Valid Transfer-on-Death Deed Form for Michigan State

In the state of Michigan, the Transfer-on-Death Deed (TODD) serves as a valuable tool for property owners looking to simplify the transfer of real estate upon their passing. This form allows individuals to designate one or more beneficiaries who will automatically inherit the property without the need for probate, streamlining the process and reducing potential legal complications. By filling out the TODD, property owners can retain full control of their property during their lifetime, ensuring that they can sell, mortgage, or otherwise manage their assets as they see fit. Upon the owner's death, the designated beneficiaries can claim ownership directly, provided the deed is properly recorded and all requirements are met. This method not only offers peace of mind but also provides a clear pathway for the transfer of property, avoiding the often lengthy and costly probate process. Understanding the nuances of the Transfer-on-Death Deed is essential for anyone considering this option, as it can significantly impact estate planning and the distribution of assets after death.

Similar forms

The Transfer-on-Death Deed (TOD Deed) is a unique legal document that allows property owners to designate beneficiaries who will inherit their property upon their death, without the need for probate. Several other documents serve similar purposes in estate planning and property transfer. Here are ten documents that share similarities with the Transfer-on-Death Deed:

- Will: A will outlines how a person's assets will be distributed after their death. Like a TOD Deed, it allows for the transfer of property but typically requires probate.

- Living Trust: A living trust holds assets during a person's lifetime and specifies how they should be distributed upon death. It avoids probate, similar to a TOD Deed.

- Beneficiary Designation Forms: These forms are used for financial accounts, allowing account holders to name beneficiaries who will receive assets upon their death, similar to how a TOD Deed designates property heirs.

- Joint Tenancy with Right of Survivorship: This arrangement allows co-owners to automatically inherit each other's share of property upon death, akin to the beneficiary transfer in a TOD Deed.

- Transfer-on-Death Registration for Vehicles: Some states allow vehicle owners to designate beneficiaries for their vehicles, similar to how a TOD Deed works for real estate.

- Employment Verification Form: The Florida Employment Verification form is essential for confirming employee eligibility to work in the United States. This document is necessary for legal compliance and contributes to the integrity of the labor market. For more information, visit OnlineLawDocs.com.

- Payable-on-Death Accounts: These bank accounts allow the account holder to name a beneficiary who will receive the funds upon their death, reflecting the beneficiary concept in a TOD Deed.

- Life Estate Deed: This deed allows a person to retain the right to use a property during their lifetime while designating a beneficiary to inherit it afterward, much like a TOD Deed.

- Family Limited Partnership Agreements: These agreements can facilitate the transfer of business interests to heirs while providing some control during the owner's lifetime, similar to the intentions of a TOD Deed.

- Community Property with Right of Survivorship: In some states, this arrangement allows spouses to jointly own property, which automatically passes to the surviving spouse upon death, paralleling the TOD Deed's beneficiary transfer.

- Durable Power of Attorney: While primarily used for financial decisions during a person's lifetime, it can help ensure that property is managed and transferred according to the person's wishes, similar to the intent behind a TOD Deed.

Guidelines on Writing Michigan Transfer-on-Death Deed

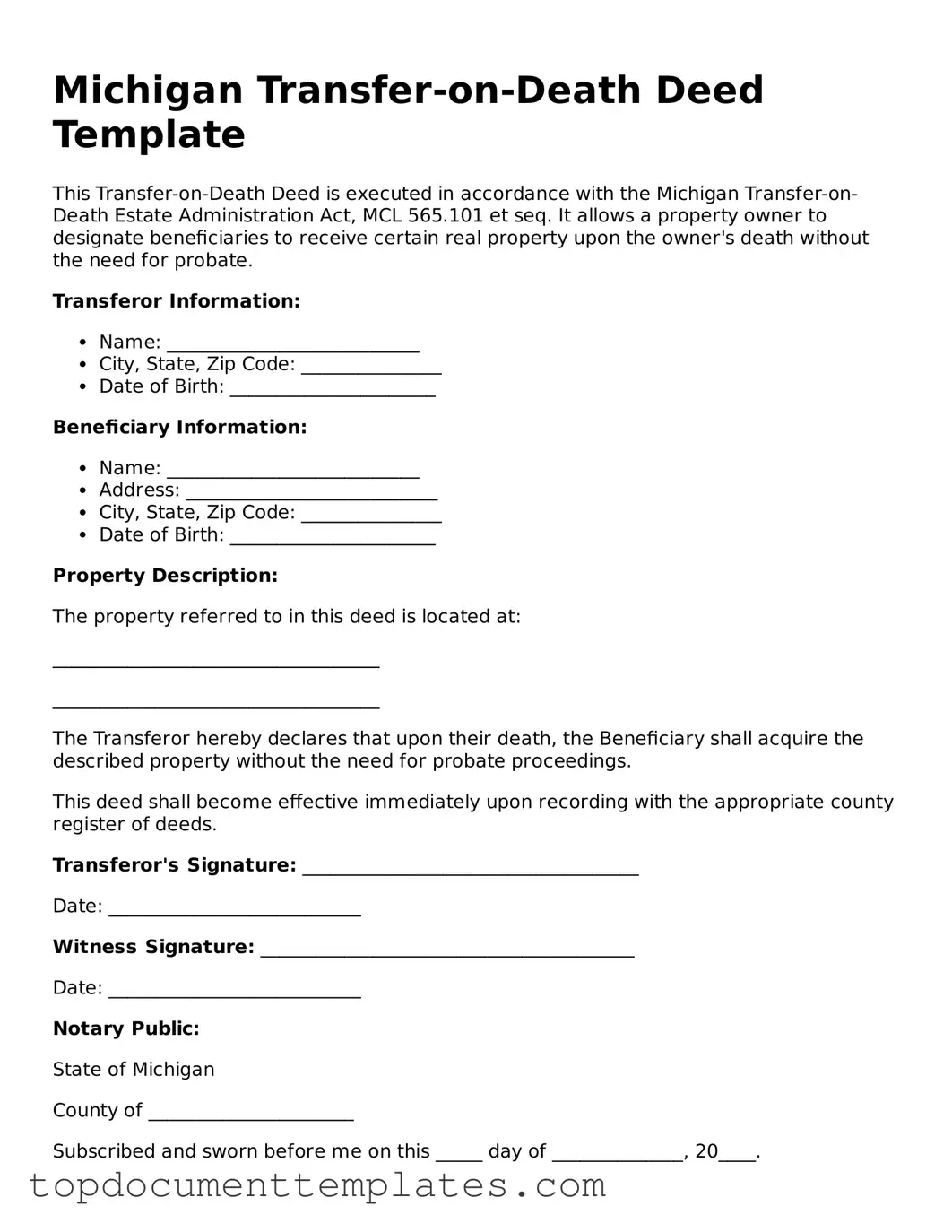

Once you have obtained the Michigan Transfer-on-Death Deed form, it is essential to fill it out accurately to ensure that your property is transferred as intended. Follow the steps below carefully to complete the form.

- Begin by entering the name of the property owner in the designated space at the top of the form.

- Provide the current address of the property owner, including the city, state, and ZIP code.

- Next, identify the property being transferred. Include the full legal description of the property as well as the address.

- List the name(s) of the beneficiary or beneficiaries who will receive the property upon the owner's death. Ensure that the names are spelled correctly.

- Include the address of each beneficiary, detailing the city, state, and ZIP code.

- Sign the form in the presence of a notary public. The notary will need to witness your signature and affix their seal.

- Finally, submit the completed form to the appropriate county register of deeds office for recording. Check for any specific requirements or fees that may apply.

After completing these steps, keep a copy of the filed deed for your records. It is advisable to inform the beneficiaries about the transfer to ensure they are aware of the arrangement. This proactive communication can help avoid confusion in the future.

File Information

| Fact Name | Details |

|---|---|

| Definition | A Transfer-on-Death Deed allows property owners in Michigan to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | The Michigan Transfer-on-Death Deed is governed by the Michigan Compiled Laws, specifically MCL 565.25a. |

| Eligibility | Any individual who owns real estate in Michigan can create a Transfer-on-Death Deed. |

| Beneficiary Designation | Property owners can designate one or more beneficiaries to receive the property upon their death. |

| Revocation | The deed can be revoked at any time before the owner's death by executing a new deed or a written revocation. |

| Filing Requirements | The Transfer-on-Death Deed must be recorded with the county register of deeds where the property is located. |

| Tax Implications | Property transferred via a Transfer-on-Death Deed may be subject to property taxes, but it does not trigger immediate tax consequences upon transfer. |

| Effectiveness | The deed becomes effective upon the death of the property owner, allowing beneficiaries to claim the property directly. |

| Legal Assistance | While not required, consulting with an attorney is advisable to ensure the deed is executed correctly and meets all legal requirements. |

Other Popular Transfer-on-Death Deed State Forms

How to Transfer Property After Death - A Transfer-on-Death Deed can be revoked or changed at any time before the owner's death.

When completing the sale of an all-terrain vehicle, it is crucial to ensure that both parties are protected by using the appropriate documentation. The New York ATV Bill of Sale form is designed specifically for this purpose, providing a reliable record of the transaction. For those looking to obtain this essential form, it can be found at https://documentonline.org/blank-new-york-atv-bill-of-sale, streamlining the process of buying or selling an ATV.

Transfer on Death Deed Illinois Cost - Using this deed allows you to make a clear statement about who should inherit your property.