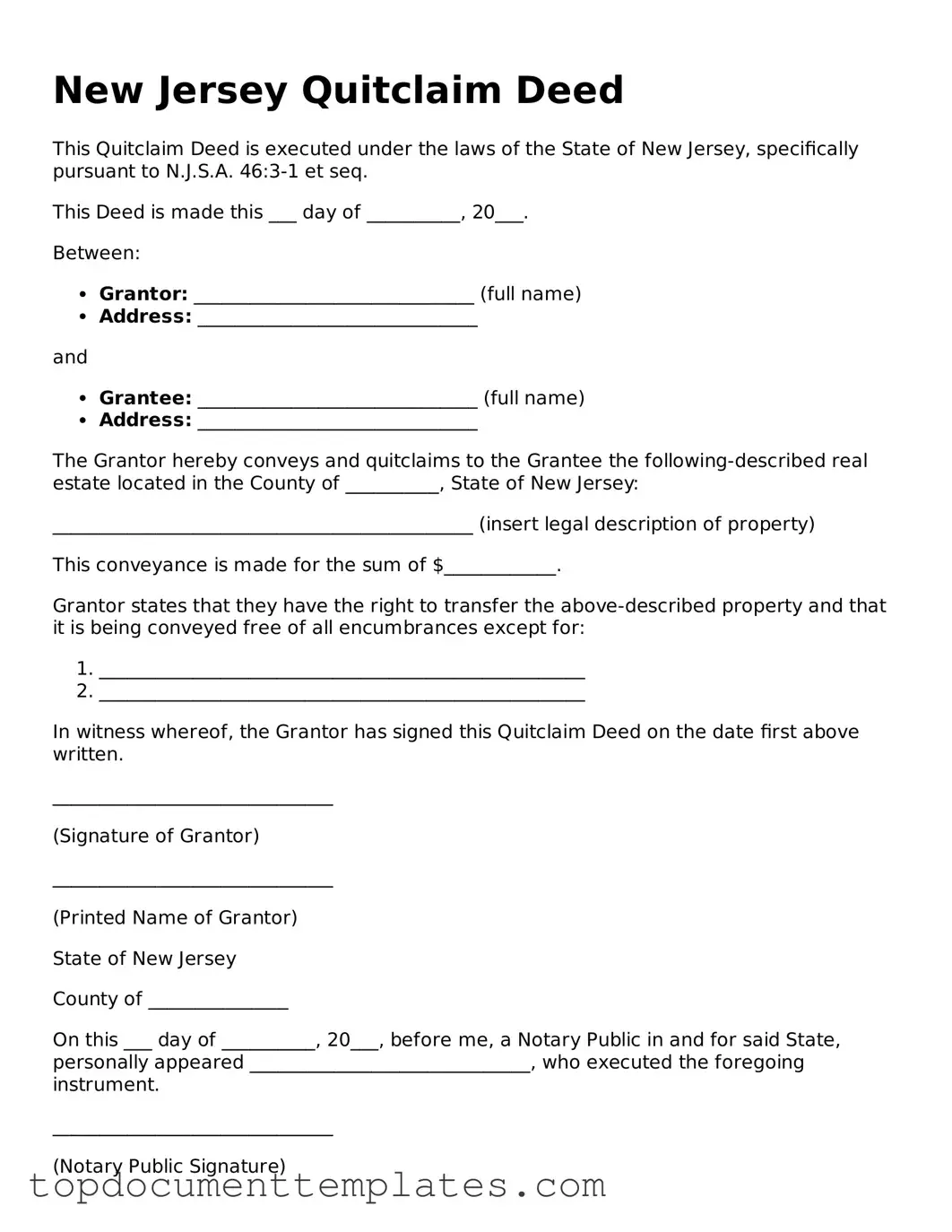

Valid Quitclaim Deed Form for New Jersey State

In New Jersey, the Quitclaim Deed serves as a vital tool for property transfers, allowing individuals to convey their interest in real estate without making any guarantees about the title. This form is particularly useful in situations where the parties involved have a pre-existing relationship, such as between family members or business partners, and trust that the transfer will be executed without disputes. The Quitclaim Deed does not provide any warranties, which means that the grantor is not responsible for any claims against the property that may arise after the transfer. This form typically includes essential information such as the names of the grantor and grantee, a description of the property, and the date of execution. While it is simpler than other types of deeds, such as warranty deeds, it is crucial for parties to understand the implications of using a Quitclaim Deed, particularly regarding potential risks associated with undisclosed liens or encumbrances. As a result, careful consideration and, if necessary, legal advice are recommended before proceeding with this method of property transfer.

Similar forms

A Quitclaim Deed is a legal document used to transfer ownership of real property. It is important to understand that several other documents serve similar purposes in property transactions. Below is a list of six documents that share similarities with a Quitclaim Deed:

- Warranty Deed: This document also transfers property ownership but provides a guarantee that the grantor holds clear title to the property and has the right to sell it. In contrast to a Quitclaim Deed, a Warranty Deed offers more protection to the buyer.

-

Marital Separation Agreement: The Arizona Marital Separation Agreement form is a legally binding document that outlines the terms of separation between spouses in Arizona, including division of assets, debts, and, if applicable, custody arrangements. Completing this form can simplify the separation process, ensure fairness, and help avoid disputes in the future. For those ready to take this step towards formal separation in Arizona, filling out the form is made easy by clicking the button below. For additional resources, refer to All Arizona Forms.

- Grant Deed: Like a Quitclaim Deed, a Grant Deed transfers ownership of property. However, it assures the grantee that the property has not been sold to anyone else and that it is free from undisclosed encumbrances.

- Deed of Trust: This document serves as a security instrument for a loan. While it does not transfer ownership in the same way as a Quitclaim Deed, it does involve the transfer of an interest in the property to a trustee until the loan is repaid.

- Lease Agreement: A Lease Agreement allows a tenant to occupy a property for a specified period. While it does not transfer ownership, it grants rights to use the property, similar to how a Quitclaim Deed transfers ownership rights.

- Real Estate Purchase Agreement: This document outlines the terms of a property sale. Although it is a contract rather than a deed, it initiates the transfer of property ownership, paralleling the function of a Quitclaim Deed.

- Affidavit of Title: This sworn statement provides information about the title of a property. While it does not transfer ownership, it can accompany a Quitclaim Deed to affirm the status of the title being conveyed.

Guidelines on Writing New Jersey Quitclaim Deed

Once you have the New Jersey Quitclaim Deed form, you can begin filling it out. Ensure you have all necessary information at hand, such as the names of the parties involved and the property details. Follow these steps carefully to complete the form accurately.

- Start by entering the date at the top of the form.

- In the "Grantor" section, write the name of the person or entity transferring the property.

- In the "Grantee" section, fill in the name of the person or entity receiving the property.

- Provide the address of the Grantee, including the city, state, and zip code.

- Describe the property being transferred. Include the lot number, block number, and any other relevant details.

- Check the box indicating whether the property is a primary residence, rental property, or other type of property.

- Sign the form in the "Grantor's Signature" section. Ensure the signature matches the name written above.

- Have the signature notarized. The notary will complete the section provided for them.

- Include any additional information required by local regulations, if applicable.

- Make copies of the completed form for your records before filing.

After filling out the Quitclaim Deed, the next step is to file it with the appropriate county office. This ensures the transfer is officially recorded and recognized. Be sure to check for any filing fees and additional requirements specific to your county.

File Information

| Fact Name | Description |

|---|---|

| Definition | A quitclaim deed is a legal document that transfers ownership of real estate from one party to another without any warranties. |

| Governing Law | The New Jersey Quitclaim Deed is governed by the New Jersey Statutes, Title 46, Chapter 3. |

| Parties Involved | The form requires at least two parties: the grantor (seller) and the grantee (buyer). |

| No Guarantees | Unlike other types of deeds, a quitclaim deed offers no guarantees regarding the title's validity. |

| Use Cases | Commonly used for transferring property between family members or in divorce settlements. |

| Filing Requirements | The completed deed must be filed with the county clerk's office where the property is located. |

| Consideration | While consideration (payment) is not required, it is often included for record-keeping purposes. |

| Signature Requirements | The grantor must sign the deed in the presence of a notary public for it to be valid. |

| Tax Implications | Property transfers using a quitclaim deed may still be subject to transfer taxes in New Jersey. |

| Revocation | A quitclaim deed cannot be revoked once it has been executed and filed, unless a new deed is created. |

Other Popular Quitclaim Deed State Forms

How Much Does an Attorney Charge for a Quit Claim Deed - This type of deed is effective for conveying property among individuals who trust each other.

Free Quit Claim Deed Template - A Quitclaim Deed does not offer protection against debts or liens on the property.

When applying for a position at Cracker Barrel, it is essential to understand the significance of the Cracker Barrel Background Check form. This document not only requires applicants to consent to background verifications but also emphasizes the importance of providing accurate and thorough information. To further educate yourself on the background check process, you can visit OnlineLawDocs.com for comprehensive resources and guidance.

Michigan Quit Claim Deed Pdf - A Quitclaim Deed is often used in family transfers, such as when one spouse gives property to another.