Official Lady Bird Deed Template

The Lady Bird Deed, also known as an enhanced life estate deed, offers a unique way for property owners to transfer their real estate while retaining control during their lifetime. This legal document allows the property owner to maintain the right to live in and manage the property, even after the deed is executed. One of its most significant advantages is the ability to bypass probate, ensuring a smoother transition of ownership to the designated beneficiaries upon the owner’s passing. With a Lady Bird Deed, the property owner can change their mind about the beneficiaries at any time, providing flexibility that is often not available with other types of estate planning documents. Additionally, this deed can help protect the property from Medicaid claims, making it an appealing option for individuals concerned about long-term care costs. Understanding the nuances of the Lady Bird Deed can empower property owners to make informed decisions about their estate planning needs.

Similar forms

- Transfer on Death Deed (TOD Deed): Similar to a Lady Bird Deed, a Transfer on Death Deed allows property owners to designate beneficiaries who will receive the property upon their death. This document bypasses probate, ensuring a smoother transfer process.

- Life Estate Deed: A Life Estate Deed grants one person the right to use and benefit from a property during their lifetime. After their death, the property automatically transfers to another designated person, similar to how a Lady Bird Deed functions.

- Revocable Trust: A Revocable Trust allows individuals to manage their assets during their lifetime and specify how those assets will be distributed after death. Like a Lady Bird Deed, it avoids probate and provides flexibility in managing property.

- Joint Tenancy with Right of Survivorship: This form of ownership allows two or more individuals to hold title to a property together. Upon the death of one owner, the surviving owner(s) automatically inherit the deceased's share, resembling the transfer mechanism of a Lady Bird Deed.

- DA Form 31: This form is essential for Army personnel to request leave, ensuring proper authorization and documentation. For more information, visit OnlineLawDocs.com.

- Will: A Will outlines how a person's assets should be distributed after their death. While it does not avoid probate like a Lady Bird Deed, both documents can include instructions for property transfer to beneficiaries.

Guidelines on Writing Lady Bird Deed

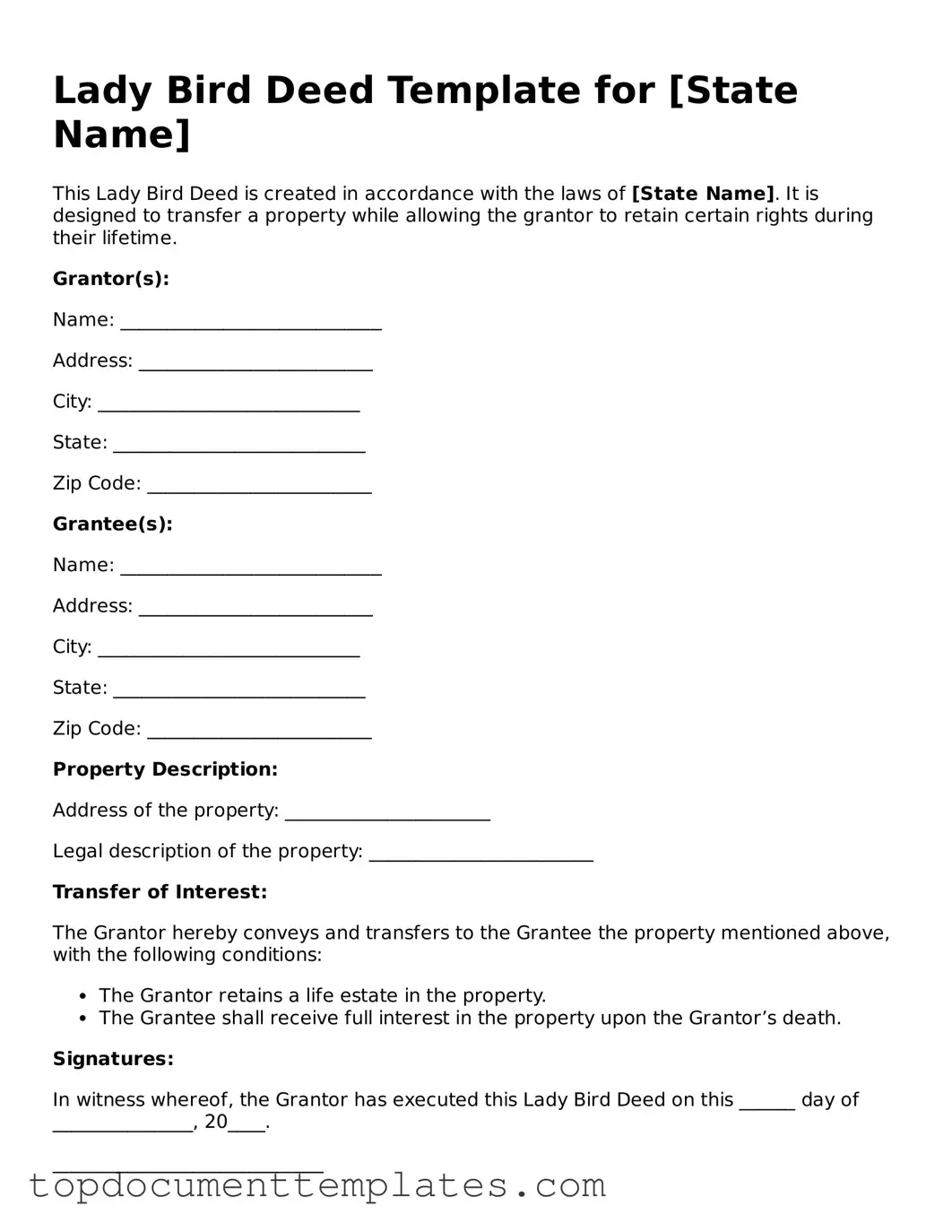

Filling out a Lady Bird Deed form can be straightforward if you follow the right steps. Once you have completed the form, you will need to sign it and have it notarized. After that, you will file it with the appropriate county clerk's office to ensure it is legally recognized. Below are the steps to guide you through the process of filling out the form.

- Start by downloading the Lady Bird Deed form from a reliable source or obtain a physical copy from your local office.

- At the top of the form, enter the name of the current property owner(s). Make sure to include full legal names as they appear on the property deed.

- Next, provide the address of the property. This should include the street address, city, state, and zip code.

- Identify the beneficiaries. List the names of individuals or entities who will inherit the property. Be specific about how you want the property divided among them, if applicable.

- In the designated section, specify any conditions or restrictions related to the transfer of the property, if necessary.

- Complete the section that details the type of ownership. Indicate whether the beneficiaries will have joint ownership or individual shares.

- Sign and date the form at the bottom. Ensure that you do this in the presence of a notary public.

- After notarization, make copies of the completed form for your records.

- Finally, file the original deed with the county clerk's office where the property is located. Check if there is a filing fee and prepare to pay it.

File Information

| Fact Name | Description |

|---|---|

| Definition | A Lady Bird Deed is a type of transfer deed that allows property owners to retain control over their property during their lifetime while designating beneficiaries for the property upon their death. |

| State Usage | This form is primarily used in states like Texas, Florida, and Michigan, where specific laws govern its use. |

| Governing Law | In Texas, the Lady Bird Deed is governed by Texas Property Code § 5.041. |

| Benefits | It helps avoid probate, allowing for a smoother transfer of property to beneficiaries without court involvement. |

| Revocability | The deed can be revoked or modified by the property owner at any time before their death. |

| Tax Implications | Property transferred through a Lady Bird Deed generally receives a step-up in basis for tax purposes, which can reduce capital gains taxes for beneficiaries. |

| Limitations | This deed cannot be used to transfer property subject to a mortgage without the lender's consent, as it may trigger a due-on-sale clause. |

Find Other Types of Lady Bird Deed Templates

Correction Deed California - A Corrective Deed allows property owners to correct and reaffirm their rights smoothly.

Completing a Last Will and Testament is essential for anyone who wants to ensure that their final wishes are respected and their family members are protected. This document provides clear instructions regarding the distribution of assets, care for minor children, and the appointment of an executor. To help you create this important legal form, you can find a useful resource at https://documentonline.org/blank-last-will-and-testament/, which offers a blank template that you can customize to suit your individual needs.

What Is a Deed-in-lieu of Foreclosure? - A Deed in Lieu can restore some peace of mind in a difficult housing market.