Valid Durable Power of Attorney Form for New Jersey State

In New Jersey, the Durable Power of Attorney (DPOA) form serves as a vital legal document that empowers individuals to designate someone they trust to make financial and legal decisions on their behalf, particularly in the event of incapacity. This form is not just a simple tool; it provides a framework for ensuring that your wishes are respected when you may no longer be able to communicate them. The DPOA can cover a wide range of responsibilities, from managing bank accounts and paying bills to handling real estate transactions and making investment decisions. Importantly, the document remains effective even if you become incapacitated, which distinguishes it from a standard power of attorney. New Jersey law allows for specific customization within the DPOA, enabling you to outline the exact powers you wish to grant to your agent, whether they are broad or limited. Additionally, the form requires proper execution, including signatures and witnesses, to ensure its validity. Understanding the nuances of the Durable Power of Attorney can provide peace of mind, knowing that your financial affairs will be managed according to your wishes, even when you are unable to do so yourself.

Similar forms

- General Power of Attorney: Like the Durable Power of Attorney, this document allows one person to act on behalf of another. However, it typically becomes invalid if the principal becomes incapacitated.

- Health Care Proxy: This document specifically designates someone to make medical decisions for an individual when they cannot do so themselves, similar to how a Durable Power of Attorney can manage financial matters.

- Living Will: While not a power of attorney, a living will outlines an individual’s wishes regarding medical treatment in situations where they are unable to communicate. Both documents address decision-making in times of incapacity.

- Financial Power of Attorney: This is a specific type of power of attorney focused solely on financial matters. Like the Durable Power of Attorney, it allows someone to manage finances on behalf of another.

- Springing Power of Attorney: This document becomes effective only upon a specified event, usually the incapacitation of the principal. It shares similarities with the Durable Power of Attorney in terms of authority granted during incapacity.

- Articles of Incorporation - This document is essential for establishing a corporation in New York, detailing the company's name, purpose, and structure. To learn more, visit https://documentonline.org/blank-new-york-articles-of-incorporation/.

- Trust Agreement: A trust can appoint a trustee to manage assets for beneficiaries. Both a trust and a Durable Power of Attorney provide mechanisms for asset management, though they operate differently.

- Guardianship Documents: When a court appoints a guardian for an incapacitated person, that guardian has similar decision-making authority as someone designated under a Durable Power of Attorney.

- Living Trust: This document allows individuals to manage their assets during their lifetime and specify distribution after death. It is similar to a Durable Power of Attorney in that it can provide for asset management.

- Medical Power of Attorney: This allows someone to make healthcare decisions on behalf of another. It is closely related to the Health Care Proxy but often includes broader powers similar to those in a Durable Power of Attorney.

- Advance Directive: This combines elements of a living will and health care proxy, allowing individuals to express their medical preferences and appoint a decision-maker. It shares the focus on decision-making during incapacity with the Durable Power of Attorney.

Guidelines on Writing New Jersey Durable Power of Attorney

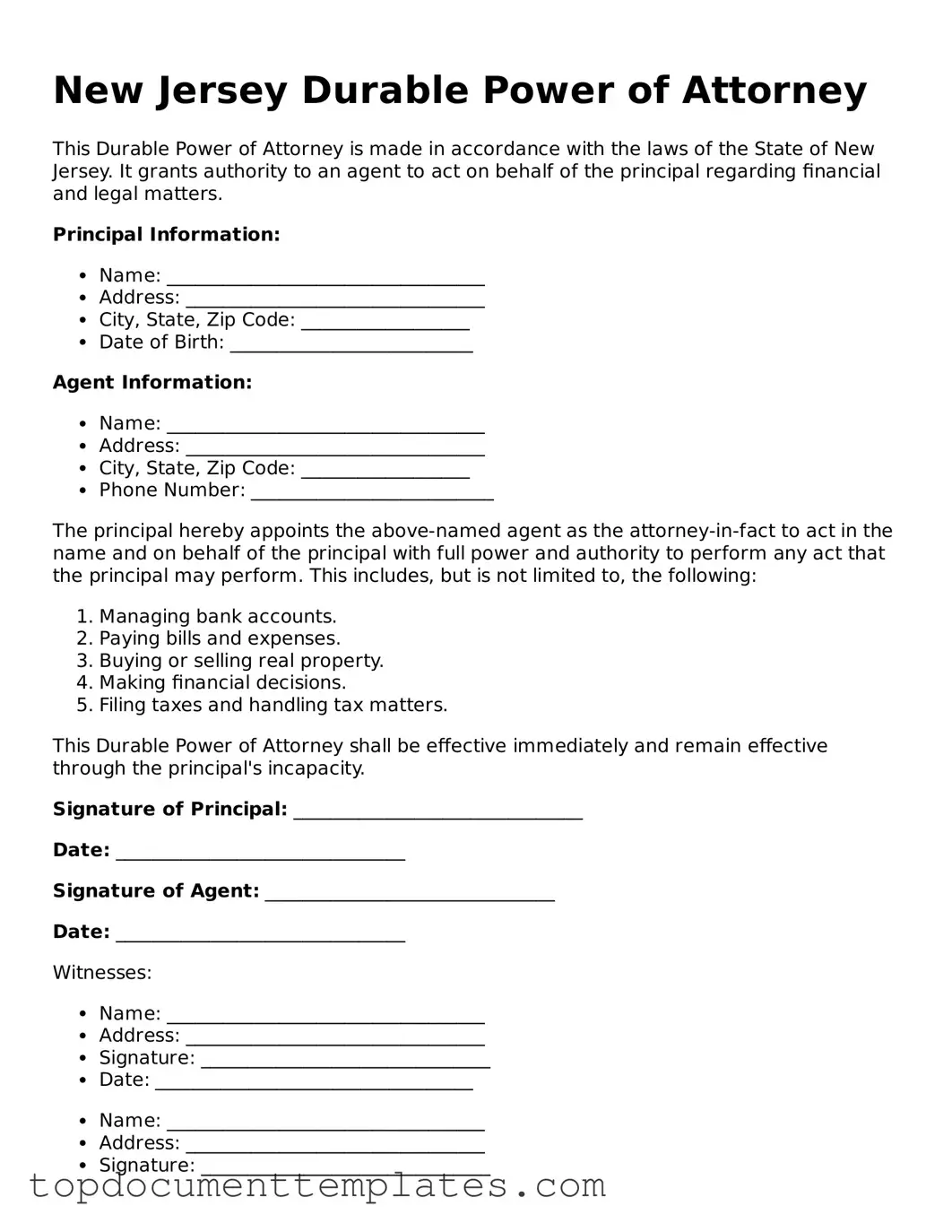

Filling out the New Jersey Durable Power of Attorney form is a straightforward process. This document allows you to designate someone to handle your financial matters if you become unable to do so yourself. Follow these steps carefully to ensure that the form is completed correctly.

- Obtain the form: Download the New Jersey Durable Power of Attorney form from a reliable source or visit your local courthouse to get a physical copy.

- Read the instructions: Familiarize yourself with the form’s sections and requirements to avoid mistakes.

- Fill in your information: Enter your full name, address, and date of birth at the top of the form.

- Select your agent: Clearly write the name and address of the person you are appointing as your agent. Ensure they are willing to accept this responsibility.

- Specify powers: Indicate which powers you are granting your agent. Be specific about financial matters or decisions they can make on your behalf.

- Include successor agents: If desired, list one or more successor agents who can take over if your primary agent is unable to serve.

- Sign and date the form: You must sign and date the document in the presence of a notary public or two witnesses, depending on state requirements.

- Notarization: Have the form notarized or signed by witnesses as required to validate the document.

- Distribute copies: Provide copies of the completed form to your agent, any successor agents, and relevant financial institutions.

File Information

| Fact Name | Description |

|---|---|

| Definition | A Durable Power of Attorney (DPOA) allows an individual to designate another person to manage their financial and legal affairs, even if they become incapacitated. |

| Governing Law | The New Jersey Durable Power of Attorney is governed by the New Jersey Statutes, specifically N.J.S.A. 46:2B-8. |

| Durability | The term "durable" signifies that the authority granted remains in effect during the principal's incapacity. |

| Agent Authority | The agent can perform a variety of tasks, such as managing bank accounts, paying bills, and making investment decisions on behalf of the principal. |

| Revocation | A Durable Power of Attorney can be revoked at any time by the principal, provided they are mentally competent to do so. |

| Witness Requirements | The form must be signed by the principal in the presence of two witnesses or a notary public to be valid. |

| Agent Selection | Choosing a trustworthy agent is crucial, as this person will have significant control over the principal's financial matters. |

| Health Care Decisions | A Durable Power of Attorney is primarily for financial matters; a separate document, such as a Health Care Proxy, is needed for medical decisions. |

| Limitations | Certain actions, like making or changing a will, cannot be authorized through a Durable Power of Attorney. |

| State-Specific Considerations | New Jersey law provides specific guidelines and forms that must be followed to ensure the DPOA is legally binding. |

Other Popular Durable Power of Attorney State Forms

Does a Power of Attorney Need to Be Recorded in Arizona - Including alternate agents can provide a backup in case the primary agent is unable to serve.

Does Durable Power of Attorney Cover Medical - Securing a Durable Power of Attorney reflects thoughtful consideration for your future well-being.

A Durable Power of Attorney form in Florida is a legal document that allows someone to act on your behalf if you become unable to manage your own affairs. This document remains in effect even if you become incapacitated, ensuring that your chosen representative can make decisions regarding your finances, property, and other important matters. Understanding how to properly complete and use this form is critical for safeguarding your interests. For more information, you can visit onlinelawdocs.com/.

Durable Power of Attorney Form California - Incapacity can be unpredictable; prepare accordingly with this form.

Illinois Durable Power of Attorney Form Pdf - This document is a proactive step toward protecting your interests and affairs.