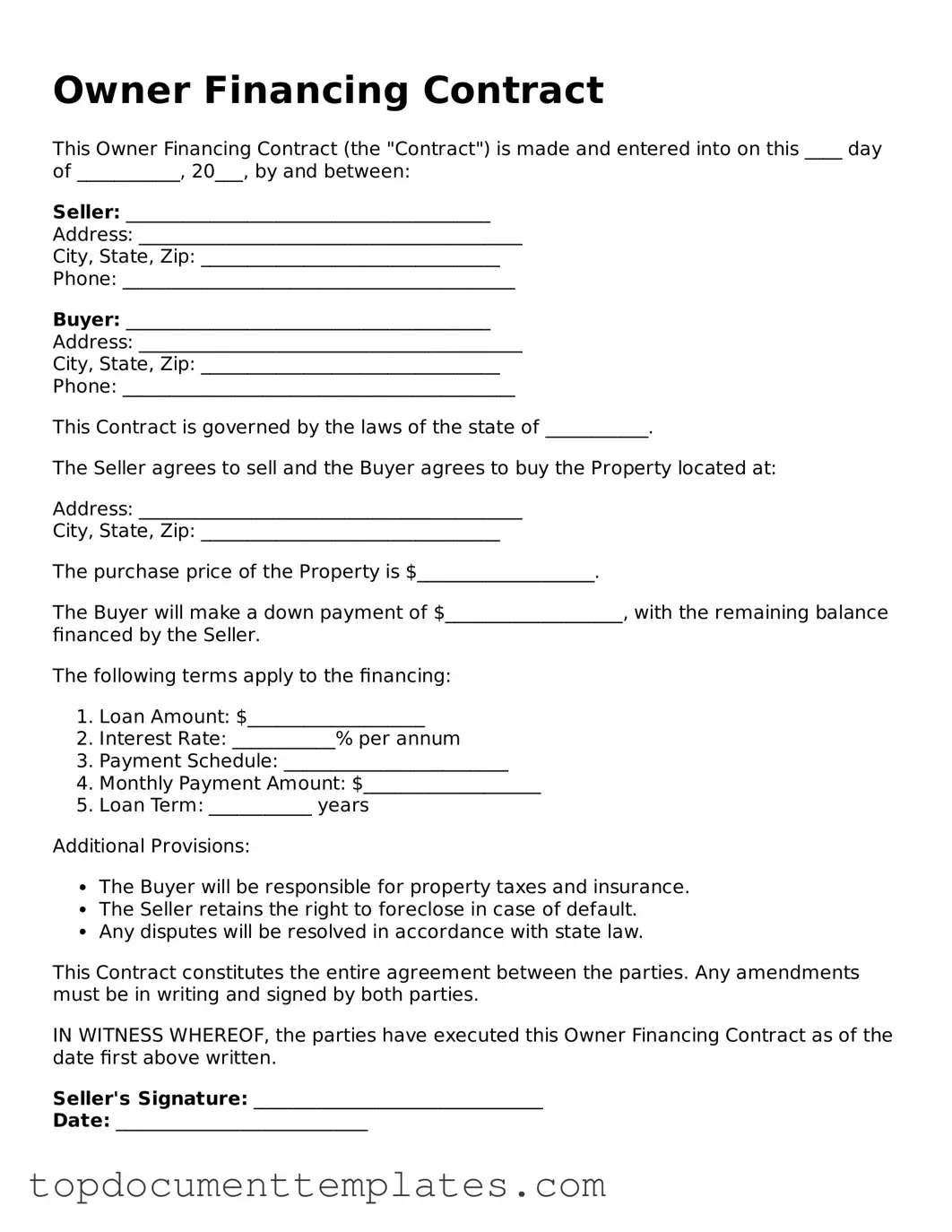

Official Owner Financing Contract Template

When navigating the complexities of real estate transactions, the Owner Financing Contract form emerges as a valuable tool for both buyers and sellers. This form allows the seller to provide financing directly to the buyer, bypassing traditional lenders. It outlines essential terms such as the purchase price, down payment, interest rate, and repayment schedule, ensuring that both parties have a clear understanding of their obligations. Additionally, it addresses important conditions, such as default terms and property maintenance responsibilities. By detailing these aspects, the Owner Financing Contract not only facilitates a smoother transaction but also fosters trust between the involved parties. Understanding this form is crucial for anyone considering owner financing, as it provides a framework that can lead to a successful sale and a mutually beneficial agreement.

Similar forms

The Owner Financing Contract form shares similarities with several other documents commonly used in real estate transactions. Here are four such documents:

- Promissory Note: Like the Owner Financing Contract, a promissory note outlines the borrower's promise to repay a loan. It specifies the loan amount, interest rate, and repayment schedule, ensuring both parties understand their obligations.

California Real Estate Purchase Agreement: This legally binding document outlines the terms and conditions of a real estate transaction in California, covering crucial details such as the purchase price, property description, and contingencies that must be met before the sale can proceed. For more details, visit All California Forms.

- Mortgage or Deed of Trust: This document secures the loan by placing a lien on the property. Similar to the Owner Financing Contract, it protects the lender's interest in the property until the loan is fully repaid.

- Purchase Agreement: A purchase agreement details the terms of the sale, including price and contingencies. The Owner Financing Contract can be part of this agreement, providing an alternative payment method for the buyer.

- Lease Purchase Agreement: This document combines elements of a lease and a purchase agreement. It allows a tenant to rent a property with the option to buy later, similar to owner financing where payments contribute toward the purchase price.

Guidelines on Writing Owner Financing Contract

Completing the Owner Financing Contract form is an essential step in establishing an agreement between a seller and a buyer regarding the terms of financing. Following these steps will help ensure that all necessary information is accurately captured.

- Gather Required Information: Collect all necessary details about the buyer, seller, property, and financing terms.

- Fill in Seller Information: Enter the full name, address, and contact details of the seller in the designated section.

- Fill in Buyer Information: Provide the full name, address, and contact details of the buyer.

- Property Description: Describe the property being sold, including the address, legal description, and any relevant identifiers.

- Financing Terms: Clearly outline the financing terms, including the purchase price, down payment amount, interest rate, and repayment schedule.

- Contingencies: Specify any contingencies that must be met for the contract to be valid, such as inspections or financing approvals.

- Signatures: Ensure that both the seller and buyer sign and date the form in the appropriate sections.

- Review the Form: Double-check all entries for accuracy and completeness before finalizing the document.

Once the form is completed, it is advisable to make copies for both parties and retain a copy for your records. This will help facilitate a smooth transaction and provide a clear reference for both the buyer and seller.

File Information

| Fact Name | Description |

|---|---|

| Definition | An Owner Financing Contract is an agreement where the seller provides financing to the buyer, allowing them to purchase property without traditional bank financing. |

| Parties Involved | The contract involves two primary parties: the seller (owner) and the buyer. Each party has specific rights and responsibilities outlined in the agreement. |

| Down Payment | Typically, the buyer makes a down payment to the seller. The amount can vary based on the agreement but is often a percentage of the purchase price. |

| Payment Terms | The contract specifies the payment schedule, including the amount of each installment, interest rate, and duration of the loan. |

| Governing Law | The laws governing the Owner Financing Contract vary by state. For example, in California, it is governed by the California Civil Code. |

| Default Provisions | The contract outlines what happens in the event of a default, including potential remedies for the seller, such as foreclosure procedures. |

| Title Transfer | Ownership of the property typically transfers to the buyer upon signing the contract, although the seller may retain a security interest until the loan is paid off. |

| Legal Requirements | Each state has specific legal requirements for Owner Financing Contracts, including disclosures and documentation that must be provided to the buyer. |

| Benefits | Owner financing can benefit both parties. Buyers may secure a home more easily, while sellers can attract more buyers and potentially earn interest on the financing. |

Find Other Types of Owner Financing Contract Templates

Purchase Agreement Addendum - This form can include conditions for financing approvals.

The New York Real Estate Purchase Agreement form is a legally binding document that outlines the terms and conditions under which a piece of real estate will be sold and purchased. It details everything from the price to the responsibilities of both the buyer and the seller. To ensure clarity and compliance, it is advisable to refer to templates such as the NY PDF Forms, which can assist in navigating the complexities of buying or selling property in New York.