settlements, or when transferring property into a trust. The form itself typically includes essential details such as the names of the parties involved, a description of the property, and the date of the transfer. While it may seem simple, the implications of using a Quitclaim Deed can be significant, particularly if the property has outstanding liens or claims. Therefore, understanding its purpose and potential consequences is crucial for anyone looking to make a smooth transition in property ownership.

Similar forms

A Quitclaim Deed is a legal document used to transfer ownership of property. It is important to understand that several other documents serve similar purposes in real estate transactions. Here are eight documents that share similarities with a Quitclaim Deed:

- Warranty Deed: This document guarantees that the seller holds clear title to the property and has the right to sell it. Unlike a Quitclaim Deed, a Warranty Deed provides a warranty of title, ensuring the buyer is protected against any future claims.

- Grant Deed: A Grant Deed also transfers property ownership and includes certain warranties. It assures that the property has not been sold to anyone else and that there are no undisclosed encumbrances, unlike the more limited assurances of a Quitclaim Deed.

- Deed of Trust: This document secures a loan by transferring the title of the property to a trustee until the borrower pays off the loan. While it serves a different purpose, it involves the transfer of property interests, similar to a Quitclaim Deed.

- Lease Agreement: A Lease Agreement allows a tenant to use a property owned by another party for a specified period. While it does not transfer ownership, it grants certain rights to use the property, much like a Quitclaim Deed transfers ownership rights.

- Affidavit of Title: This document is a sworn statement by the seller confirming their ownership of the property. It provides assurance to the buyer, similar to the assurances given in a Quitclaim Deed regarding the seller's interest in the property.

Articles of Incorporation: The Articles of Incorporation form is a crucial document used to establish a corporation in the state of New York. This form outlines essential details about the company, such as its name, purpose, and structure. Understanding its components is key for anyone looking to successfully launch a business in New York. For more information, visit https://documentonline.org/blank-new-york-articles-of-incorporation/.

- Property Transfer Tax Declaration: This form is often required when property ownership changes hands. It documents the transfer and provides information about the property, akin to how a Quitclaim Deed records ownership transfer.

- Power of Attorney: This legal document allows one person to act on behalf of another in property transactions. While it does not transfer property directly, it enables the authorized person to execute a Quitclaim Deed or other property documents.

- Real Estate Purchase Agreement: This contract outlines the terms of a property sale. It does not transfer ownership itself but establishes the intent to transfer, similar to the purpose of a Quitclaim Deed in facilitating property transfers.

Quitclaim Deed - Tailored for State

Guidelines on Writing Quitclaim Deed

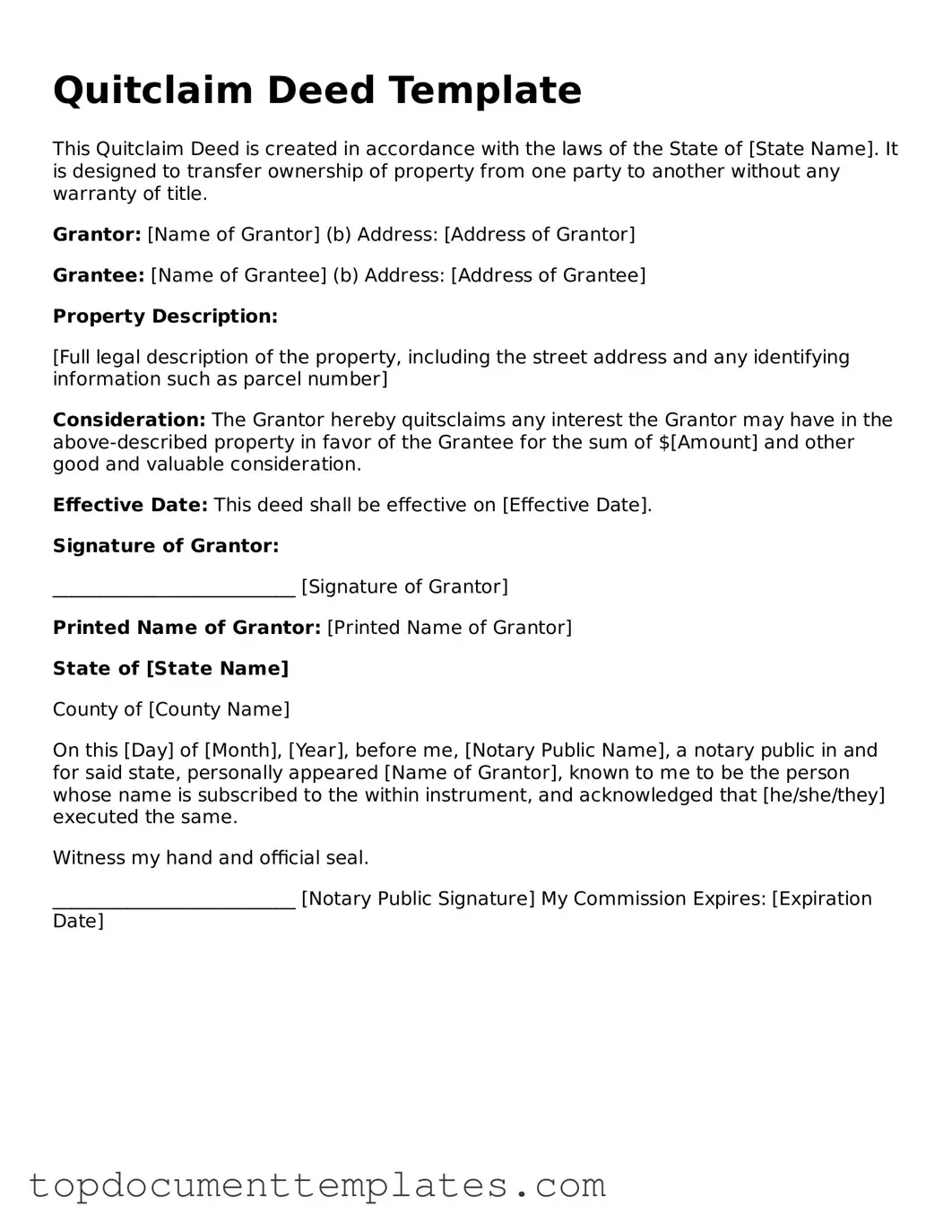

After you have gathered all necessary information and documents, you can begin filling out the Quitclaim Deed form. This form is essential for transferring property ownership. Ensure that you have the correct details at hand to avoid any issues during the process.

- Title the Document: At the top of the form, write "Quitclaim Deed." This clearly identifies the purpose of the document.

- Grantor Information: Fill in the name and address of the person transferring the property (the grantor). Include any relevant details such as marital status if applicable.

- Grantee Information: Next, enter the name and address of the person receiving the property (the grantee). Make sure to include any necessary identifying information.

- Property Description: Provide a detailed description of the property being transferred. This includes the street address, city, county, and legal description if available. Accuracy is crucial.

- Consideration: Indicate the amount of money or value exchanged for the property, if applicable. If the transfer is a gift, you can note that as well.

- Date: Write the date on which the deed is being executed. This is important for legal records.

- Signatures: The grantor must sign the form. If there are multiple grantors, each one should sign. Ensure that the signature is witnessed if required by your state.

- Notary Public: Have the document notarized. This step may be necessary to validate the deed. The notary will sign and stamp the document.

- Recording: Finally, submit the completed Quitclaim Deed to the appropriate county office for recording. Check with local regulations for any specific requirements.

File Information

| Fact Name | Description |

|---|---|

| Definition | A quitclaim deed is a legal document used to transfer ownership of real estate from one party to another without any warranties regarding the title. |

| Governing Laws | In the United States, quitclaim deeds are governed by state laws, which can vary. For example, in California, the relevant law is found in the California Civil Code Section 1092. |

| Use Cases | Commonly used in situations like divorce settlements, transferring property between family members, or clearing up title issues. |

| Limitations | A quitclaim deed does not guarantee that the property title is free of liens or other claims. It simply conveys whatever interest the grantor has at the time of transfer. |

Find Other Types of Quitclaim Deed Templates

Tod in California - This deed allows for a straightforward, non-contested transfer of property, reducing potential family disputes after death.

A Durable Power of Attorney form in Florida is a legal document that allows someone to act on your behalf if you become unable to manage your own affairs. This document remains in effect even if you become incapacitated, ensuring that your chosen representative can make decisions regarding your finances, property, and other important matters. To gain a deeper understanding of how to properly complete and use this form for safeguarding your interests, you can refer to resources like OnlineLawDocs.com.

Gift Deed Form - A Gift Deed can signify trust and confidence between parties.

What Is a Deed-in-lieu of Foreclosure? - This can be a way for homeowners to walk away from an underwater mortgage.