Blank Mortgage Statement PDF Form

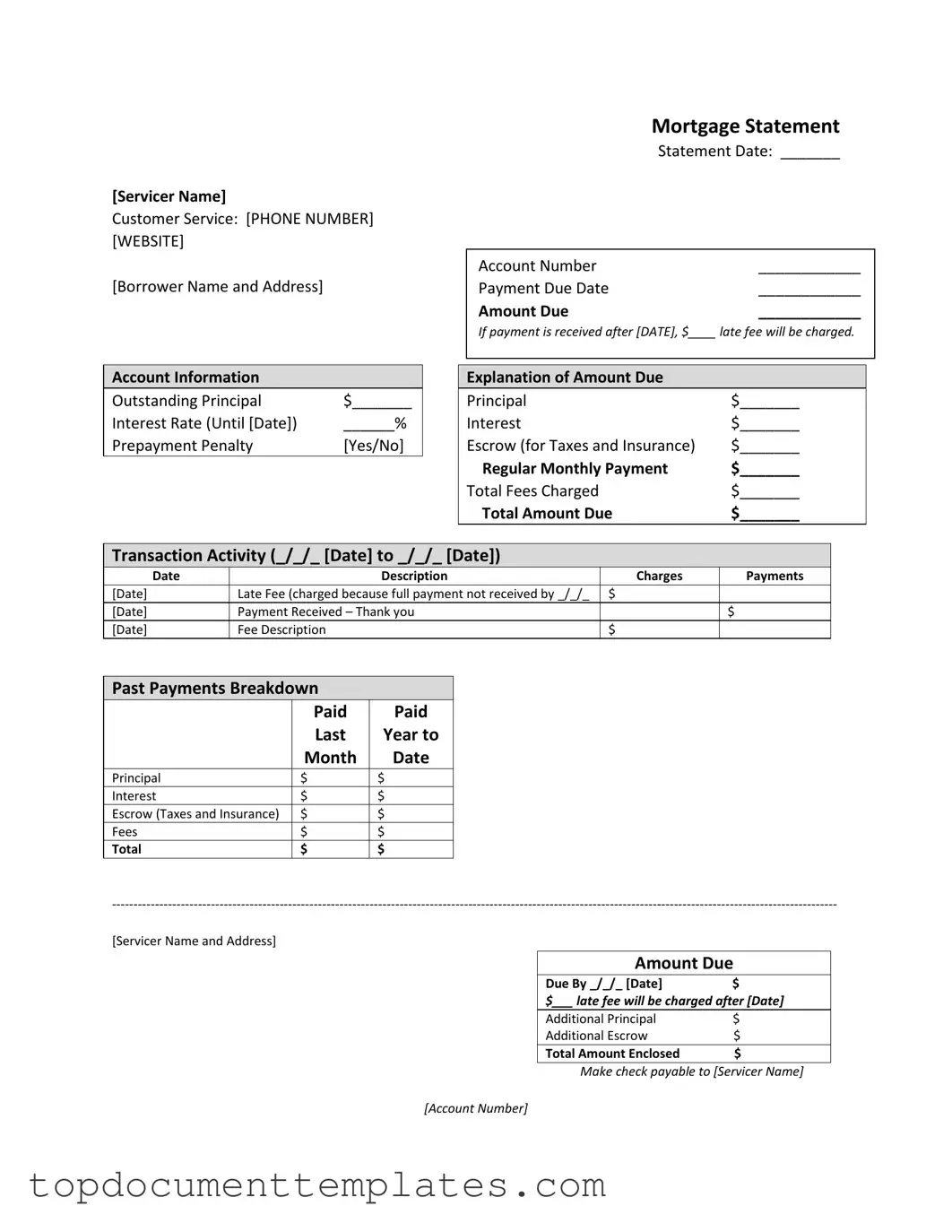

The Mortgage Statement form serves as a crucial document for homeowners, providing a comprehensive overview of their mortgage account status. It begins with essential details such as the servicer's name and contact information, ensuring borrowers can easily reach customer service for inquiries. The statement includes the borrower's name and address, along with vital dates like the statement date, payment due date, and account number. An important section highlights the amount due, indicating any late fees that may apply if payment is not received by the specified date. Account information is meticulously detailed, showcasing outstanding principal, interest rates, and any applicable prepayment penalties. A breakdown of the amount due clarifies the contributions of principal, interest, and escrow for taxes and insurance, culminating in a total amount due. Transaction activity is documented, providing transparency on charges and payments made over a specified period. Additionally, the form includes a past payments breakdown, allowing borrowers to track their payment history. Important messages inform borrowers about partial payments and the consequences of delinquency, underscoring the urgency of staying current on payments. For those facing financial difficulties, resources for mortgage counseling are readily available, emphasizing the support systems in place for homeowners.

Similar forms

-

Billing Statement: A billing statement outlines the amounts owed for services rendered, including due dates and payment history. Similar to a mortgage statement, it provides a breakdown of charges and payments made over a specific period.

-

Loan Statement: A loan statement details the balance, interest, and payment history for any type of loan. Like a mortgage statement, it shows the amount due, payment due date, and any late fees that may apply.

-

Credit Card Statement: A credit card statement summarizes the transactions made during a billing cycle. It includes amounts due, payment due dates, and any fees incurred, paralleling the structure of a mortgage statement.

-

Property Tax Statement: This document provides information on property taxes owed, including amounts due and deadlines. It shares similarities with a mortgage statement in that it outlines financial obligations related to real estate.

-

Homeowners Association (HOA) Statement: An HOA statement details fees owed to a homeowners association, including payment history and any penalties for late payments. It functions similarly to a mortgage statement by tracking dues and deadlines.

-

Utility Bill: A utility bill provides information on services such as water, gas, or electricity. It includes amounts due and due dates, much like a mortgage statement, which outlines payment obligations.

-

Insurance Statement: An insurance statement summarizes premiums owed for policies, including payment history and due dates. This document is similar to a mortgage statement in that it details amounts owed and any penalties for late payments.

-

Student Loan Statement: A student loan statement shows the balance owed, payment due dates, and interest rates. It mirrors a mortgage statement by providing a clear overview of financial obligations and payment history.

Power of Attorney Document: The Florida Power of Attorney form enables a designated agent to make critical decisions on behalf of the principal, covering various areas like finance and healthcare. Understanding this form is important, and resources like OnlineLawDocs.com can provide valuable guidance.

-

Personal Loan Statement: This document outlines the terms of a personal loan, including the outstanding balance, payment due dates, and any fees. It is similar to a mortgage statement in its structure and purpose.

-

Lease Statement: A lease statement provides details on rental payments due, including amounts and due dates. Like a mortgage statement, it tracks financial obligations related to property.

Guidelines on Writing Mortgage Statement

Filling out the Mortgage Statement form is an important step in managing your mortgage. It helps you keep track of your payments and any outstanding amounts due. To ensure accuracy and clarity, follow these steps carefully.

- Start by entering the Servicer Name at the top of the form.

- Provide the Customer Service Phone Number and Website for easy reference.

- Fill in your Borrower Name and Address to identify yourself.

- Write the Statement Date in the designated space.

- Enter your Account Number accurately.

- Indicate the Payment Due Date for your next payment.

- Specify the Amount Due that you need to pay.

- Note the date after which a late fee will be charged, along with the fee amount.

- In the Account Information section, fill in the Outstanding Principal amount.

- Enter your Interest Rate and the date it remains effective until.

- Indicate whether there is a Prepayment Penalty (Yes or No).

- Break down the Explanation of Amount Due into its components: Principal, Interest, Escrow, Regular Monthly Payment, Total Fees Charged, and Total Amount Due.

- For the Transaction Activity, fill in the dates and corresponding charges and payments.

- Provide details in the Past Payments Breakdown section, including amounts paid for Principal, Interest, Escrow, and Fees.

- At the bottom of the form, write the Amount Due and the date it is due.

- Include any Additional Principal or Escrow amounts if applicable.

- Write the Total Amount Enclosed if you are sending a payment.

- Finally, make your check payable to the Servicer Name and include your Account Number.

Once you have completed the form, review it for accuracy. Make sure all entries are clear and legible before submitting it. This will help avoid any potential issues with your mortgage account.

Form Data

| Fact Name | Description |

|---|---|

| Servicer Information | The mortgage statement includes the servicer's name, customer service phone number, and website for borrower inquiries. |

| Statement Date | The statement date indicates when the mortgage statement was issued, providing a reference for payment due dates. |

| Payment Due Date | This date specifies when the borrower must make their payment to avoid late fees. |

| Outstanding Principal | The amount of principal that remains unpaid on the mortgage is clearly stated in the account information section. |

| Late Fee Policy | If payment is received after the specified date, a late fee will be charged, which is detailed in the statement. |

| Partial Payments | Any partial payments are held in a separate suspense account and do not apply to the mortgage until the full payment is made. |

| Delinquency Notice | The statement includes a notice if the borrower is late on payments, outlining potential consequences such as fees and foreclosure. |

Other PDF Documents

How to File a Lien in Florida - This form acts as a safeguard against prolonged non-payment issues.

For those looking to establish a solid foundation for living arrangements, a well-prepared Room Rental Agreement is crucial. This form can be accessed easily through our website, where you can find a comprehensive guide on effectively drafting this essential document. For more information, visit the Room Rental Agreement essentials.

Passport Update - You must provide two identical color photographs that meet specific requirements, taken within the last six months.

Contract for Leased Owner Operators - It provides a framework for understanding the responsibilities of the Carrier and the Owner Operator.