Valid Promissory Note Form for New Jersey State

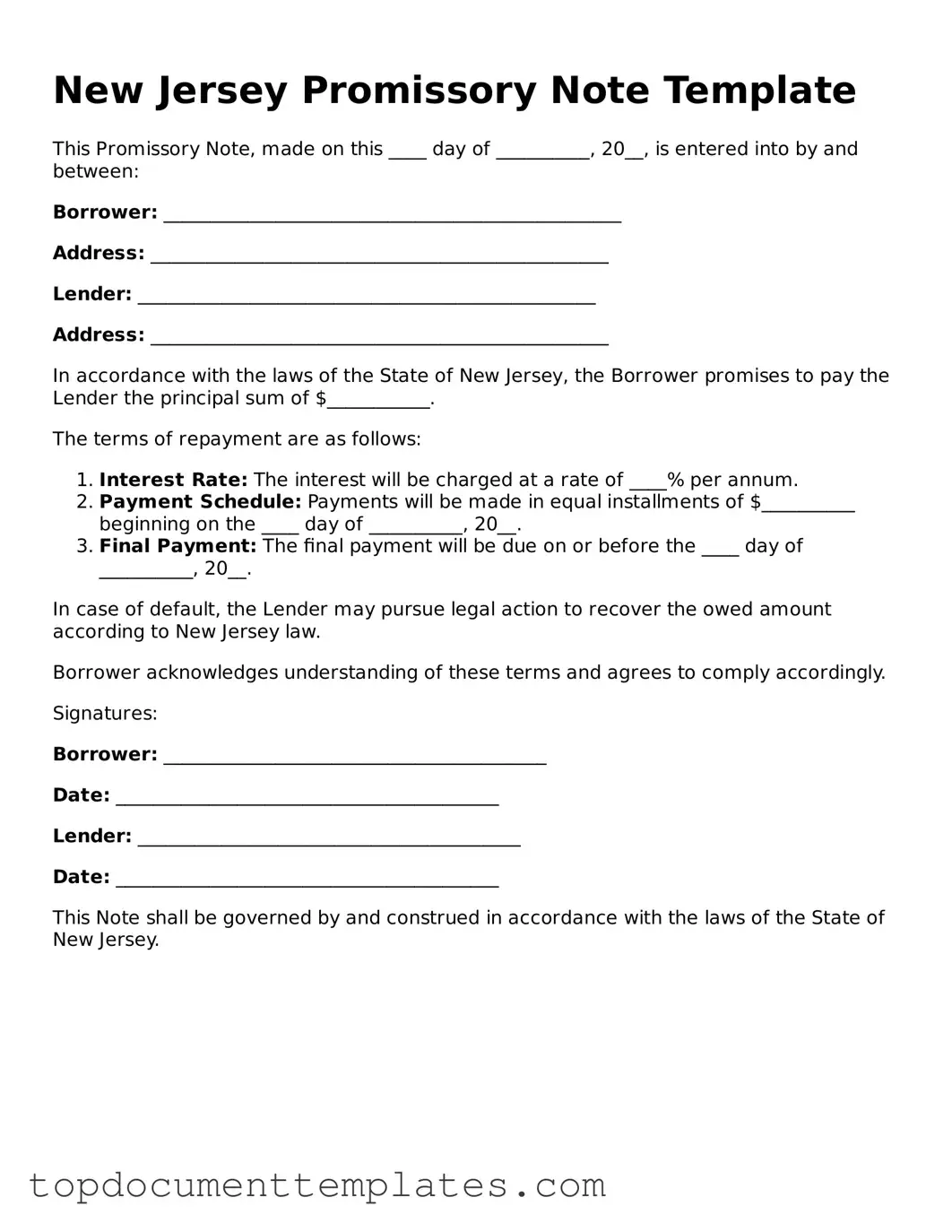

In the realm of personal and business finance, the New Jersey Promissory Note form serves as a vital tool for establishing clear agreements between lenders and borrowers. This legally binding document outlines the terms of a loan, ensuring that both parties understand their rights and obligations. Key components of the form include the principal amount borrowed, the interest rate, and the repayment schedule, which detail how and when payments will be made. Additionally, it often specifies the consequences of default, providing essential protection for lenders while also informing borrowers of their responsibilities. By utilizing this form, individuals and businesses can foster trust and transparency in their financial transactions, ultimately paving the way for smoother interactions and reducing the potential for disputes. Whether you're lending money to a friend or financing a business venture, understanding the nuances of the New Jersey Promissory Note is crucial for safeguarding your interests.

Similar forms

- Loan Agreement: Similar to a promissory note, a loan agreement outlines the terms of a loan, including repayment schedules and interest rates. However, it often includes additional details such as collateral and borrower obligations.

- Promissory Note Form: To ensure a clear understanding of loan agreements, refer to our essential Promissory Note form guide for detailed documentation and requirements.

- Mortgage: A mortgage is a specific type of loan secured by real estate. Like a promissory note, it includes a promise to repay, but it also involves the property as collateral, providing the lender with rights to the property if the borrower defaults.

- Credit Agreement: This document details the terms under which a borrower can access credit. It resembles a promissory note in its promise to repay, but it may allow for multiple draws or advances against a credit limit.

- Installment Agreement: An installment agreement outlines a repayment plan for a debt. It is similar to a promissory note as it specifies payment amounts and due dates, but it often covers a broader range of debts.

- Personal Guarantee: This document involves an individual agreeing to repay a loan if the primary borrower defaults. It shares the essence of a promissory note in its promise to pay, but it places the liability on a different party.

- Lease Agreement: While primarily used for rental situations, a lease agreement can include terms for payment similar to a promissory note. It specifies the obligation to pay rent over a set period.

- Debt Settlement Agreement: This agreement outlines the terms under which a debtor will pay a reduced amount to settle a debt. Like a promissory note, it includes a repayment promise but focuses on settling existing debts rather than initiating new ones.

- Forbearance Agreement: This document allows a borrower to pause or reduce payments temporarily. It shares similarities with a promissory note by outlining obligations, but it modifies the repayment terms due to financial hardship.

- Secured Note: A secured note is similar to a promissory note but is backed by collateral. This means that if the borrower defaults, the lender has the right to seize the collateral, adding an extra layer of security.

- Business Loan Application: While primarily a request for funding, this application often includes a commitment to repay the loan, similar to a promissory note. It lays the groundwork for the formal loan agreement that follows.

Guidelines on Writing New Jersey Promissory Note

After obtaining the New Jersey Promissory Note form, you are ready to fill it out. Ensure you have all necessary information at hand, such as the names of the parties involved, the loan amount, and the repayment terms. Follow these steps carefully to complete the form accurately.

- Begin by entering the date at the top of the form. Use the format MM/DD/YYYY.

- Write the full name of the borrower in the designated space. This is the person or entity receiving the loan.

- Enter the full name of the lender. This is the person or entity providing the loan.

- Clearly state the principal amount of the loan. This is the total amount being borrowed.

- Specify the interest rate, if applicable. Indicate whether it is fixed or variable.

- Outline the repayment terms. Include details such as the payment schedule (monthly, quarterly, etc.) and the due date of the final payment.

- Include any late fees or penalties for missed payments, if applicable.

- Sign the form where indicated. The borrower should sign, and if there is a co-signer, they should also sign.

- Provide the date of signing next to each signature.

- Make copies of the completed form for both the borrower and lender for their records.

File Information

| Fact Name | Description |

|---|---|

| Definition | A promissory note is a written promise to pay a specified amount of money to a designated person or entity at a specified time. |

| Governing Law | New Jersey's promissory notes are governed by the New Jersey Uniform Commercial Code (UCC), specifically N.J.S.A. 12A:3-101 et seq. |

| Parties Involved | The note typically involves two parties: the maker (borrower) and the payee (lender). |

| Interest Rate | Interest rates on promissory notes can be fixed or variable, depending on the agreement between the parties. |

| Signature Requirement | The maker must sign the promissory note for it to be legally binding. |

| Payment Terms | Payment terms should be clearly outlined, including the amount, due date, and method of payment. |

| Default Provisions | In the event of default, the note should specify the consequences, such as late fees or acceleration of payment. |

| Transferability | Promissory notes can be transferred to other parties, making them negotiable instruments under the UCC. |

| Enforceability | A properly executed promissory note is enforceable in court, provided it meets all legal requirements. |

| State-Specific Considerations | New Jersey law may impose specific requirements regarding notarization or witness signatures for certain types of promissory notes. |

Other Popular Promissory Note State Forms

Create Promissory Note - It is advisable for both parties to keep a copy of the signed note.

A Maine Promissory Note is a legal document that outlines a borrower's promise to repay a loan to a lender under specified terms. This form serves as a written record of the agreement, detailing the amount borrowed, interest rates, and repayment schedule. To ensure a smooth lending process, consider filling out the Promissory Note form by clicking the button below.

Illinois Promissory Note - It can incorporate recourse options for the lender in case of non-payment.

Promissory Note California - This note is a fundamental part of many personal finance strategies.