Blank Profit And Loss PDF Form

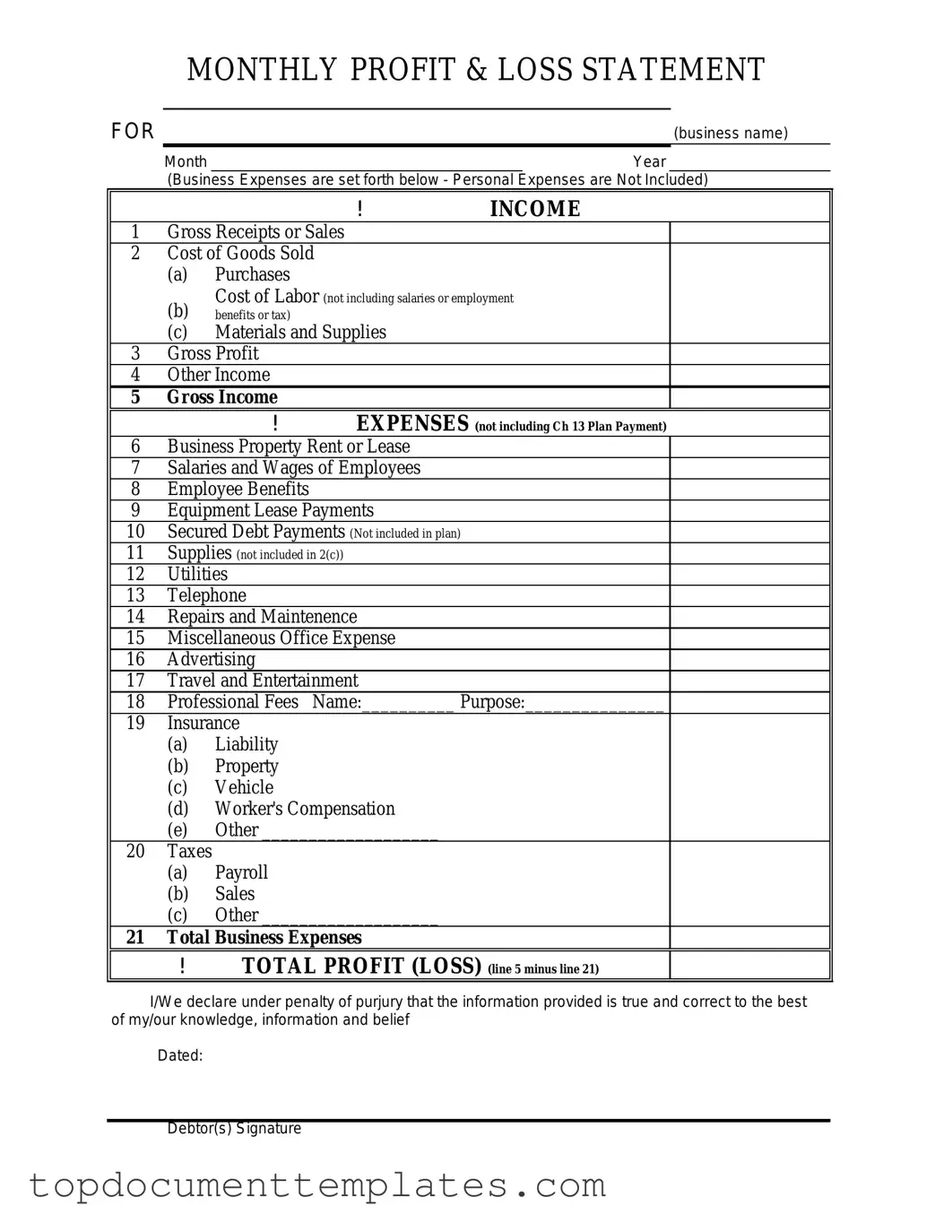

The Profit and Loss form, often referred to as the P&L statement, serves as a crucial financial tool for individuals and businesses alike. This document provides a clear overview of revenues, costs, and expenses over a specific period, allowing users to assess their financial performance. By summarizing income and expenditures, the form highlights whether an entity has made a profit or incurred a loss during that time frame. Key components typically include total revenue, cost of goods sold, gross profit, operating expenses, and net income. Understanding these elements is essential for effective financial management, as they help inform decisions related to budgeting, investment, and strategic planning. Whether you are a small business owner, a freelancer, or managing personal finances, the Profit and Loss form can offer valuable insights into your financial health.

Similar forms

Balance Sheet: This document provides a snapshot of a company's assets, liabilities, and equity at a specific point in time. Like the Profit and Loss form, it helps assess financial health but focuses on a different aspect of financial reporting.

Cash Flow Statement: This statement details the cash inflows and outflows over a period. It complements the Profit and Loss form by showing how operating activities impact cash levels.

Income Statement: Often used interchangeably with the Profit and Loss form, it summarizes revenues and expenses to show net income. Both documents aim to assess profitability.

Statement of Retained Earnings: This document outlines changes in retained earnings over a period. It relates to the Profit and Loss form by showing how profits are reinvested or distributed.

Budget Report: A budget report compares projected revenues and expenses to actual figures. It serves a similar purpose to the Profit and Loss form by evaluating financial performance.

Tax Return: This document summarizes income, expenses, and tax obligations for the year. It shares similarities with the Profit and Loss form in detailing financial performance for tax purposes.

Sales Report: This report focuses specifically on sales revenue over a period. Like the Profit and Loss form, it helps analyze financial performance but narrows in on sales activities.

Expense Report: This document itemizes business expenses incurred during a specific timeframe. It is similar to the Profit and Loss form in that it tracks costs affecting profitability.

Financial Forecast: A financial forecast estimates future revenues and expenses based on historical data. It relates to the Profit and Loss form by projecting potential financial outcomes.

Guidelines on Writing Profit And Loss

Completing the Profit and Loss form is an essential step in tracking your financial performance. This form provides a clear overview of your income and expenses over a specific period. Follow these steps to ensure that you fill it out accurately and effectively.

- Gather your financial documents, including income statements, invoices, and receipts for expenses.

- Start with the Revenue section. Enter all sources of income earned during the period.

- Next, move to the Cost of Goods Sold (COGS). List the direct costs associated with producing your goods or services.

- Calculate your Gross Profit by subtracting COGS from your total revenue. Write this figure in the designated space.

- Proceed to the Operating Expenses section. Include all indirect costs like rent, utilities, and salaries.

- After listing all operating expenses, calculate your Total Operating Expenses and enter this amount.

- Now, find your Operating Income by subtracting Total Operating Expenses from Gross Profit.

- Include any Other Income or expenses that are not part of your regular operations, such as interest or investments.

- Finally, calculate your Net Income by adding Other Income and subtracting Other Expenses from Operating Income.

Once you have completed the form, review all entries for accuracy. This will help you maintain clear and precise financial records.

Form Data

| Fact Name | Description |

|---|---|

| Purpose | The Profit and Loss form is used to summarize the revenues, costs, and expenses incurred during a specific period, providing a clear view of a business's financial performance. |

| Components | This form typically includes sections for gross revenue, cost of goods sold, operating expenses, and net profit or loss. |

| Frequency of Use | Businesses often prepare Profit and Loss statements on a monthly, quarterly, or annual basis to track financial health over time. |

| Tax Implications | The information from the Profit and Loss form is crucial for tax reporting, as it helps determine taxable income. |

| State-Specific Forms | Some states may require specific formats or additional information on the Profit and Loss form, governed by state tax laws. |

| Financial Analysis | This form serves as a key tool for financial analysis, allowing stakeholders to assess profitability and make informed decisions. |

| Comparison | Businesses can compare Profit and Loss statements over different periods to identify trends in revenue and expenses. |

| Stakeholder Importance | Investors, creditors, and management rely on the Profit and Loss form to evaluate the business's financial viability and operational efficiency. |

Other PDF Documents

Health Guarantee for Puppies Template - The agreement includes provisions for the health guarantees applicable to the specific puppy purchased.

Bdsm Checklist - Keeping an open mind allows for exploration within BDSM.