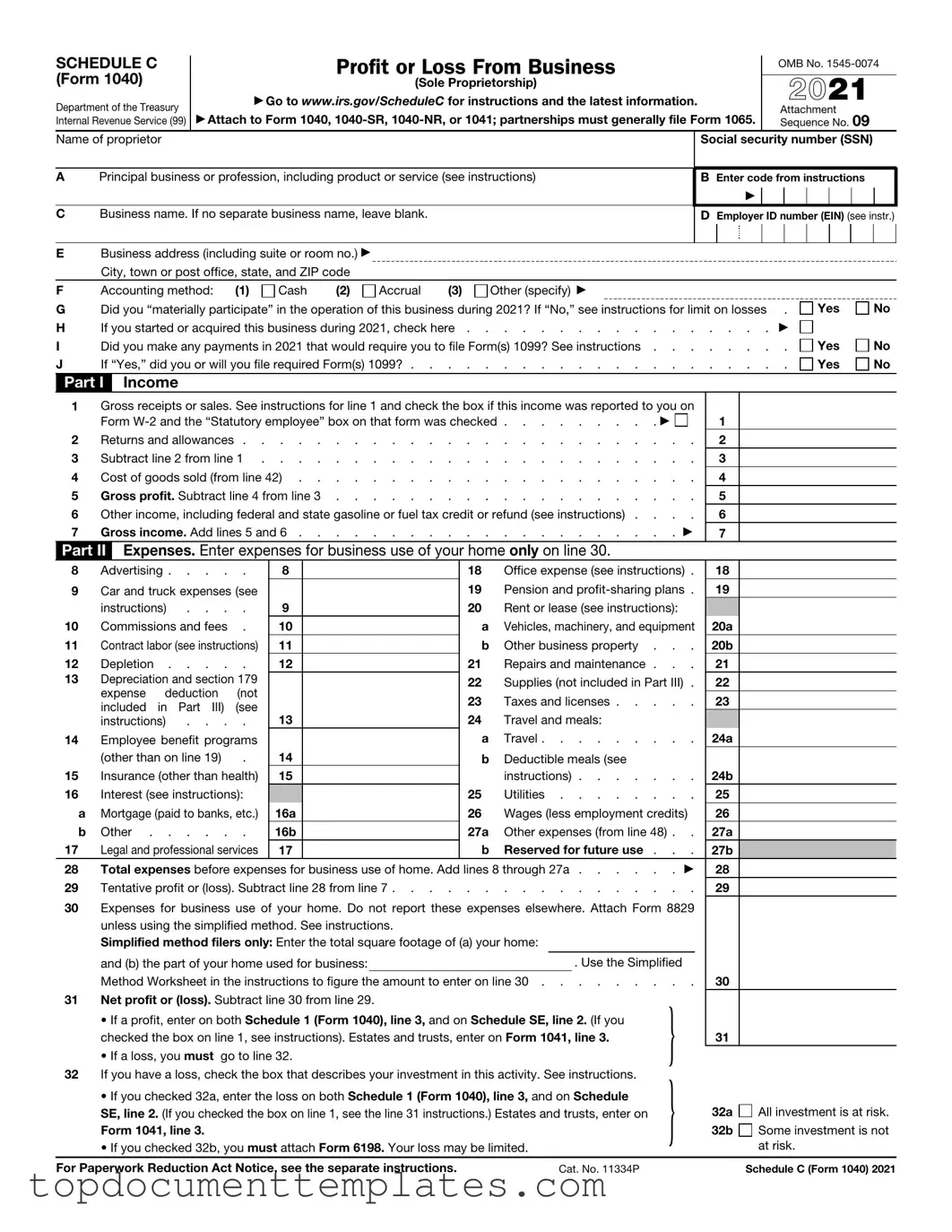

Blank IRS Schedule C 1040 PDF Form

The IRS Schedule C (Form 1040) serves as a crucial document for individuals engaged in self-employment or operating a sole proprietorship. This form allows taxpayers to report income or loss from their business activities, providing a comprehensive overview of earnings and expenses. Key components include sections for reporting gross receipts, cost of goods sold, and various business expenses, such as advertising, utilities, and travel costs. By detailing these financial elements, the form facilitates the calculation of net profit or loss, which ultimately impacts the taxpayer's overall income tax liability. Additionally, Schedule C requires the disclosure of specific information about the business, including its name, address, and principal business activity. Understanding the intricacies of this form is essential for self-employed individuals to ensure accurate reporting and compliance with federal tax regulations.

Similar forms

- IRS Form 1040: The Schedule C is part of the individual income tax return, Form 1040. Both documents are essential for reporting income and expenses, specifically for sole proprietors.

- IRS Schedule SE: This form is used to calculate self-employment tax. Like Schedule C, it pertains to self-employed individuals and is filed alongside Form 1040.

- IRS Form 1065: This is used by partnerships to report income, deductions, and profits. While Schedule C is for sole proprietors, both forms require a detailed breakdown of income and expenses.

- IRS Form 1120: Corporations use this form to report their income. Similar to Schedule C, it requires a comprehensive accounting of revenues and costs, though it applies to corporate entities.

- IRS Form 1120S: This is for S corporations and shares similarities with Schedule C in reporting income and deductions, but it focuses on the income of the corporation rather than an individual.

- IRS Schedule E: Used for reporting supplemental income and loss, Schedule E can be similar to Schedule C when dealing with rental income or income from partnerships.

- Georgia Power of Attorney form - The TopTemplates.info provides a comprehensive overview of the legal authority granted to an individual to make decisions on behalf of another, essential for future incapacity planning.

- IRS Form 4562: This form is for depreciation and amortization. It complements Schedule C by allowing self-employed individuals to report the depreciation of business assets.

- IRS Form 8829: This form is used to claim expenses for business use of your home. Like Schedule C, it helps self-employed individuals detail their business expenses.

- IRS Form 1040X: This is the amended tax return form. If changes are needed to a previously filed Schedule C, Form 1040X will be used to correct any errors.

- IRS Form 1099-MISC: This form reports miscellaneous income. For self-employed individuals, it can be relevant as it may detail income that also needs to be reported on Schedule C.

Guidelines on Writing IRS Schedule C 1040

Filling out the IRS Schedule C (Form 1040) is an important step for self-employed individuals or sole proprietors. Completing this form accurately ensures that your business income and expenses are reported correctly. Follow these steps carefully to fill out the form.

- Gather all necessary documents, including income records, expense receipts, and previous tax returns.

- Start by entering your name and Social Security number at the top of the form.

- Provide your business name and address in the appropriate fields.

- Indicate your principal business activity by selecting the correct code from the provided list.

- Report your gross receipts or sales in the designated section. This includes all income earned from your business.

- List your business expenses in the appropriate categories. Common expenses include advertising, car and truck expenses, and supplies.

- Calculate your total expenses and subtract them from your gross income to determine your net profit or loss.

- Fill out the section for other income or expenses if applicable.

- Review the completed form for accuracy and ensure all calculations are correct.

- Sign and date the form before submitting it with your tax return.

Make sure to keep a copy of the completed Schedule C for your records. This will be useful for future reference and in case of an audit.

Form Data

| Fact Name | Description |

|---|---|

| Purpose | The IRS Schedule C (Form 1040) is used by sole proprietors to report income and expenses from a business. |

| Filing Requirement | Individuals must file Schedule C if they earned income from self-employment or a business. |

| Income Reporting | Schedule C allows taxpayers to report gross receipts or sales from their business activities. |

| Deductible Expenses | Taxpayers can deduct various business expenses, such as supplies, rent, and utilities, on Schedule C. |

| Net Profit or Loss | The form calculates the net profit or loss, which is then transferred to the main Form 1040. |

| Self-Employment Tax | Net earnings from Schedule C may be subject to self-employment tax, which is reported on Schedule SE. |

| State-Specific Forms | Many states have their own forms for reporting business income, governed by state tax laws. |

Other PDF Documents

Roof Warrenty - MCS Roofing takes pride in providing exceptional service, evident in this comprehensive warranty.

For those seeking to navigate the complexities of commercial property leasing, understanding the nuances of a robust Commercial Lease Agreement is vital. This legal document not only outlines the key responsibilities of landlords and tenants, but it also provides a framework for the successful management of the leased space. To learn more, you can access the comprehensive guide on Commercial Lease Agreement essentials to ensure all parties are well informed.

Puppy Health Record - Write location and route of vaccine administration for accuracy.