Official Loan Agreement Template

When individuals or businesses seek financial assistance, a Loan Agreement form becomes an essential document that outlines the terms and conditions of the loan. This form typically includes key details such as the loan amount, interest rate, repayment schedule, and any collateral required. Borrowers and lenders alike benefit from a clear understanding of their obligations, which helps prevent misunderstandings in the future. Additionally, the Loan Agreement specifies the duration of the loan, the consequences of late payments, and any fees that may apply. By laying out these critical components, the form serves as a safeguard for both parties, ensuring that the lending process is transparent and mutually beneficial. Understanding the nuances of this document is vital for anyone involved in borrowing or lending money, as it establishes the framework for a successful financial relationship.

Similar forms

Promissory Note: This document outlines the borrower's promise to repay a loan, including the amount, interest rate, and repayment terms.

Mortgage Agreement: Similar to a loan agreement, this document secures a loan with real property as collateral, detailing the terms of the mortgage.

Lease Agreement: This contract allows one party to use another's property for a specified time in exchange for payment, similar to how a loan agreement outlines repayment for borrowed funds.

Credit Agreement: This document defines the terms of a line of credit, including limits, interest rates, and repayment schedules, akin to a loan agreement.

Personal Loan Agreement: This is a specific type of loan agreement for personal loans, detailing terms between individuals rather than financial institutions.

Business Loan Agreement: This document outlines the terms for loans taken by businesses, including repayment terms and interest rates, similar to a standard loan agreement.

Installment Agreement: This document allows for payment in installments over time, similar to how loan agreements may structure repayment schedules.

Debt Settlement Agreement: This outlines the terms under which a borrower agrees to settle a debt for less than the full amount owed, reflecting negotiation aspects found in loan agreements.

Forbearance Agreement: This document allows borrowers temporary relief from payments, similar to provisions that may exist in loan agreements for hardship situations.

Security Agreement: This document creates a security interest in collateral for a loan, similar to how a loan agreement may detail collateral requirements.

Loan Agreement - Tailored for State

Loan Agreement Types

Guidelines on Writing Loan Agreement

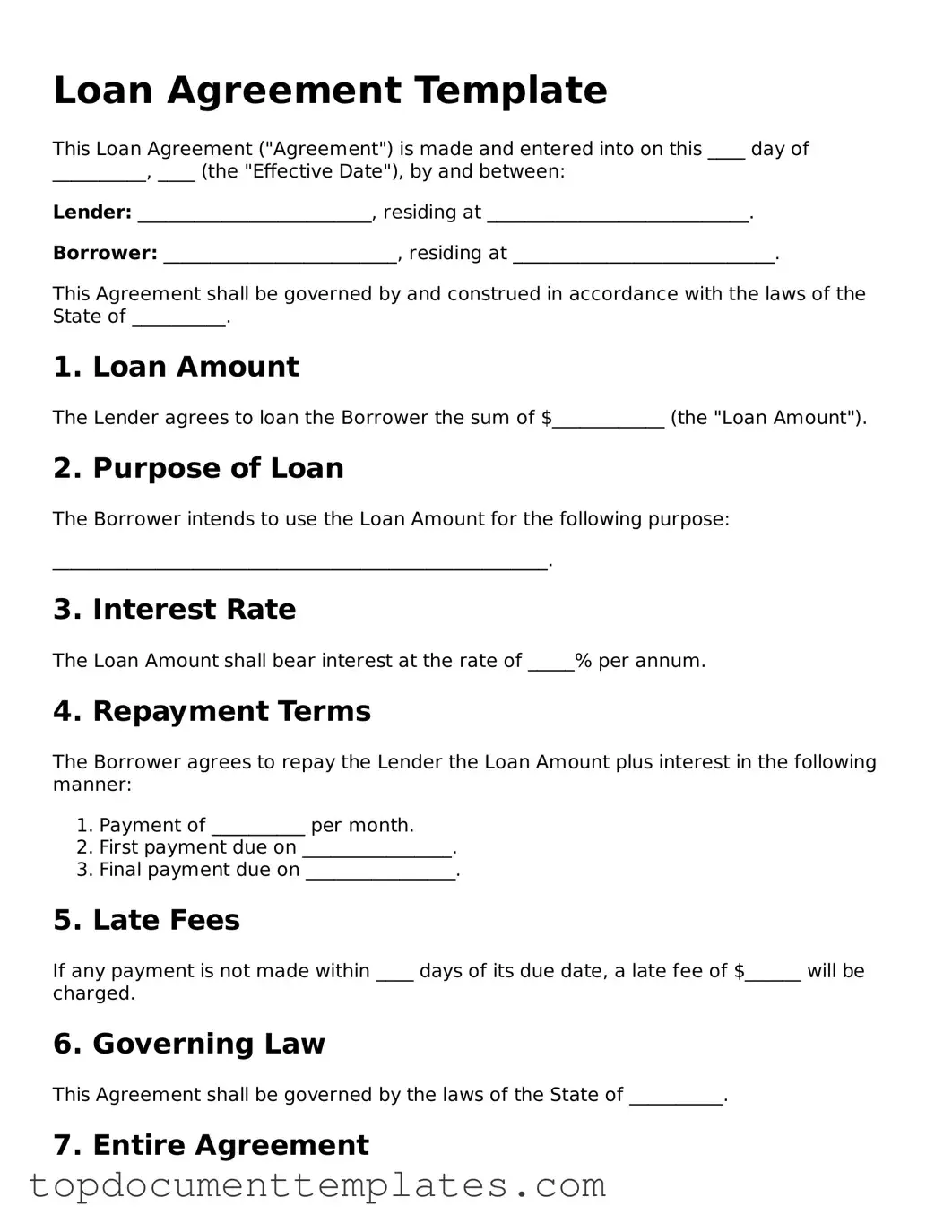

Filling out the Loan Agreement form is an important step in securing the funds you need. This process ensures that all necessary information is accurately documented and agreed upon. Follow the steps outlined below to complete the form effectively.

- Begin by carefully reading the instructions provided with the form. Understanding the requirements is crucial.

- Enter your personal information in the designated sections. This typically includes your name, address, and contact details.

- Provide the details of the loan amount you are requesting. Be clear and specific about the total sum.

- Indicate the purpose of the loan. This helps the lender understand your financial needs.

- Fill in the repayment terms, including the interest rate, payment schedule, and duration of the loan.

- Review any additional clauses or conditions that may apply to your loan agreement. Ensure you understand each one.

- Sign and date the form in the appropriate sections. This signifies your agreement to the terms outlined.

- Make a copy of the completed form for your records before submitting it to the lender.

After you have filled out the form, the next step involves submitting it to the lender for review. They will assess your application and may contact you for further information if needed. Be prepared for this communication, as it will help expedite the process.

File Information

| Fact Name | Description |

|---|---|

| Definition | A Loan Agreement is a legal document outlining the terms of a loan between a lender and a borrower. |

| Parties Involved | The agreement typically includes the lender, the borrower, and sometimes a guarantor. |

| Loan Amount | The specific amount of money being borrowed is clearly stated in the agreement. |

| Interest Rate | The agreement specifies the interest rate applied to the loan, which can be fixed or variable. |

| Repayment Terms | Details about how and when the borrower will repay the loan are outlined, including payment frequency. |

| Governing Law | For state-specific forms, the governing law varies; for example, California loans are governed by California Civil Code. |

| Default Clause | The agreement includes terms that define what happens if the borrower fails to repay the loan. |

| Signatures | Both parties must sign the agreement to make it legally binding, often requiring witnesses or notarization. |

Consider Other Forms

Employee Loan Agreement Template Word - Establishes the rights and responsibilities of both parties.

Power of Attorney Document - Facilitate the buying or selling of a home even if you're not physically present with this document.

Custody Affidavit - The use of this affidavit helps courts to ascertain the voluntary nature of the rights relinquishment.