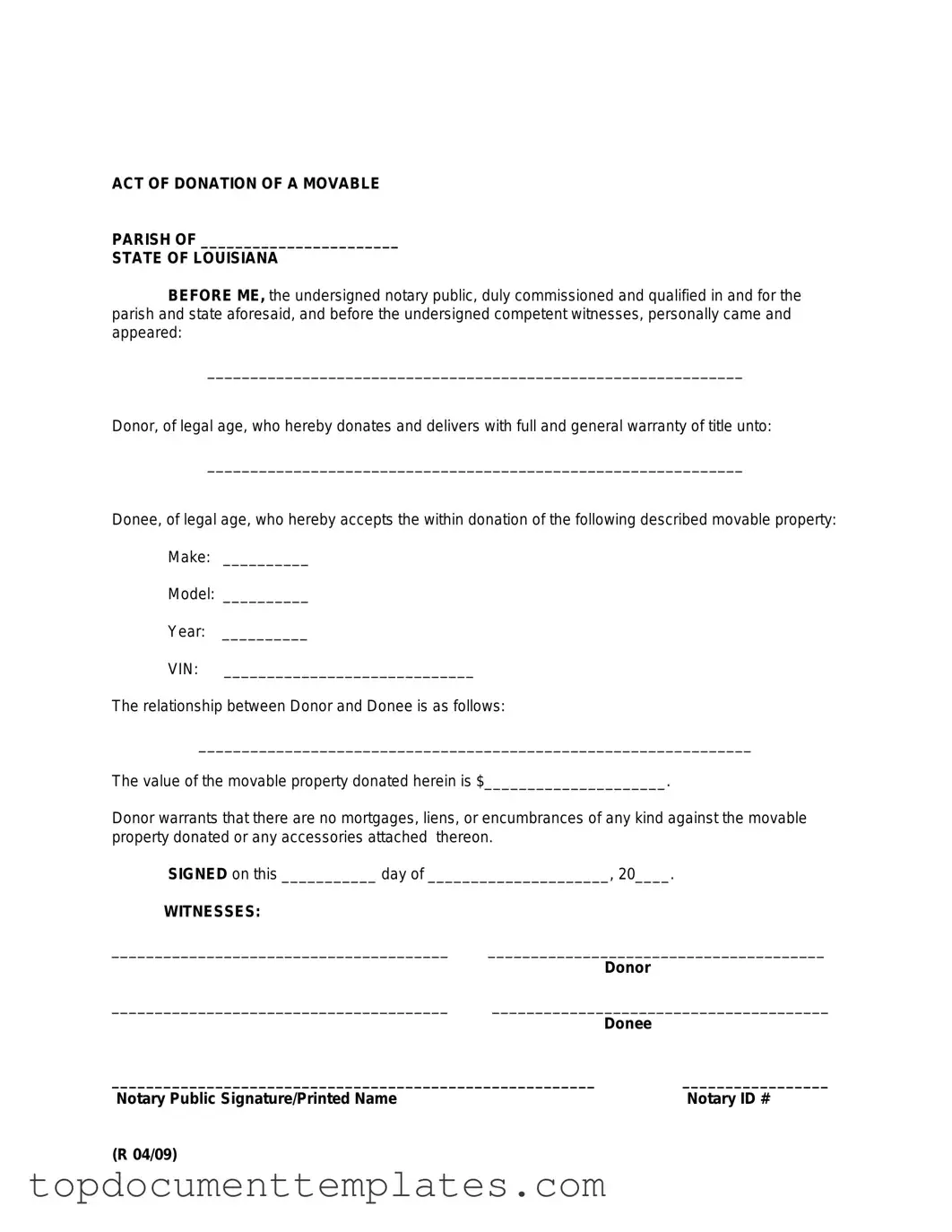

Blank Louisiana act of donation PDF Form

The Louisiana Act of Donation form serves as a crucial legal document in the state of Louisiana, facilitating the transfer of property or assets from one individual to another without the expectation of payment. This form is particularly significant in the context of estate planning and family law, as it allows individuals to gift property to family members or friends while adhering to state laws. Key elements of the form include the identification of the donor and the donee, a clear description of the property being donated, and any conditions or stipulations related to the donation. Additionally, the form often requires signatures from witnesses and may need notarization to ensure its validity. Understanding the implications of using this form is essential for anyone considering making a donation, as it not only outlines the intent to transfer ownership but also helps prevent future disputes over the property. By adhering to the guidelines set forth in this form, donors can ensure a smooth transition of assets and uphold their wishes regarding the distribution of their property.

Similar forms

The Louisiana act of donation form is a vital legal document that facilitates the transfer of property or assets from one individual to another without any exchange of money. It is important to understand that this form shares similarities with several other legal documents. Here are eight documents that are similar to the Louisiana act of donation form, along with explanations of how they are alike:

- Gift Deed: A gift deed serves a similar purpose by transferring property ownership without compensation. Like the act of donation, it requires the donor's intent to give the property as a gift.

- Power of Attorney: This document allows an individual to grant another person the authority to act on their behalf. Both are about the delegation and transfer of rights, though a power of attorney typically allows for management rather than outright transfer. For more information, visit onlinelawdocs.com.

- Will: A will outlines how a person's assets should be distributed after their death. Both documents express the intent to transfer ownership, though a will takes effect upon death, while the act of donation is immediate.

- Trust Agreement: A trust agreement allows a person to place their assets into a trust for the benefit of others. Similar to the act of donation, it involves the transfer of property, but it often includes specific conditions for its use.

- Power of Attorney: A power of attorney grants someone the authority to act on another's behalf. While it does not transfer ownership outright, it allows for the management of assets, paralleling the intent behind the act of donation.

- Quitclaim Deed: A quitclaim deed transfers whatever interest a person has in a property without guaranteeing that interest is valid. This document, like the act of donation, can be used to transfer property without monetary exchange.

- Real Estate Transfer Form: This form is used to transfer real estate ownership, similar to the act of donation, and often requires the same legal formalities to ensure the transfer is valid.

- Charitable Donation Receipt: This document acknowledges the transfer of property or assets to a charitable organization. It shares the spirit of generosity found in the act of donation, though it specifically pertains to charitable contributions.

- Assignment of Benefits: This document allows an individual to transfer benefits or rights under a contract to another party. It is similar in that it involves the transfer of rights, although it typically relates to contractual agreements rather than property.

Understanding these similarities can help clarify the intent and legal implications of the Louisiana act of donation form. Each document plays a unique role in property and asset management, but they all share the common goal of facilitating ownership transfer in various contexts.

Guidelines on Writing Louisiana act of donation

Completing the Louisiana Act of Donation form is a crucial step in ensuring that your intentions regarding the transfer of property are clearly documented. This process requires careful attention to detail to avoid any potential issues in the future. Follow the steps outlined below to accurately fill out the form.

- Begin by obtaining the Louisiana Act of Donation form. You can find it online or at a local courthouse.

- At the top of the form, fill in the date of the donation.

- Provide your full name and address in the designated sections. This is important for identifying you as the donor.

- Next, enter the full name and address of the recipient. Ensure that this information is accurate to avoid any confusion later.

- Clearly describe the property being donated. Include details such as the type of property, its location, and any identifying information, like a parcel number.

- If there are any conditions attached to the donation, state them clearly in the appropriate section of the form.

- Sign and date the form. Your signature signifies your intent to donate the property.

- Have the form notarized. This step is essential to ensure the document is legally binding.

- Make copies of the completed form for your records and for the recipient.

Once you have filled out the form, it is important to ensure that both you and the recipient understand the implications of the donation. Properly storing the signed and notarized document will help prevent any disputes in the future.

Form Data

| Fact Name | Description |

|---|---|

| Purpose | The Louisiana Act of Donation form is used to formally transfer ownership of property or assets from one party to another without any exchange of payment. |

| Governing Law | This form is governed by the Louisiana Civil Code, specifically Articles 1461 to 1467, which outline the requirements for donations. |

| Requirements | The form must be executed in writing and may require notarization to be legally binding, depending on the value of the donated property. |

| Tax Implications | Donors may be subject to gift tax regulations, and recipients should be aware of potential tax liabilities associated with the received property. |

Other PDF Documents

Melaleuca Cancelation Form - You can choose from several reasons for suspension.

Texas Hub - Original issue data is noted to distinguish from subsequent transfers.

For those looking to navigate the specifics of dirt bike transactions, understanding the important aspects of the Dirt Bike Bill of Sale is vital. This document formalizes the sale and includes essential details that safeguard both buyer and seller in the ownership transfer process.

Simple Boyfriend Application Form - How do you feel about pets and having them in the home?