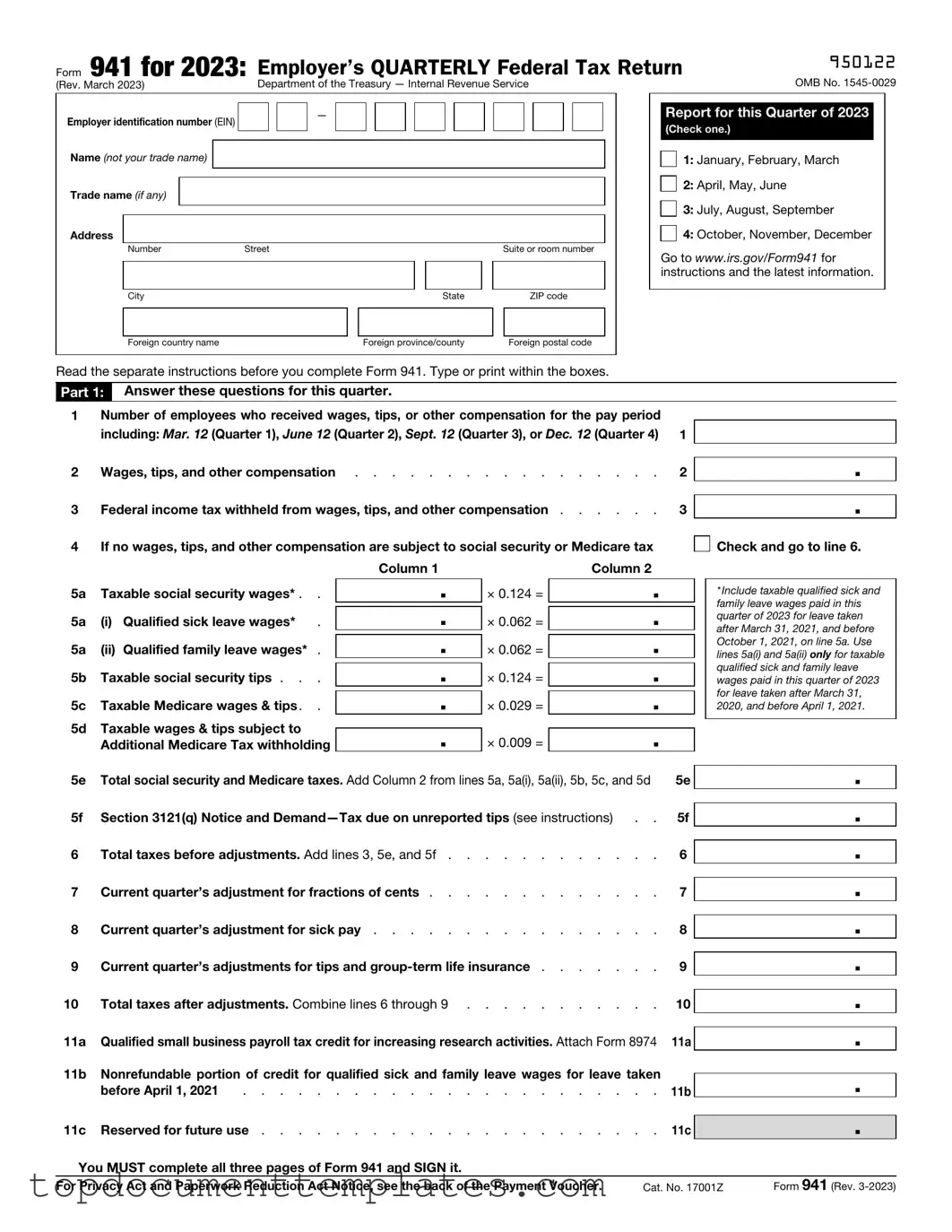

Blank IRS 941 PDF Form

The IRS 941 form plays a crucial role in the landscape of payroll taxes for employers in the United States. This quarterly report is used by businesses to report income taxes, Social Security tax, and Medicare tax withheld from employee paychecks. It serves as a key tool for the Internal Revenue Service to ensure compliance with tax obligations. Employers must also indicate the total wages paid to employees during the quarter, as well as any adjustments for prior periods. Understanding the nuances of this form is essential, as it not only affects the employer's tax liability but also impacts employees' future benefits. Timely and accurate filing is vital, as failure to comply can lead to penalties and interest charges. For many businesses, the 941 form is more than just a piece of paperwork; it is a reflection of their commitment to fulfilling their tax responsibilities and supporting the social safety net that benefits all workers.

Similar forms

- Form 940: This form is used to report annual Federal Unemployment Tax Act (FUTA) taxes. Like Form 941, it is essential for employers, ensuring compliance with federal tax obligations related to unemployment insurance. Both forms require accurate reporting of employee wages and taxes withheld.

- Form W-2: Employers use this form to report annual wages and the taxes withheld from employees' paychecks. Similar to Form 941, it provides a summary of an employee's earnings and tax contributions, ensuring that individuals receive proper credit for Social Security and Medicare.

- Form W-3: This is the transmittal form for Form W-2. It summarizes the total earnings and taxes reported for all employees. Like Form 941, it ensures that the IRS has a comprehensive view of the tax obligations and contributions made by the employer.

- Georgia Power of Attorney form - This legal document authorizes one individual to make decisions on behalf of another, covering various responsibilities such as financial and personal care, and is essential for planning future incapacity. For more details, visit TopTemplates.info.

- Form 1099-MISC: Used to report miscellaneous income, this form shares similarities with Form 941 in that both require accurate reporting of payments made to non-employees. Employers must ensure that they report all relevant income to avoid discrepancies with the IRS.

- Form 944: This form is designed for smaller employers to report annual payroll taxes instead of quarterly. While Form 941 is filed quarterly, Form 944 simplifies the process for those with lower payroll tax liabilities, making compliance more manageable.

- Form 943: Agricultural employers use this form to report income taxes, Social Security, and Medicare taxes withheld from farmworkers. Similar to Form 941, it addresses specific employment types and ensures that the IRS receives accurate payroll information.

- Form 945: This form is used to report backup withholding on payments made to non-employees. Both Form 941 and Form 945 are crucial for ensuring proper reporting of tax withholdings, helping the IRS track compliance across various payment types.

Guidelines on Writing IRS 941

Once you have gathered all necessary information, you are ready to fill out the IRS 941 form. This form is used to report employment taxes and must be submitted quarterly. Ensure that you have accurate data to avoid delays or penalties.

- Obtain the IRS 941 form. You can download it from the IRS website or request a paper copy.

- Fill in your business information. This includes your name, address, and Employer Identification Number (EIN).

- Enter the quarter for which you are reporting. Indicate the appropriate box for the month that ends the quarter.

- Report the number of employees who received wages during the quarter. This information is crucial for accurate calculations.

- Calculate the total wages paid to employees during the quarter. Include all taxable wages and tips.

- Determine the total taxes withheld from employees. This includes federal income tax and Social Security and Medicare taxes.

- Complete the section for adjustments. If you have any adjustments to make, ensure they are accurately reflected.

- Calculate the total tax liability for the quarter. This should include all taxes due based on the wages and withholdings reported.

- Report any payments made during the quarter. This will help determine if you owe additional tax or are due a refund.

- Sign and date the form. Ensure that the person signing has the authority to do so.

- Submit the completed form by the due date. You can file electronically or send it by mail to the appropriate IRS address.

Form Data

| Fact Name | Description |

|---|---|

| Purpose | The IRS Form 941 is used by employers to report income taxes, Social Security tax, and Medicare tax withheld from employee paychecks. |

| Filing Frequency | This form must be filed quarterly, which means employers need to submit it four times a year. |

| Due Dates | Form 941 is due on the last day of the month following the end of the quarter. For example, the due date for Q1 is April 30. |

| State-Specific Forms | Some states may have additional forms or requirements. For instance, California requires employers to file the DE 9 form alongside the federal 941. |

| Penalties for Late Filing | Filing late can result in penalties. The IRS may impose fines based on the amount of tax owed and how late the form is submitted. |

| Electronic Filing | Employers have the option to file Form 941 electronically, which can streamline the process and reduce errors. |

Other PDF Documents

Form 4506 T - For students, this transcript is useful in determining eligibility for certain tax credits.

When engaging in a transaction in Illinois, it is crucial to utilize the Illinois Bill of Sale form, which can be found at https://documentonline.org/blank-illinois-bill-of-sale/. This document not only provides legal proof of the transfer of ownership for personal property but also safeguards the interests of both buyers and sellers by detailing the terms of the sale.

What Does a Direct Deposit Form Look Like - Providing accurate information on the form will minimize the risk of errors in deposits.

Free Printable Daycare Receipt - It is important to provide accurate payment information.