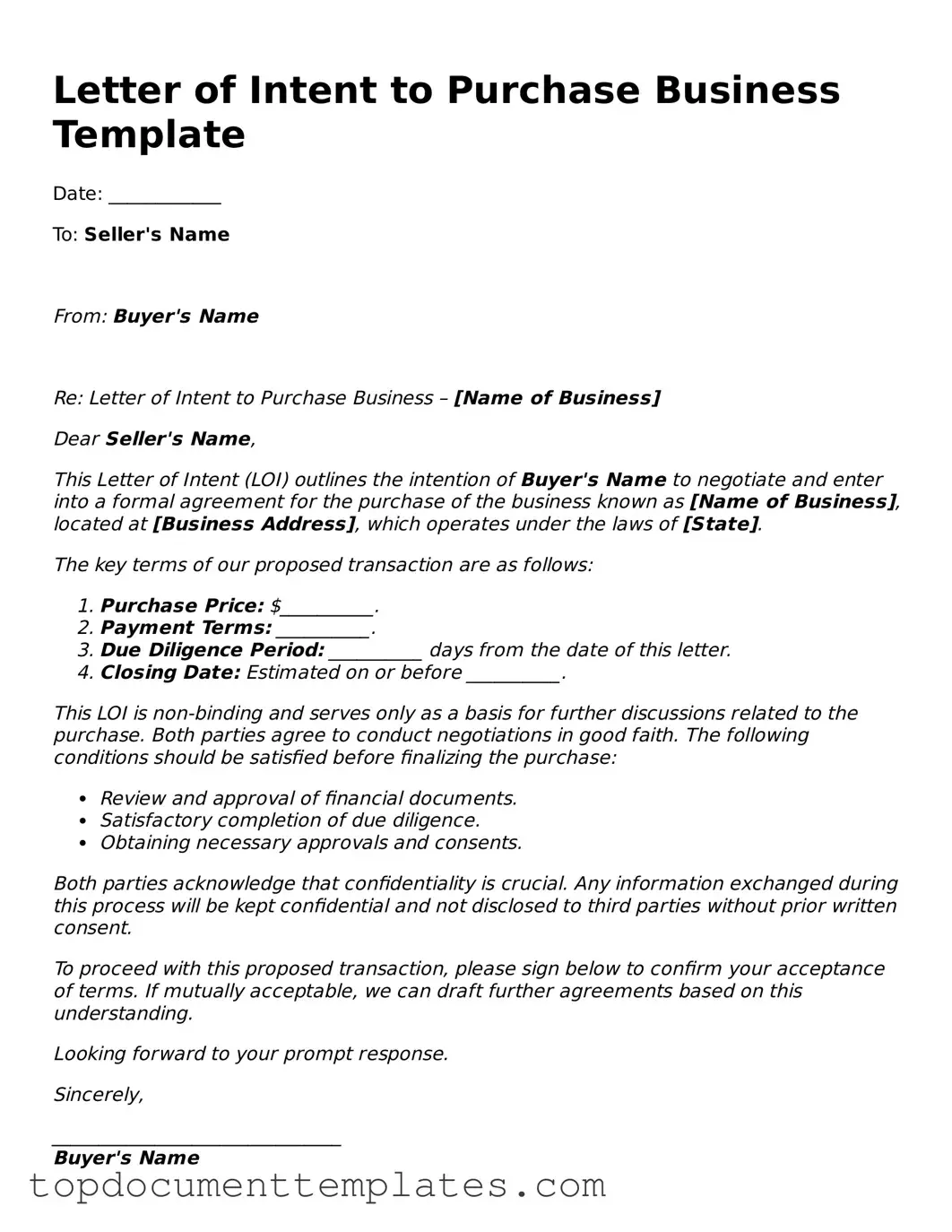

Official Letter of Intent to Purchase Business Template

In the dynamic landscape of business transactions, the Letter of Intent (LOI) to Purchase a Business serves as a crucial preliminary document that outlines the intentions of the buyer and seller before a formal agreement is established. This document typically includes key components such as the purchase price, terms of payment, and a timeline for due diligence, which together create a framework for negotiations. Additionally, the LOI often addresses confidentiality agreements and exclusivity clauses, ensuring that both parties are protected during the negotiation process. By clarifying the fundamental aspects of the proposed transaction, the LOI not only fosters transparency but also helps to mitigate potential disputes that may arise later. Furthermore, while the LOI is generally non-binding, it establishes a mutual understanding and commitment to move forward, setting the stage for more detailed contracts to follow. Understanding the nuances of this form is essential for both buyers and sellers, as it lays the groundwork for a successful business acquisition.

Similar forms

- Purchase Agreement: This document outlines the final terms of a business sale, including price, payment terms, and conditions. It serves as a legally binding contract, whereas a Letter of Intent is typically non-binding.

- Memorandum of Understanding (MOU): An MOU establishes a mutual agreement between parties, similar to a Letter of Intent. However, it often includes broader terms and is used in various contexts beyond business purchases.

- Non-Disclosure Agreement (NDA): An NDA protects confidential information shared during negotiations. While a Letter of Intent may touch on confidentiality, an NDA specifically focuses on safeguarding sensitive information.

- Term Sheet: This document summarizes the key terms and conditions of a business deal. Like a Letter of Intent, it serves as a preliminary outline, but it is often more detailed in financial terms.

- Due Diligence Checklist: This list is used to evaluate a business's financial and operational status before purchase. It complements a Letter of Intent by ensuring that all necessary information is reviewed before finalizing the deal.

- Business Valuation Report: This document provides an assessment of a business's worth. It is often referenced in a Letter of Intent to justify the proposed purchase price.

Nevada Homeschool Letter of Intent: This form is essential for parents to notify the state of their homeschooling plans, guiding them through the process. Find out more about the necessary Nevada homeschool letter of intent documentation required for compliance.

- Closing Statement: This final document summarizes the financial transaction at the closing of a business sale. It is similar to a Letter of Intent in that it formalizes the agreement, but it occurs at the end of the process.

- Escrow Agreement: This agreement outlines the terms under which funds are held by a third party until all conditions of the sale are met. It is similar to a Letter of Intent as both involve conditions that must be satisfied for a transaction to proceed.

Guidelines on Writing Letter of Intent to Purchase Business

Completing the Letter of Intent to Purchase Business form is a crucial step in moving forward with your business acquisition. Once filled out correctly, this document serves as a foundation for negotiations and can lead to a formal purchase agreement.

- Gather necessary information: Collect all relevant details about the business you intend to purchase, including its name, address, and any pertinent financial data.

- Identify the parties: Clearly state the names and addresses of both the buyer and the seller. Ensure that the information is accurate.

- Outline the purchase terms: Specify the proposed purchase price and any payment terms. Include details about deposits or financing arrangements if applicable.

- Include contingencies: List any conditions that must be met before the sale can proceed, such as financing approval or due diligence results.

- Define the timeline: Indicate key dates for closing the deal and any other important milestones in the transaction process.

- Sign and date: Ensure that both parties sign and date the document to indicate agreement and commitment to the terms outlined.

After completing the form, review it carefully for accuracy and clarity. Once both parties have signed, you can proceed with the next steps in the acquisition process, including negotiations and due diligence.

File Information

| Fact Name | Details |

|---|---|

| Definition | A Letter of Intent to Purchase Business is a document outlining the preliminary agreement between a buyer and a seller regarding the sale of a business. |

| Purpose | This document serves to express the buyer's interest and intentions, laying the groundwork for further negotiations. |

| Non-Binding Nature | Typically, a Letter of Intent is non-binding, meaning that it does not create a legal obligation to complete the sale. |

| Key Components | Common elements include purchase price, payment terms, and timelines for due diligence and closing. |

| Confidentiality Clause | Many Letters of Intent include a confidentiality clause to protect sensitive business information during negotiations. |

| State-Specific Forms | Some states may have specific forms or requirements; for example, California's Business and Professions Code may apply. |

| Governing Law | The governing law of the agreement is often specified, determining which state's laws will apply in case of a dispute. |

| Importance in Negotiations | It plays a crucial role in negotiations, providing a framework for discussions and helping to clarify intentions. |

Find Other Types of Letter of Intent to Purchase Business Templates

Sue Letter of Intent to Take Legal Action Template - This letter serves the purpose of expressing your willingness to resolve matters legally.

When preparing an Investment Letter of Intent, it's essential to ensure clarity and detail to avoid any misunderstandings between the involved parties. This form acts as a crucial step in establishing the terms for potential investments and helps set the stage for further negotiation. For more information on how to create a comprehensive Investment Letter of Intent, you can refer to smarttemplates.net.

Grant Loi - Be concise and clear when presenting your project details.