Official Promissory Note Template

When it comes to personal and business financing, a Promissory Note serves as a crucial document that outlines the terms of a loan agreement between a borrower and a lender. This written promise details the amount of money being borrowed, the interest rate, and the repayment schedule, ensuring that both parties have a clear understanding of their obligations. A well-crafted Promissory Note not only protects the lender’s investment but also provides the borrower with a structured plan for repayment. It can include provisions for late fees, collateral, and even what happens in the event of default. Whether you’re lending money to a friend or financing a new business venture, understanding the components of a Promissory Note is essential for safeguarding your interests and fostering trust in financial transactions.

Similar forms

The Promissory Note is a key financial document, and several other documents share similarities with it. Here are four such documents:

- Loan Agreement: This document outlines the terms of a loan, including the amount borrowed, interest rates, and repayment schedule. Like a promissory note, it establishes a borrower's obligation to repay the lender.

- Articles of Incorporation: Essential for founding a corporation in Florida, the Articles of Incorporation form captures vital details such as the company's name, purpose, and share structure, marking the start of its legal existence. For more information, visit https://onlinelawdocs.com/.

- Mortgage: A mortgage secures a loan against real property. Similar to a promissory note, it involves a borrower promising to repay the loan, but it also includes collateral in the form of the property itself.

- Credit Agreement: This document details the terms under which credit is extended. It specifies the borrower's obligations, much like a promissory note, but often includes additional terms related to credit limits and conditions for repayment.

- Installment Sale Agreement: This agreement allows a buyer to purchase an item by making payments over time. It resembles a promissory note in that it creates a payment obligation, but it also typically includes details about the item being purchased.

Promissory Note - Tailored for State

Promissory Note Types

Guidelines on Writing Promissory Note

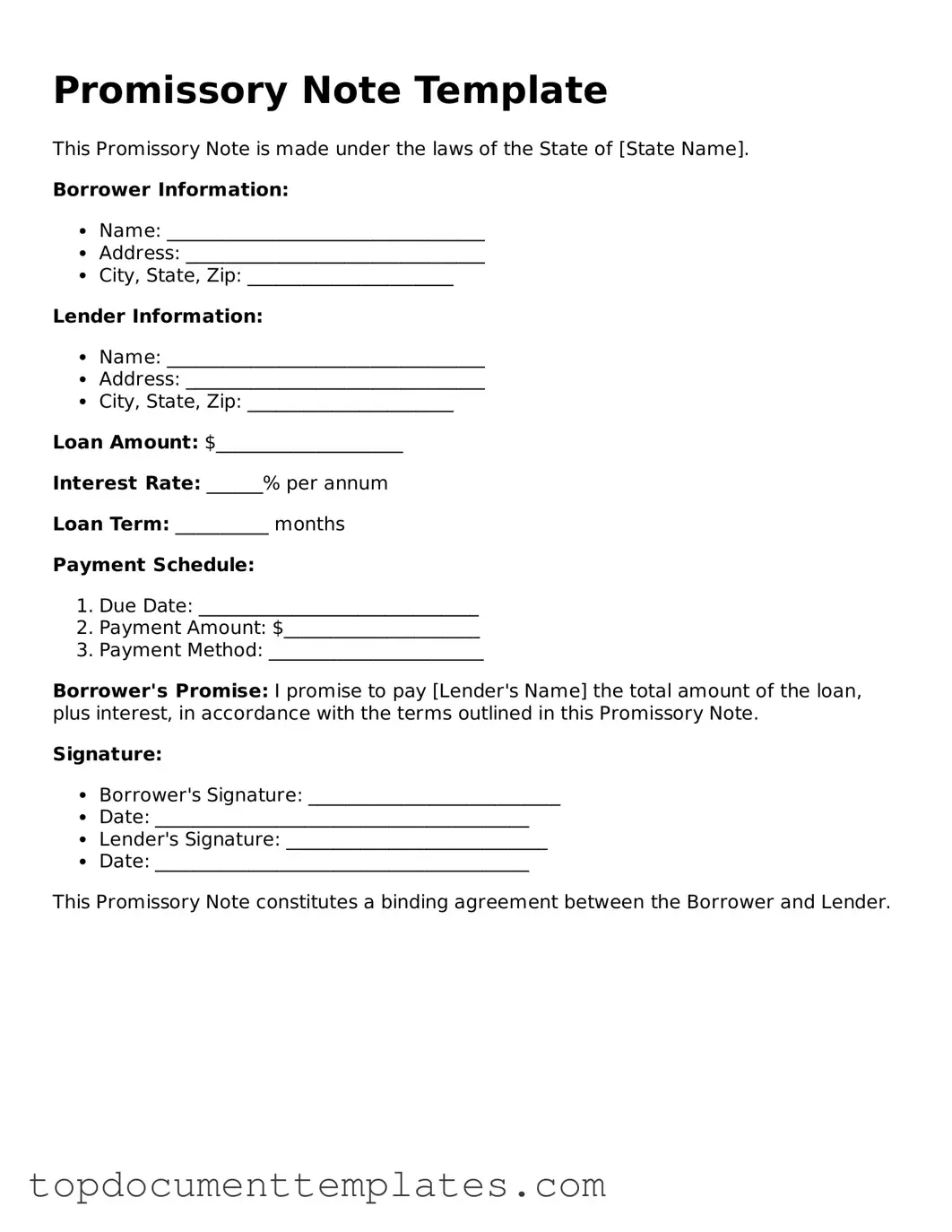

Once you have the Promissory Note form in hand, it is essential to complete it accurately to ensure that all parties involved understand their obligations. After filling out the form, you will typically need to sign it and provide it to the relevant parties for their signatures. This document will then serve as a formal agreement regarding the loan terms.

- Begin by entering the date at the top of the form. This indicates when the agreement is being made.

- Fill in the name and address of the borrower. This identifies the individual or entity that will be responsible for repaying the loan.

- Next, enter the lender's name and address. This is the person or organization providing the loan.

- Specify the principal amount of the loan. This is the total sum that is being borrowed.

- Detail the interest rate applicable to the loan. Clearly state whether it is fixed or variable.

- Indicate the repayment schedule. This includes how often payments will be made (e.g., monthly, quarterly) and the duration of the loan.

- Include any late fees or penalties that may apply if payments are not made on time.

- Clearly state the purpose of the loan, if applicable. This provides context for the borrowing.

- Provide space for the borrower’s signature and date. This signifies their agreement to the terms outlined in the note.

- Finally, include a space for the lender’s signature and date, indicating their acceptance of the terms as well.

File Information

| Fact Name | Description |

|---|---|

| Definition | A promissory note is a written promise to pay a specified amount of money to a designated person or entity at a defined time. |

| Parties Involved | Typically, there are two parties: the maker (borrower) and the payee (lender). |

| Interest Rate | The note may specify an interest rate, which can be fixed or variable. |

| Maturity Date | The maturity date is the date by which the borrower must repay the loan in full. |

| Governing Law | Each state has its own laws governing promissory notes. For example, in California, the relevant law is the California Commercial Code. |

| Transferability | Promissory notes can often be transferred to another party, making them negotiable instruments. |

| Default Provisions | Many notes include provisions outlining what happens in the event of a default. |

| Signatures | Both parties must sign the note for it to be legally binding. |

| Amendments | Changes to the terms of the note usually require written consent from both parties. |

| Legal Enforcement | A promissory note can be enforced in court if the borrower fails to repay as agreed. |

Consider Other Forms

No Trespassing Letter to Neighbor - This is a firm reminder that my property is private and should not be visited without permission.

Letter to Terminate Lease - Can contribute to positive reviews and references for future rentals.

To initiate the rental process in Florida, both landlords and tenants should familiarize themselves with the essential terms of the lease. The Florida Residential Lease Agreement form ensures all necessary details are documented, providing clarity on the rental arrangement. Once you are ready to formalize your agreement, you can get the document to ensure compliance with state regulations and safeguard your rights.

Partial Waiver of Lien Chicago Title - The notary public’s acknowledgment is essential for the document's validity.