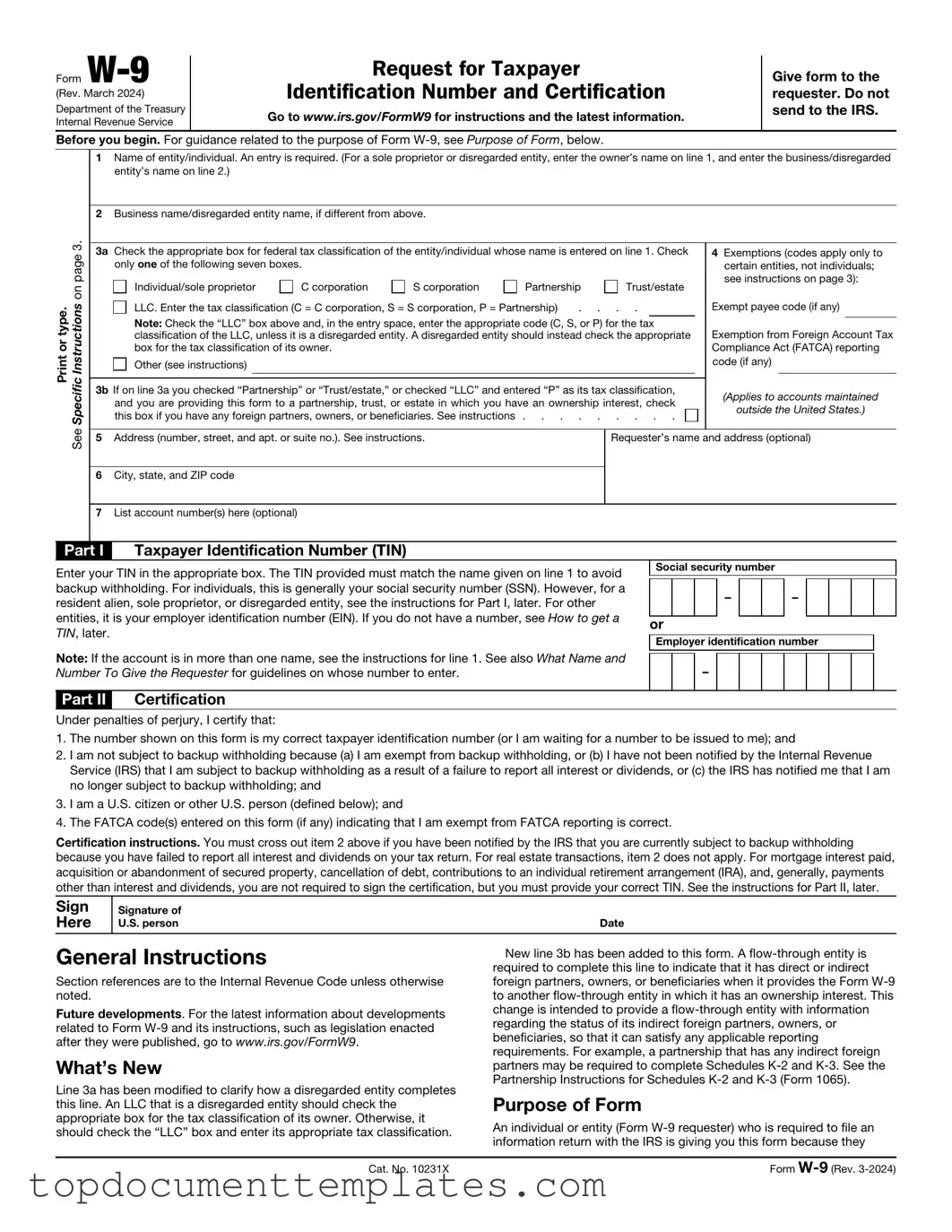

Blank IRS W-9 PDF Form

The IRS W-9 form is a crucial document for individuals and businesses alike, serving as a means to provide essential taxpayer information to those who will be paying you. When you fill out a W-9, you’re essentially confirming your name, business name (if applicable), address, and taxpayer identification number (TIN), which can be your Social Security number or Employer Identification Number. This form is typically requested by clients or companies that need to report payments made to you to the IRS, such as freelancers, independent contractors, and other service providers. Understanding the importance of the W-9 form can help you avoid potential tax issues down the road. It’s important to remember that while the W-9 itself doesn’t determine your tax liability, it plays a significant role in ensuring that the correct information is reported to the IRS. Completing this form accurately is essential for maintaining compliance and ensuring that you receive the payments you’re owed without unnecessary delays or complications.

Similar forms

- Form W-4: This form is used by employees to determine the amount of federal income tax withholding from their paychecks. Like the W-9, it collects personal information and tax identification details.

- Form 1099: This form reports various types of income other than wages, salaries, and tips. It requires similar identification information as the W-9, as it is often issued to individuals who have provided services.

- Form 1040: This is the individual income tax return form. It requires taxpayer identification and personal information, similar to what is provided on the W-9, to report income and calculate taxes owed.

- Form SS-4: This form is used to apply for an Employer Identification Number (EIN). It collects information about the entity applying, similar to the W-9, which identifies individuals or businesses for tax purposes.

- Form 4506-T: This form allows individuals to request a transcript of their tax return. It requires personal identification details akin to those on the W-9 to verify the requestor's identity.

Guidelines on Writing IRS W-9

After you complete the IRS W-9 form, you'll need to submit it to the requester who asked for it. This is often a business or individual that needs your taxpayer information for reporting purposes. Make sure to keep a copy for your records.

- Begin by downloading the W-9 form from the IRS website or obtaining a physical copy from the requester.

- Fill in your name as it appears on your tax return in the first box.

- If you are using a business name, enter it in the second box labeled "Business name/disregarded entity name." If not, you can skip this step.

- Select the appropriate tax classification that applies to you or your business. Options include individual, corporation, partnership, etc.

- Provide your address in the designated fields. This includes your street address, city, state, and ZIP code.

- Enter your taxpayer identification number (TIN). This is usually your Social Security number (SSN) or Employer Identification Number (EIN).

- If applicable, fill out the "Exemptions" section. Most individuals won’t need to fill this out.

- Sign and date the form at the bottom. Your signature certifies that the information provided is accurate.

Once you have completed these steps, make sure to review the form for any errors before submitting it to the requester.

Form Data

| Fact Name | Description |

|---|---|

| Purpose | The W-9 form is used to provide taxpayer identification information to businesses and entities that pay you income. |

| Who Uses It | Individuals and businesses use the W-9 form to report income, such as freelancers and contractors. |

| Tax Identification Number | The form requires a Social Security Number (SSN) or Employer Identification Number (EIN). |

| Submission | You do not submit the W-9 to the IRS. Instead, you provide it to the requester who needs it for their records. |

| Frequency of Use | Complete a W-9 form each time you start a new contract or relationship that requires reporting income. |

| Penalties | Failure to provide accurate information can lead to backup withholding on payments you receive. |

| State-Specific Forms | Some states may have their own versions or additional requirements for reporting income. |

| Governing Laws | State laws vary. For example, California's laws regarding contractor payments can be found in the California Revenue and Taxation Code. |

| Form Updates | The IRS occasionally updates the W-9 form. Always ensure you are using the most current version. |

Other PDF Documents

Can You Make Your Own Family Crest - An emblematic shield signifying personal journey.

Baseball Evaluation Sheets - Rate the player’s overall attitude and focus during drills and assessments.