Valid Promissory Note Form for Michigan State

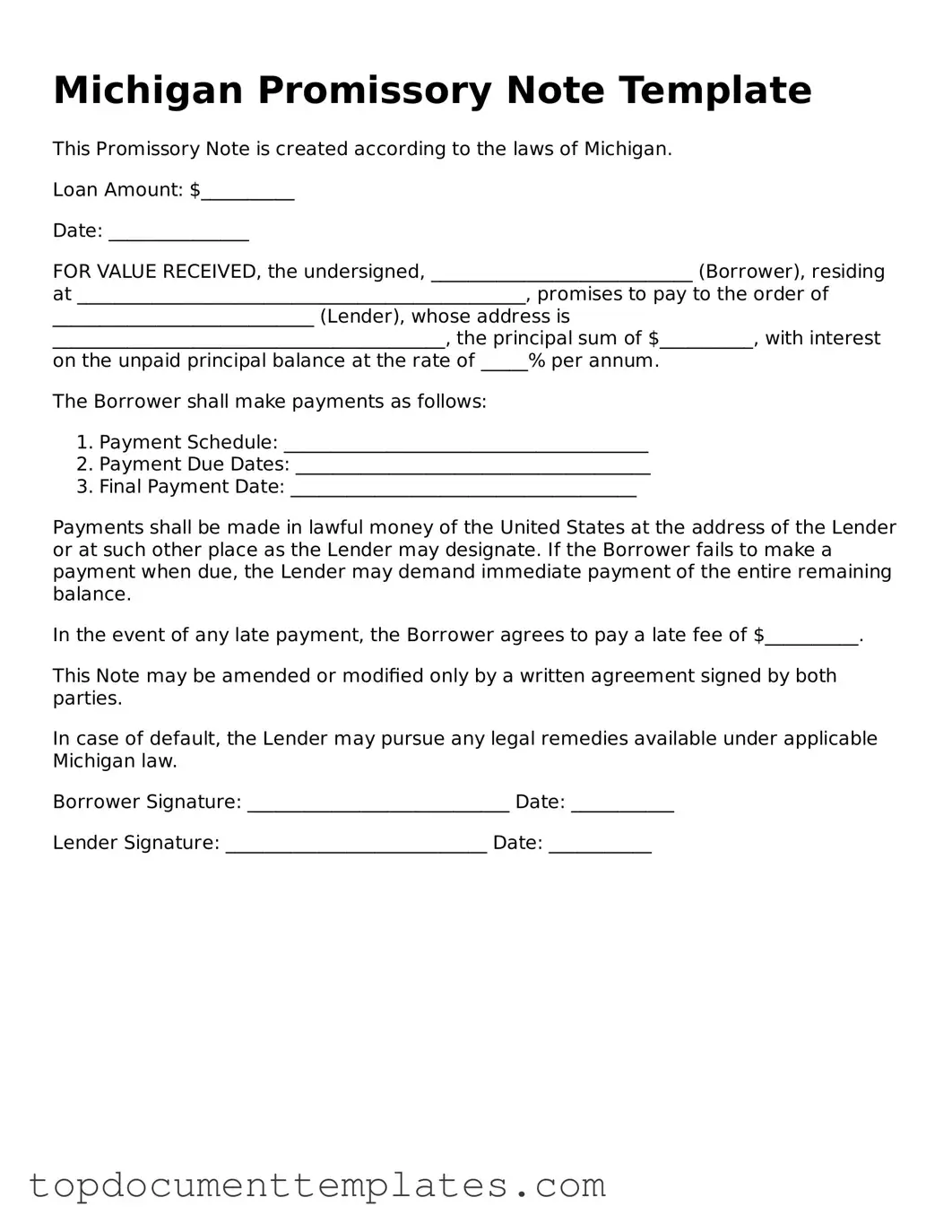

The Michigan Promissory Note form serves as a crucial document in financial transactions, outlining the terms of a loan agreement between a borrower and a lender. This form typically includes essential details such as the principal amount borrowed, the interest rate applicable, and the repayment schedule. Additionally, it specifies the maturity date, which is when the borrower must repay the entire loan amount. The document may also address any penalties for late payments and the rights of the lender in the event of default. By clearly stating these terms, the Promissory Note provides legal protection for both parties, ensuring that the obligations and expectations are understood. Furthermore, the form may include provisions for prepayment, allowing the borrower to pay off the loan early without incurring additional fees. Understanding the components of this form is vital for anyone entering into a loan agreement in Michigan, as it lays the groundwork for a transparent and enforceable financial relationship.

Similar forms

-

Loan Agreement: Similar to a promissory note, a loan agreement outlines the terms of a loan, including the amount borrowed, interest rate, and repayment schedule. However, it is typically more detailed and may include clauses regarding collateral and default.

-

Mortgage: A mortgage is a specific type of loan agreement secured by real property. Like a promissory note, it includes a promise to repay the borrowed amount, but it also involves the transfer of property rights until the loan is repaid.

-

Personal Guarantee: This document involves a promise by an individual to repay a debt if the primary borrower defaults. It shares similarities with a promissory note in that it represents a commitment to pay, but it usually pertains to business loans.

-

IOU (I Owe You): An IOU is a simple acknowledgment of a debt. While less formal than a promissory note, it serves a similar purpose by confirming that one party owes money to another, though it often lacks detailed repayment terms.

-

Credit Agreement: This document outlines the terms under which credit is extended to a borrower. Like a promissory note, it details repayment obligations, but it may also include terms regarding credit limits and fees.

- ATV Bill of Sale: This document serves as a critical legal record confirming the transaction for the purchase of an all-terrain vehicle (ATV), ensuring both parties have a clear understanding of the details involved, including the ATV's unique identification. More information can be found at documentonline.org/blank-new-york-atv-bill-of-sale/.

-

Lease Agreement: A lease agreement is a contract between a landlord and tenant that outlines the terms of renting property. While its primary focus is on rental terms, it includes payment obligations similar to those found in a promissory note.

Guidelines on Writing Michigan Promissory Note

After obtaining the Michigan Promissory Note form, you will need to provide specific information to complete it. This document will outline the terms of a loan agreement between the lender and the borrower. Follow these steps to fill out the form accurately.

- Title the Document: At the top of the form, write "Promissory Note." This clearly identifies the purpose of the document.

- Enter the Date: Write the date when the note is being created. This is important for record-keeping.

- Identify the Borrower: Fill in the full name and address of the borrower. This ensures that the correct individual is held responsible for repayment.

- Identify the Lender: Provide the full name and address of the lender. This is typically the person or entity providing the loan.

- State the Loan Amount: Clearly write the total amount of money being borrowed. Be sure to use both numbers and words for clarity.

- Set the Interest Rate: Specify the interest rate for the loan. This can be a fixed or variable rate, depending on the agreement.

- Define the Payment Terms: Outline how and when payments will be made. Include the frequency (monthly, quarterly, etc.) and the due date for each payment.

- Include Late Fees: If applicable, state any fees for late payments. This encourages timely repayment.

- Signatures: Both the borrower and lender must sign and date the document. This signifies agreement to the terms laid out in the note.

Once the form is completed and signed, it is advisable to keep a copy for your records. The original should be given to the lender or stored securely, depending on the agreement. This will help ensure that both parties have a clear understanding of their obligations.

File Information

| Fact Name | Description |

|---|---|

| Definition | A Michigan Promissory Note is a written promise to pay a specified amount of money to a designated person or entity at a defined time. |

| Governing Law | The Michigan Promissory Note is governed by the Michigan Uniform Commercial Code (UCC), specifically Article 3. |

| Parties Involved | The note involves two parties: the borrower (maker) and the lender (payee). |

| Interest Rate | The interest rate can be fixed or variable, but it must be clearly stated in the note. |

| Payment Terms | Payment terms should specify when payments are due, including the frequency and amount. |

| Default Conditions | Conditions under which the borrower is considered in default should be outlined in the note. |

| Signatures | Both parties must sign the note for it to be legally binding. Witness signatures are not required but can be beneficial. |

Other Popular Promissory Note State Forms

Texas Promissory Note Requirements - A promissory note is a written promise to pay a specified amount to a designated party at a certain time.

The Florida Employment Verification form is an essential resource for employers aiming to confirm their employees' eligibility to work in the United States. For detailed information on this crucial document and its importance in complying with employment laws, you can visit OnlineLawDocs.com, where you can find guidance on ensuring that your workforce is properly verified.

Promissory Note California - The document may specify the governing law applicable to its enforcement.