Blank Netspend Dispute PDF Form

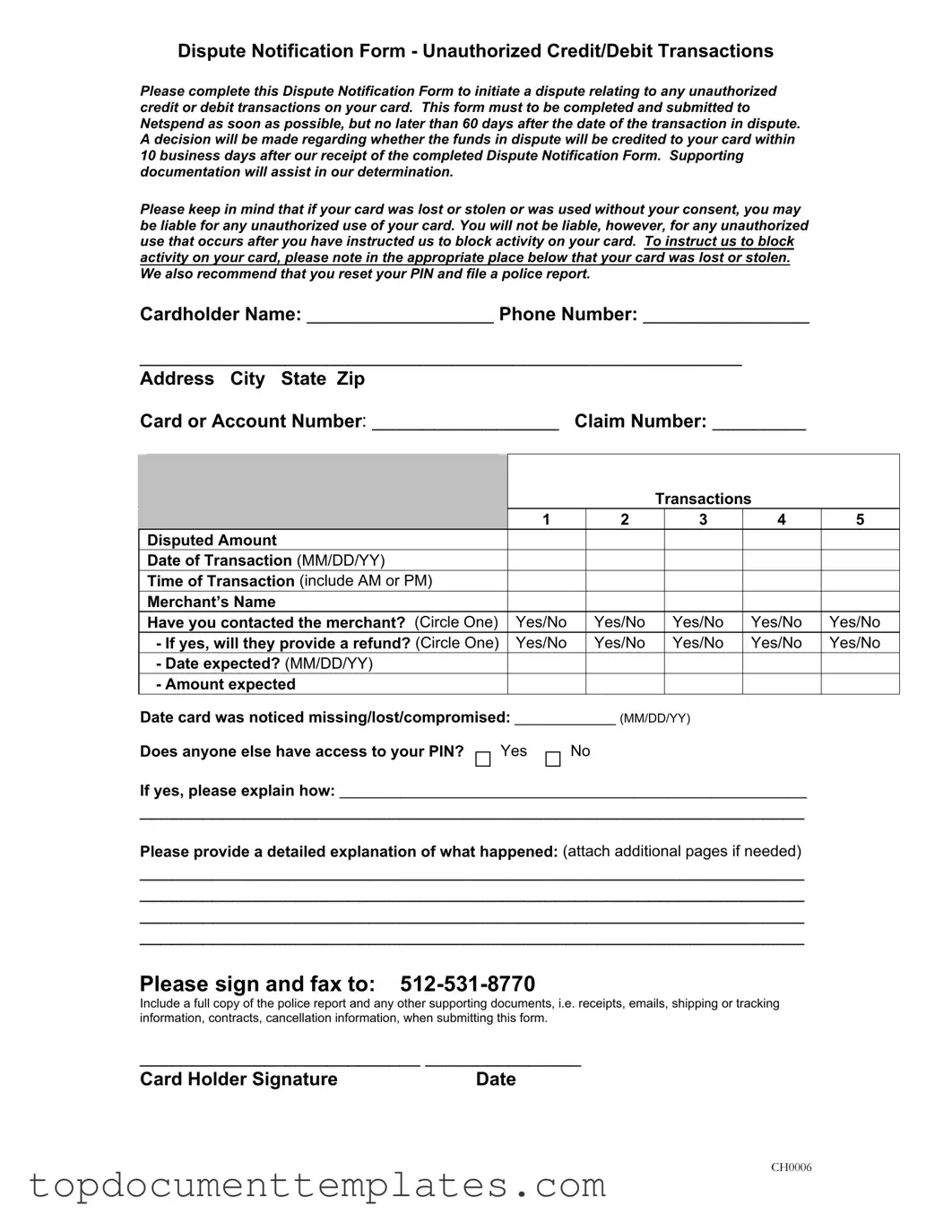

The Netspend Dispute Notification Form is an essential tool for cardholders who need to address unauthorized credit or debit transactions. Completing this form initiates the dispute process, allowing you to report any suspicious activity on your card. Timeliness is crucial; you must submit the form within 60 days of the disputed transaction. Once Netspend receives your completed form, they will make a decision regarding the disputed funds within 10 business days. Including supporting documents, such as receipts or police reports, can help strengthen your case. If your card was lost or stolen, you must indicate this on the form to limit your liability for unauthorized transactions. Additionally, resetting your PIN and notifying law enforcement are recommended steps to take. The form requires basic personal information, details about the disputed transactions, and a section for you to explain what occurred. By providing thorough and accurate information, you can help ensure a smoother resolution to your dispute.

Similar forms

The Netspend Dispute form shares similarities with several other documents that serve to initiate disputes or report issues related to financial transactions. Here are eight such documents:

- Credit Card Dispute Form: This form is used by credit card holders to report unauthorized charges. Like the Netspend form, it requires details about the transaction and supporting documentation.

- Fraud Report Form: Individuals use this form to report suspected fraud on their accounts. It asks for information about the transactions and any relevant evidence, similar to the Netspend Dispute form.

- Chargeback Request Form: This document allows consumers to request a chargeback for a disputed transaction. It typically requires transaction details and reasons for the dispute, paralleling the requirements of the Netspend form.

- Non-disclosure Agreement: Essential for Florida businesses, this legal form safeguards confidential information, ensuring it remains undisclosed. For further details, visit OnlineLawDocs.com.

- Bank Statement Dispute Form: Customers can use this form to contest discrepancies on their bank statements. It seeks transaction details and explanations, akin to the information requested in the Netspend form.

- Unauthorized Transaction Report: This report is submitted to financial institutions to address transactions that were not authorized by the account holder. It includes similar information about the disputed transactions.

- Identity Theft Report: This form is used when someone’s identity has been stolen and unauthorized transactions have occurred. It requires detailed information about the incidents, much like the Netspend form.

- Merchant Dispute Resolution Form: Merchants may use this form to address disputes raised by customers regarding transactions. It collects information about the transaction and the nature of the dispute, reflecting the structure of the Netspend form.

- Consumer Complaint Form: This document allows consumers to file complaints about financial services. It often requires specific details about the complaint, similar to the information needed for a dispute with Netspend.

Guidelines on Writing Netspend Dispute

After completing the Netspend Dispute form, it should be submitted promptly to ensure timely processing. A decision regarding your dispute will be made within 10 business days after the form is received. If you have supporting documents, include them with your submission to strengthen your case.

- Fill in your Cardholder Name at the top of the form.

- Provide your Phone Number and Address, including City, State, and Zip code.

- Enter your Card or Account Number and Claim Number.

- For each disputed transaction (up to 5), fill in the following details:

- Disputed Amount

- Date of Transaction (MM/DD/YY)

- Time of Transaction (include AM or PM)

- Merchant’s Name

- Indicate if you have contacted the merchant (Yes/No).

- If yes, will they provide a refund? (Yes/No).

- If applicable, provide the expected refund date (MM/DD/YY).

- State the expected refund amount.

- Record the date you noticed your card was missing, lost, or compromised.

- Indicate if anyone else has access to your PIN (Yes/No) and explain if applicable.

- Provide a detailed explanation of what happened. Attach additional pages if necessary.

- Sign and date the form at the bottom.

- Fax the completed form to 512-531-8770.

- Include a full copy of the police report and any supporting documents, such as receipts or emails, with your submission.

Form Data

| Fact Name | Fact Description |

|---|---|

| Form Purpose | This Dispute Notification Form is designed for cardholders to report unauthorized credit or debit transactions on their Netspend card. |

| Submission Deadline | Cardholders must complete and submit the form within 60 days of the transaction date in question to initiate a dispute. |

| Decision Timeline | Netspend will make a decision regarding the disputed funds within 10 business days after receiving the completed form. |

| Liability Information | If a card is lost or stolen, the cardholder may be liable for unauthorized transactions unless they have reported the loss and requested a block on the card. |

| Documentation Requirement | Submitting supporting documentation, such as a police report or receipts, can assist in the determination of the dispute. |

| State-Specific Governing Laws | Depending on the state, different laws may apply to disputes regarding unauthorized transactions. It is important to refer to the specific governing laws in your state. |

Other PDF Documents

Bpo Template - The breakdown of necessary repairs supports effective budgeting for potential buyers.

To navigate the complexities of real estate transactions, it's vital to understand the California Real Estate Purchase Agreement form, which fulfills crucial legal requirements. For comprehensive guidance, consider exploring our resources on the key aspects of the Real Estate Purchase Agreement.

Free Printable Daycare Receipt - Services received should be acknowledged with this receipt.