Blank P 45 It PDF Form

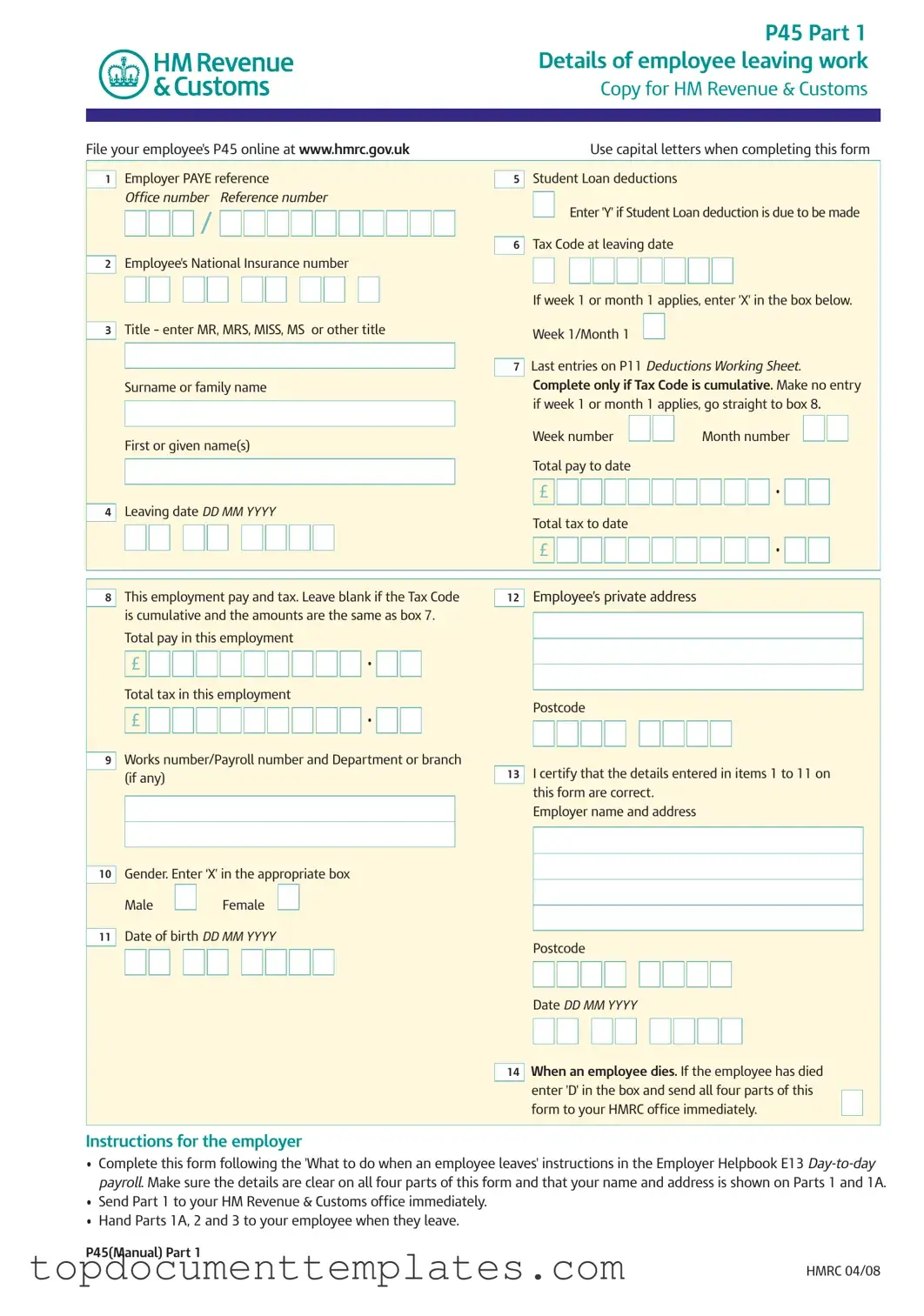

The P45 It form is a critical document for both employers and employees in the UK, particularly during transitions between jobs. This form consists of three parts: Part 1, which is sent to HM Revenue & Customs (HMRC); Part 1A, which the employee retains; and Parts 2 and 3, which are provided to the new employer. Each part includes essential information such as the employee's National Insurance number, tax code, and details about pay and tax deductions to date. Employers must complete the form accurately, ensuring that all sections are filled out clearly to avoid any issues with tax calculations. Employees should keep their copy safe, as it may be needed for tax returns or to claim tax refunds. The P45 also includes instructions for handling student loan deductions and guidelines for what to do if the employee has died. Properly managing the P45 form ensures compliance with tax regulations and facilitates a smooth transition for employees moving to new positions.

Similar forms

P60 Form: This document summarizes an employee's total earnings and tax deductions for the tax year. Like the P45, it is issued by the employer and provides important information for tax returns.

P11D Form: This form details benefits and expenses provided to employees. Similar to the P45, it is used to report income to HMRC and can affect tax calculations.

P85 Form: Used when an employee leaves the UK to work abroad, the P85 helps to claim tax refunds. It serves a similar purpose to the P45 by providing information about income and tax status.

P50 Form: This is a claim form for tax refunds when an employee stops working. Like the P45, it is used to report income and tax paid, facilitating the refund process.

-

Illinois Bill of Sale: This important document serves as proof of ownership transfer for personal property, protecting both buyers and sellers in a transaction. For more details, visit https://documentonline.org/blank-illinois-bill-of-sale.

P60U Form: This document is for employees who have received a tax refund. It summarizes income and tax information, similar to the P45, for tax return purposes.

P14 Form: This is a historical document that was used to report an employee's earnings and tax deductions at the end of the tax year. It is similar to the P45 in that it summarizes earnings and tax information.

P46 Form: This form is used when an employee starts a new job without a P45. It collects tax code information, similar to how the P45 provides tax details for a departing employee.

P2 Form: This is a notice of coding issued by HMRC that informs employees of their tax code. It is similar to the P45 in that it affects how much tax is deducted from earnings.

P60E Form: This document is for employees who have received a tax refund due to overpayment. It summarizes earnings and tax, much like the P45, helping with tax return submissions.

P11 Form: This is a record of an employee's pay and deductions during the year. Like the P45, it is important for calculating tax obligations and reporting to HMRC.

Guidelines on Writing P 45 It

Filling out the P45 It form is a straightforward process, essential for managing employee transitions. Once completed, it helps ensure that the employee’s tax information is correctly recorded and transferred. Follow these steps carefully to ensure accuracy and compliance.

- Start with Part 1 of the P45 form. Use capital letters throughout.

- Fill in the employer’s PAYE reference number and office number in the designated boxes.

- Enter the employee's National Insurance number.

- In the title box, write MR, MRS, MISS, MS, or another title as applicable.

- Provide the employee's surname and first or given names.

- Indicate the leaving date using the format DD MM YYYY.

- Record the total pay to date and total tax to date in the respective boxes.

- Complete the employee’s private address, including the postcode.

- Check if the tax code at the leaving date is cumulative. If it is, complete the relevant boxes; if not, leave them blank.

- For student loan deductions, enter 'Y' if applicable. If week 1 or month 1 applies, mark the box accordingly.

- Certify that the details entered are correct by signing and dating the form.

- Make sure to send Part 1 to HM Revenue & Customs immediately after completion.

- Hand over Parts 1A, 2, and 3 to the employee when they leave.

After filling out the form, the next steps involve ensuring that all parts are distributed correctly. The employer needs to send Part 1 to HMRC, while the employee should keep Part 1A safe for their records. Parts 2 and 3 should be given to the new employer to ensure a smooth transition and correct tax handling in the new job.

Form Data

| Fact Name | Description |

|---|---|

| Purpose | The P45 form documents an employee's tax and income details when they leave a job. |

| Parts | The form consists of three parts: Part 1 for HMRC, Part 1A for the employee, and Parts 2 and 3 for the new employer. |

| Submission Requirement | Employers must send Part 1 to HMRC immediately after an employee leaves. |

| Employee's Responsibility | Employees should keep Part 1A safe for future reference, especially for tax returns. |

| Tax Code | The form includes the employee's tax code at the time of leaving, which is crucial for tax calculations. |

| Student Loan Deductions | Employers must indicate if student loan deductions are applicable on the form. |

| Week/Month 1 Indicator | Employees must mark 'X' if they are on a week 1 or month 1 tax code. |

| Final Tax Calculations | The form provides total pay and tax amounts for the employment period, ensuring accurate tax reporting. |

| Legal Compliance | Completing the P45 is governed by UK tax law, specifically the Income Tax (Pay As You Earn) Regulations. |

Other PDF Documents

Flying Internationally With Dog - Ensure that your pet is accustomed to travel to minimize stress during transit.

Da - Information on the form must be filled out accurately to avoid discrepancies.

In situations where individuals may be unable to manage their financial and legal responsibilities, a Florida Power of Attorney form becomes essential. This document allows one person to act on behalf of another, ensuring that their interests are protected during challenging times. For those looking for resources and templates related to this important legal tool, visiting TopTemplates.info can provide valuable insights and assistance.

U.S. Corporation Income Tax Return - Corporations may need to adjust their estimated tax payments based on the results of Form 1120.