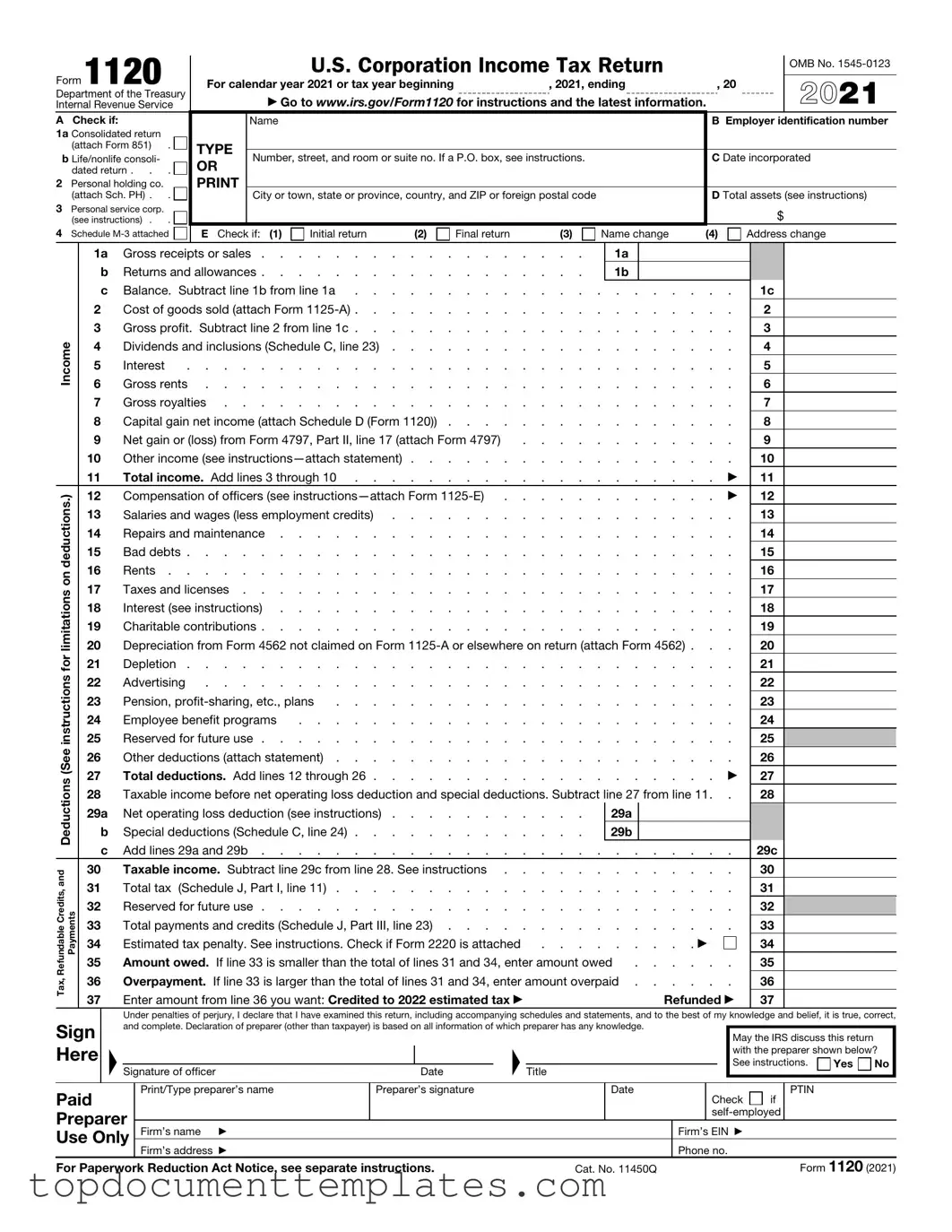

Blank IRS 1120 PDF Form

The IRS 1120 form plays a crucial role for corporations operating in the United States. It serves as the primary document for reporting income, gains, losses, deductions, and credits to the Internal Revenue Service. Corporations, both large and small, use this form to calculate their federal income tax liability. The form requires detailed financial information, including revenue earned, expenses incurred, and any applicable tax credits. Additionally, it includes sections for reporting specific types of income, such as dividends and capital gains. Understanding the nuances of the 1120 form is essential for compliance and accurate tax reporting. Filing this form accurately can help corporations avoid penalties and ensure they are meeting their tax obligations. Timely submission is also important, as it affects the overall financial health and planning of the business.

Similar forms

-

IRS Form 1065: This form is used by partnerships to report income, deductions, gains, and losses. Like Form 1120, it provides a detailed overview of the entity's financial activities, although it reflects the income passed through to partners rather than the corporation itself.

-

IRS Form 1040: Individual taxpayers use this form to report personal income. While Form 1120 focuses on corporate income, both forms require detailed reporting of income sources and deductions, highlighting the overall financial health of the taxpayer or corporation.

-

IRS Form 1120-S: This form is specifically for S corporations. Similar to Form 1120, it is used to report income, deductions, and credits, but it also allows income to pass through to shareholders, avoiding double taxation.

-

IRS Form 990: Nonprofit organizations file this form to report their financial activities. Both Form 1120 and Form 990 require detailed disclosures about revenue and expenses, ensuring transparency and accountability in financial reporting.

- Georgia Power of Attorney Form: This legal document is essential for authorizing another person to make decisions on your behalf. It ensures that your personal and financial matters are handled according to your wishes during times of incapacity or absence. For more details, visit TopTemplates.info.

-

IRS Form 941: Employers use this form to report income taxes withheld from employee paychecks and the employer's share of Social Security and Medicare taxes. While it serves a different purpose, both forms require accurate reporting of financial data to the IRS.

-

IRS Form 1065-B: This form is for electing large partnerships. It shares similarities with Form 1120 in that it requires the reporting of income, deductions, and credits, focusing on the financial activities of the partnership.

Guidelines on Writing IRS 1120

Completing the IRS 1120 form is an important step for corporations filing their taxes. The process requires careful attention to detail to ensure accuracy. Below are the steps to guide you through filling out the form.

- Gather necessary documents, including financial statements, records of income, and any deductions or credits.

- Download the IRS 1120 form from the official IRS website or obtain a physical copy.

- Fill in the corporation's name, address, and Employer Identification Number (EIN) at the top of the form.

- Complete the section for income. Report total income from all sources, including sales and other revenue.

- List allowable deductions in the appropriate section. Common deductions include salaries, rent, and utilities.

- Calculate the taxable income by subtracting total deductions from total income.

- Determine the tax liability based on the taxable income using the corporate tax rate.

- Fill out any additional schedules or forms required, such as Schedule C for dividends or Schedule J for tax computation.

- Review all entries for accuracy and completeness. Ensure all calculations are correct.

- Sign and date the form. If someone else prepared the form, that person should also sign it.

- Submit the completed form to the IRS by the due date, either electronically or by mail.

Following these steps carefully will help ensure that the IRS 1120 form is filled out correctly, minimizing the chances of errors or delays in processing. Remember to keep a copy for your records.

Form Data

| Fact Name | Description |

|---|---|

| Purpose | The IRS Form 1120 is used by corporations to report their income, gains, losses, deductions, and credits. |

| Filing Requirement | Corporations must file Form 1120 annually if they are subject to federal income tax. |

| Due Date | The form is typically due on the 15th day of the fourth month after the end of the corporation's tax year. |

| Estimated Taxes | Corporations may need to make estimated tax payments throughout the year based on expected tax liability. |

| State Forms | Many states have their own corporate tax forms, such as California's Form 100, governed by the California Revenue and Taxation Code. |

| Filing Methods | Form 1120 can be filed electronically or by mail, depending on the corporation's preference. |

| Penalties | Late filing or failure to file can result in penalties, which may increase the longer the delay. |

| Payment Options | Corporations can pay any taxes owed electronically or via check when filing Form 1120. |

| Record Keeping | Corporations must maintain adequate records to support the information reported on Form 1120 for at least three years. |

Other PDF Documents

Create Gift Card Online Free - A Gift Letter can enhance the borrower’s profile by showcasing additional financial support from family.

In addition to providing a clear record of the transaction, the Illinois Bill of Sale form can be easily accessed online, such as at documentonline.org/blank-illinois-bill-of-sale/, ensuring that both parties have the necessary documentation for their records.

Proof of Pregnancy Form Planned Parenthood California - The form allows patients to indicate the test results they hope to receive.