Valid Transfer-on-Death Deed Form for New Jersey State

In New Jersey, property owners have a valuable tool at their disposal known as the Transfer-on-Death Deed form. This form allows individuals to pass their real estate directly to designated beneficiaries without the need for probate, simplifying the process of transferring ownership upon death. By filling out this deed, property owners can specify who will inherit their property, ensuring that their wishes are honored. The Transfer-on-Death Deed is particularly beneficial for those looking to avoid the complexities and costs associated with probate court. It is important to note that the transfer only takes effect upon the owner's death, allowing them to retain full control of the property during their lifetime. Additionally, this deed can be revoked or altered at any time before the owner's passing, providing flexibility and peace of mind. Understanding how to properly execute this form can make a significant difference in estate planning, making it essential for New Jersey residents to consider this option seriously.

Similar forms

The Transfer-on-Death Deed (TODD) is a unique legal document that allows individuals to transfer their property to designated beneficiaries upon their death, avoiding probate. It shares similarities with several other documents. Here’s a look at six of those documents:

- Last Will and Testament: Like a TODD, a will specifies how a person's assets should be distributed after death. However, a will typically goes through probate, while a TODD does not.

- Living Trust: A living trust allows individuals to manage their assets during their lifetime and distribute them after death. Both documents help avoid probate, but a living trust can also provide management of assets if the person becomes incapacitated.

- Beneficiary Designation Forms: These forms are often used for financial accounts and insurance policies to designate beneficiaries. Similar to a TODD, they allow assets to transfer directly to beneficiaries without going through probate.

- ATV Bill of Sale: This document is crucial for the sale of an ATV as it provides legal proof of the transaction, detailing the ATV's identification number and the personal information of the involved parties. For more information, visit documentonline.org/blank-new-york-atv-bill-of-sale/.

- Payable-on-Death (POD) Accounts: A POD account allows bank account holders to name a beneficiary who will receive the funds upon the account holder's death. This operates similarly to a TODD in that it bypasses probate.

- Joint Tenancy with Right of Survivorship: This form of property ownership allows co-owners to automatically inherit the property upon the death of one owner. Like a TODD, it avoids probate, but it requires joint ownership from the beginning.

- Transfer-on-Death Registration for Securities: This allows individuals to designate beneficiaries for stocks and bonds, similar to how a TODD works for real estate. Both facilitate a smooth transfer of assets without probate.

Guidelines on Writing New Jersey Transfer-on-Death Deed

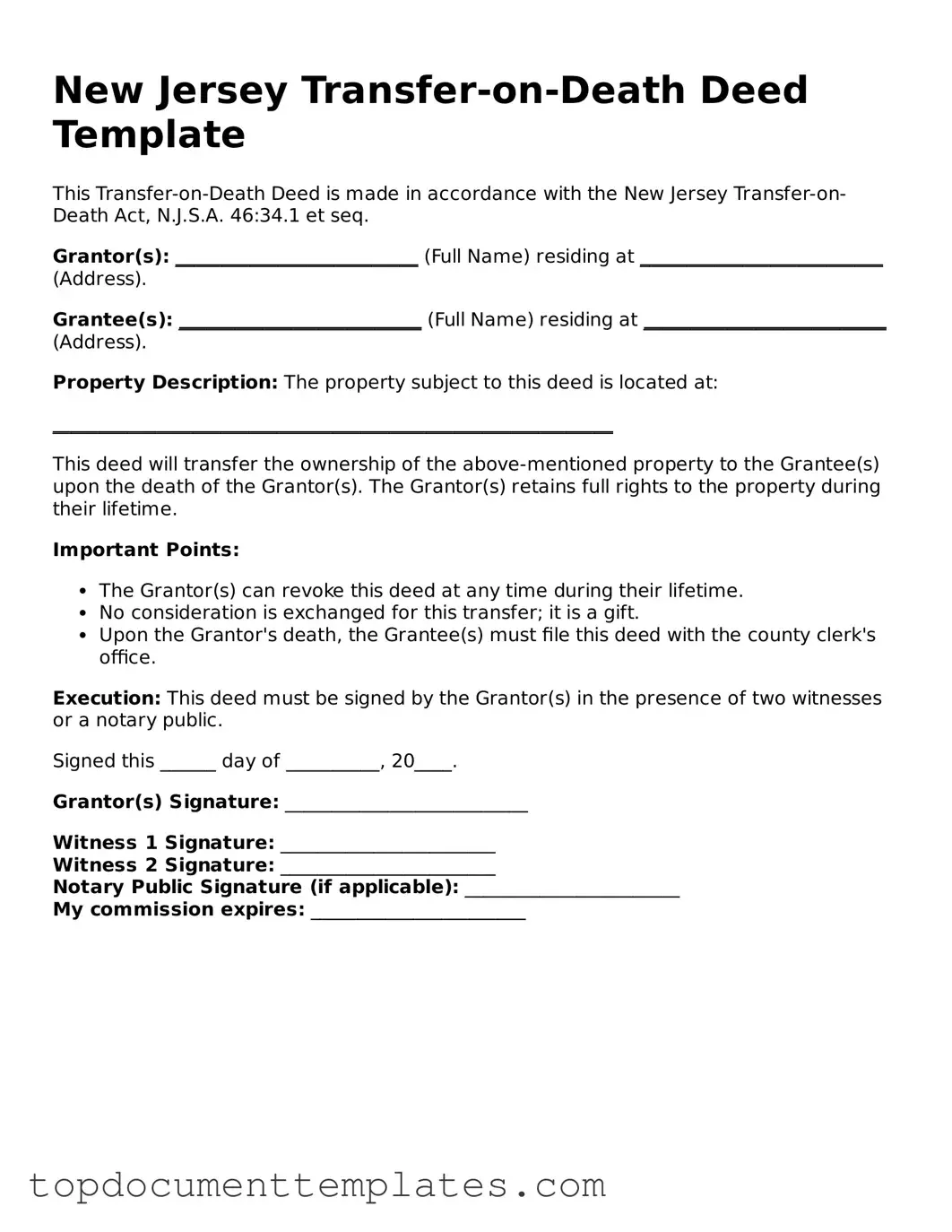

After gathering the necessary information and understanding the purpose of the New Jersey Transfer-on-Death Deed form, the next step is to fill it out accurately. Completing this form involves providing specific details about the property and the beneficiaries. Follow the steps below to ensure proper completion.

- Obtain the New Jersey Transfer-on-Death Deed form. This can be found online or at your local county clerk's office.

- Begin by entering your name and address as the grantor at the top of the form. Make sure to use your full legal name.

- Next, provide the name and address of the beneficiary or beneficiaries. If there are multiple beneficiaries, list them in the order you prefer.

- In the designated section, describe the property you are transferring. Include the property's address and any other identifying details, such as the block and lot number.

- Indicate whether the transfer is to be effective immediately upon your death or if there are any conditions attached to the transfer.

- Sign and date the form. Your signature must be witnessed by two individuals who are not beneficiaries of the deed.

- Have the form notarized. This step is essential to ensure the document is legally binding.

- Finally, file the completed deed with the county clerk's office where the property is located. There may be a filing fee, so check with the office for details.

Once the form is completed and filed, it will be recorded in the public records. This ensures that your wishes regarding the property transfer are legally recognized and can be executed upon your passing.

File Information

| Fact Name | Description |

|---|---|

| Definition | A Transfer-on-Death Deed allows an individual to transfer real estate to a beneficiary upon their death without going through probate. |

| Governing Law | The New Jersey Transfer-on-Death Deed is governed by N.J.S.A. 46:3B-1 et seq. |

| Eligibility | Any individual who owns real estate in New Jersey can create a Transfer-on-Death Deed. |

| Beneficiary Designation | The deed allows for one or more beneficiaries to be designated, who will receive the property upon the owner's death. |

| Revocation | The Transfer-on-Death Deed can be revoked at any time by the property owner through a subsequent deed or written document. |

| Recording Requirement | The deed must be recorded with the county clerk in the county where the property is located to be effective. |

| Tax Implications | Property transferred via a Transfer-on-Death Deed may be subject to estate taxes, depending on the overall estate value. |

| Effect on Creditors | Creditors of the deceased may still pursue claims against the estate, even if the property is transferred via this deed. |

| Joint Ownership | If the property is jointly owned, the Transfer-on-Death Deed does not affect the rights of the surviving owner. |

| Legal Advice | It is advisable to seek legal counsel when creating a Transfer-on-Death Deed to ensure it meets all legal requirements. |

Other Popular Transfer-on-Death Deed State Forms

Survivorship Deed Vs Transfer on Death - Property owners should consider this deed to ensure their legacy is preserved for future generations.

The Florida Employment Verification form is essential for employers to ensure their employees' eligibility to work in the United States, thereby helping to adhere to both federal and state employment laws. This form not only aids in legal compliance but also supports the integrity of the labor market, making it important for businesses to have access to resources like https://onlinelawdocs.com/ that can provide guidance on proper procedures and documentation.

Transfer on Death Deed Illinois Cost - This tool is often used in estate planning to ensure that property ends up in the right hands quickly.