Blank Payroll Check PDF Form

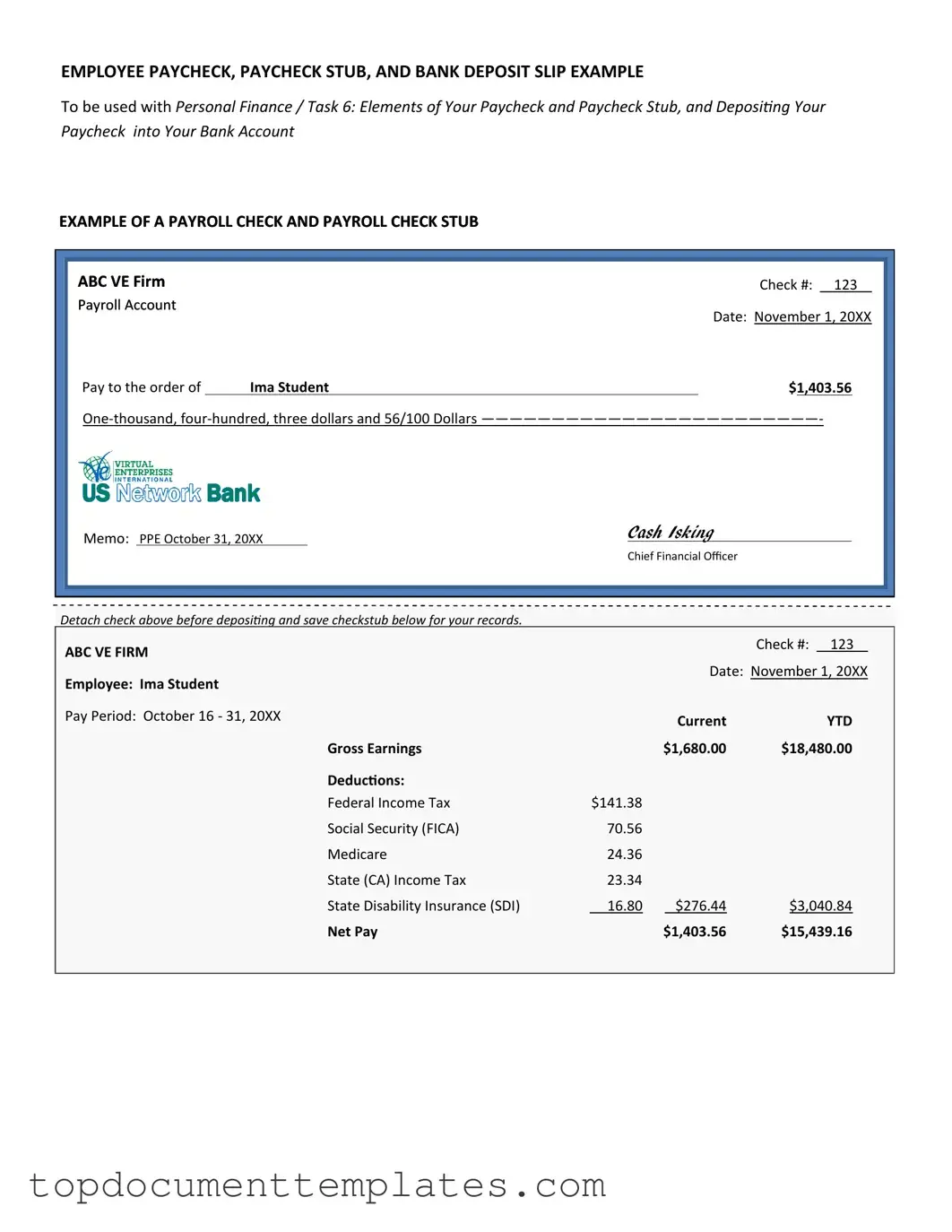

The Payroll Check form serves as a crucial document in the process of compensating employees for their work. This form typically includes essential details such as the employee's name, identification number, and pay period, ensuring that all necessary information is readily accessible. Additionally, it outlines the gross pay, deductions, and net pay, providing a clear breakdown of how the final amount is calculated. Employers often use this form to maintain accurate records for accounting and tax purposes, reinforcing the importance of compliance with labor laws. Furthermore, the Payroll Check form can also include information about overtime hours worked, bonuses, and any other relevant compensation adjustments. By standardizing this information, both employers and employees can easily understand the payment structure, fostering transparency and trust in the employer-employee relationship.

Similar forms

The Payroll Check form is an essential document in managing employee compensation. It shares similarities with several other forms used in payroll and human resources. Below is a list of nine documents that are comparable to the Payroll Check form, along with explanations of how they are similar:

- Pay Stub: A pay stub provides a detailed breakdown of an employee's earnings, deductions, and net pay, similar to the Payroll Check form, which also outlines the amount an employee is to receive.

- Direct Deposit Authorization Form: This form allows employees to authorize their employer to deposit their pay directly into their bank account, just as the Payroll Check form indicates the payment amount owed to the employee.

- W-2 Form: The W-2 form summarizes an employee's annual wages and taxes withheld, akin to the Payroll Check form, which reflects payment details for a specific pay period.

- Time Sheet: A time sheet records the hours worked by an employee, similar to the Payroll Check form, which relies on this information to calculate the total amount due.

- Payroll Register: The payroll register is a comprehensive report that lists all employees’ earnings for a specific period, much like the Payroll Check form that details individual payments.

Bill of Sale: A Bill of Sale is an essential document for the transfer of personal property ownership, confirming the details of the transaction between the parties involved. For detailed information about creating a Bill of Sale in New York, you can visit documentonline.org/blank-new-york-bill-of-sale/.

- Expense Reimbursement Form: This form is used for employees to claim reimbursement for work-related expenses, paralleling the Payroll Check form in that both involve financial compensation to employees.

- Employment Contract: An employment contract outlines the terms of employment, including salary, which directly relates to the figures presented in the Payroll Check form.

- Tax Withholding Form (W-4): This form allows employees to specify their tax withholding preferences, similar to how the Payroll Check form reflects the net pay after taxes are deducted.

- Benefits Enrollment Form: This document is used for enrolling in company benefits, and while it serves a different purpose, it also relates to the overall compensation package that the Payroll Check form represents.

Guidelines on Writing Payroll Check

Completing the Payroll Check form is an essential task that ensures employees receive their compensation accurately and on time. Following the steps outlined below will help streamline the process, making it easier for you to fill out the necessary information correctly.

- Begin by entering the date in the designated field. This should reflect the date on which the payroll check is being issued.

- Next, locate the section for the employee's name. Write the full name of the employee receiving the check, ensuring correct spelling.

- In the address field, provide the employee's current address. This should include the street address, city, state, and zip code.

- Fill in the amount of the paycheck in both numerical and written form. This ensures clarity and minimizes the risk of errors.

- Specify the pay period for which the check is being issued. Clearly indicate the start and end dates of the pay period.

- In the section for deductions, list any applicable deductions that should be taken from the employee's pay, such as taxes or benefits.

- Finally, sign the check in the designated area. This signature should belong to the authorized person responsible for issuing payroll checks.

Form Data

| Fact Name | Description |

|---|---|

| Purpose | The Payroll Check form is used to document and authorize the payment of wages to employees. |

| Frequency | Payroll checks are typically issued on a regular schedule, such as weekly, bi-weekly, or monthly, depending on company policy. |

| Components | The form generally includes employee details, pay period dates, gross pay, deductions, and net pay. |

| State-Specific Regulations | Each state may have specific laws governing payroll checks, including timing of payment and required deductions. For example, California's Labor Code Section 204 mandates timely payment of wages. |

| Record Keeping | Employers are required to maintain payroll records for a specified period, often three to seven years, depending on state laws. |

Other PDF Documents

Roof Certification Form Florida - Detail any changes or additions made to the roof since the last inspection.

Accord Form - The Acord 50 WM template simplifies the process of reporting insurance coverage details.

In addition to its importance in safeguarding sensitive information, a Florida Non-disclosure Agreement form can often be easily accessible through resources like OnlineLawDocs.com, where businesses can find templates and guidance on ensuring compliance with local laws while protecting their trade secrets.

What Is an Abn in Healthcare - For a patient, signing an ABN can help clarify potential financial implications upfront.