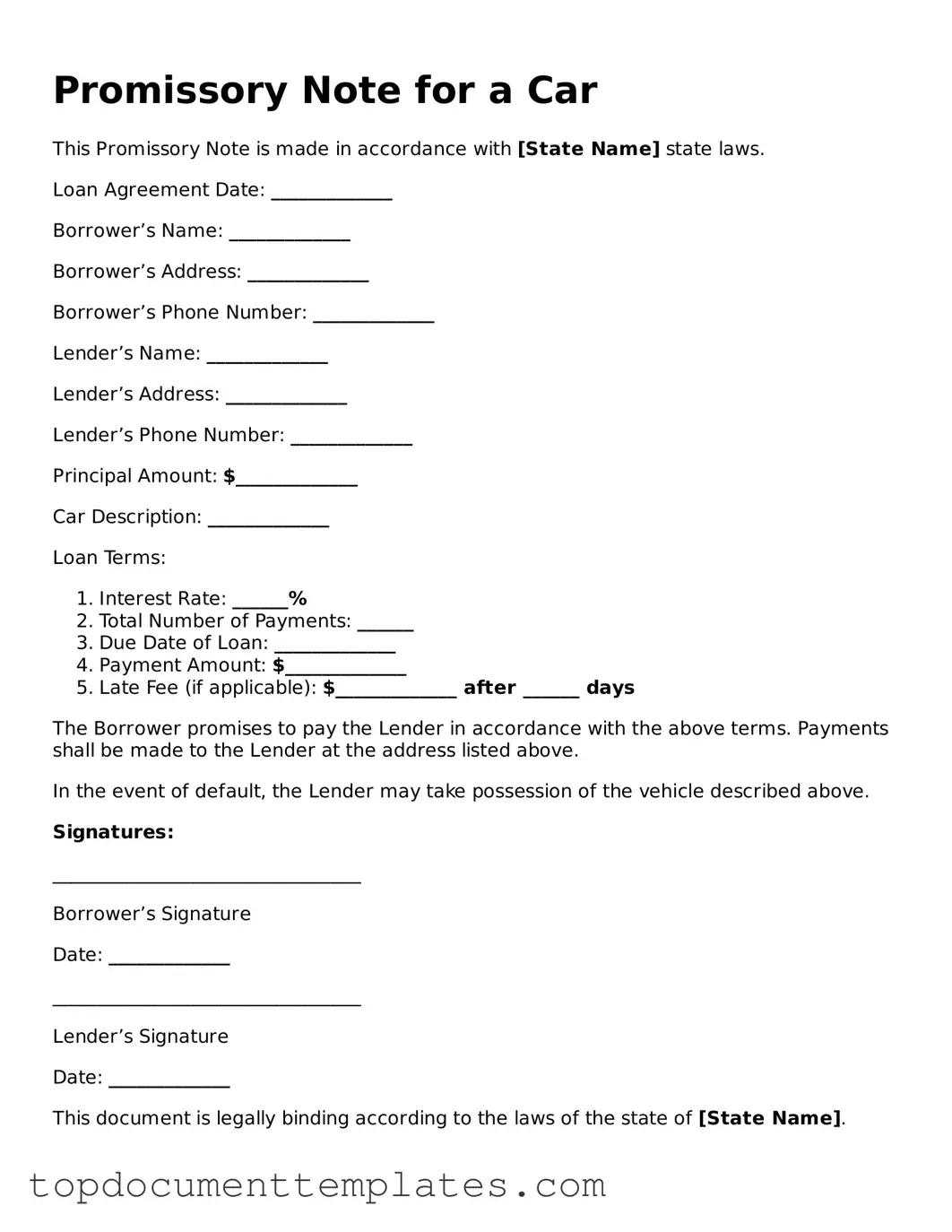

Official Promissory Note for a Car Template

When purchasing a vehicle, understanding the financial commitments involved is essential for both buyers and sellers. A Promissory Note for a Car serves as a critical document in this process, outlining the terms under which the buyer agrees to repay the seller for the vehicle. This form typically includes important details such as the total purchase price, the down payment amount, the interest rate, and the payment schedule. It also specifies the consequences of defaulting on the loan, ensuring that both parties are aware of their rights and responsibilities. By clearly delineating these terms, the Promissory Note fosters transparency and trust, making it easier for individuals to navigate the often complex world of car financing. Additionally, this document can serve as a legal safeguard, protecting both the buyer and seller in the event of disputes. Understanding how to properly complete and utilize this form can lead to a smoother transaction and a more positive experience for all involved.

Similar forms

- Loan Agreement: A loan agreement outlines the terms and conditions under which a borrower receives funds from a lender. Like a promissory note, it specifies the repayment schedule and interest rate.

- Promissory Note Template: This document provides a standardized format for creating promissory notes, ensuring that all necessary information is included. For an example of such a template, you can check https://txtemplate.com/promissory-note-pdf-template.

- Mortgage: A mortgage is a type of loan specifically used to purchase real estate. It includes similar elements, such as the borrower's promise to repay the loan and the consequences of default.

- Lease Agreement: A lease agreement is a contract that allows a person to use property for a specified time in exchange for payment. It shares the concept of a payment schedule and obligations of both parties.

- Personal Loan Agreement: This document details the terms of a personal loan, including repayment terms and interest rates, much like a promissory note for a car.

- Credit Agreement: A credit agreement outlines the terms of a credit facility, including repayment terms and interest. It serves a similar purpose in establishing the borrower's obligations.

- Installment Agreement: An installment agreement allows a borrower to pay back a debt in scheduled payments over time. The structure and intent resemble that of a promissory note.

- Debt Settlement Agreement: This document outlines the terms under which a debtor agrees to pay a reduced amount to settle a debt. It emphasizes the obligations and terms, similar to a promissory note.

- Security Agreement: A security agreement secures a loan with collateral. It includes terms regarding repayment and consequences of default, akin to a promissory note.

- Business Loan Agreement: This agreement is used when a business borrows money. It outlines repayment terms and obligations, similar to those found in a promissory note for a car.

Guidelines on Writing Promissory Note for a Car

Filling out the Promissory Note for a Car is an important step in securing your agreement for a vehicle purchase. After completing the form, you will be ready to move forward with the transaction and finalize the necessary arrangements.

- Begin by entering the date at the top of the form. This should reflect the day you are completing the note.

- Next, fill in your full name and address in the designated section. Make sure to provide accurate information.

- Identify the lender’s name and address. This is the person or institution you are borrowing from.

- Clearly state the amount you are borrowing for the car. This should be the total price agreed upon.

- Include the interest rate, if applicable. Specify whether it is a fixed or variable rate.

- Provide the repayment schedule. Indicate how often you will make payments (e.g., monthly, bi-weekly) and the duration of the loan.

- Describe any collateral, if required. This is typically the car itself.

- Sign and date the form at the bottom. Ensure that you also include any required witnesses or co-signers, if necessary.

Once the form is completed, keep a copy for your records and provide the original to the lender. This will help ensure that both parties are clear on the terms of the agreement.

File Information

| Fact Name | Description |

|---|---|

| Definition | A promissory note for a car is a written promise to pay a specified amount of money for the purchase of a vehicle. |

| Parties Involved | Typically, the parties involved are the borrower (buyer) and the lender (seller or financial institution). |

| Governing Law | The laws governing promissory notes vary by state, but they generally fall under contract law. |

| Interest Rates | Promissory notes may include an interest rate, which is the cost of borrowing the money for the vehicle. |

| Default Consequences | If the borrower defaults, the lender has the right to take legal action to recover the owed amount or repossess the vehicle. |

| State-Specific Forms | Some states require specific forms or disclosures to be included in the promissory note, such as California's Civil Code Section 2981. |

| Signature Requirement | A valid promissory note must be signed by the borrower to be enforceable. |

Find Other Types of Promissory Note for a Car Templates

Release of Promissory Note Sample - The form aids in maintaining accurate financial histories for both lenders and borrowers.

When engaging in financial transactions in Florida, it is essential to utilize a legally binding document, such as a Florida Promissory Note. This form not only specifies the loan amount and interest rate but also details the repayment schedule, ensuring that both parties have a clear understanding of their responsibilities. For those seeking a reliable template, you can find one at All Florida Forms, which can help facilitate the lending process with transparency and legal backing.