Valid Transfer-on-Death Deed Form for Iowa State

The Iowa Transfer-on-Death Deed (TODD) serves as a crucial tool for property owners who wish to ensure a smooth transition of their real estate assets upon their passing. This legal instrument allows individuals to designate one or more beneficiaries to receive their property without the need for probate, streamlining the transfer process significantly. By completing and recording the TODD, property owners can maintain control over their assets during their lifetime while providing clear instructions for their distribution after death. The form requires specific information, including the names of the property owner and the designated beneficiaries, as well as a legal description of the property involved. Importantly, the TODD can be revoked or modified at any time before the owner's death, offering flexibility as circumstances change. Understanding the nuances of this deed is essential for anyone considering its use, as it can impact estate planning strategies and the financial well-being of beneficiaries. This article will delve into the key features, advantages, and potential pitfalls of the Iowa Transfer-on-Death Deed, equipping readers with the knowledge necessary to make informed decisions about their estate planning needs.

Similar forms

The Transfer-on-Death Deed (TOD) form is a unique legal document used to transfer real estate upon the death of the owner without going through probate. Several other documents serve similar purposes in estate planning. Here are four documents that share similarities with the TOD deed:

- Last Will and Testament: A will outlines how a person's assets should be distributed after their death. Like the TOD deed, it allows individuals to specify beneficiaries but typically requires probate to validate the distribution.

- Living Trust: A living trust allows individuals to manage their assets during their lifetime and specifies how those assets should be distributed after death. Both the living trust and the TOD deed bypass probate, making the transfer process smoother for beneficiaries.

- Beneficiary Designation Forms: These forms are often used for financial accounts, such as life insurance policies or retirement accounts. Similar to the TOD deed, they allow individuals to name beneficiaries who will receive assets directly upon death, avoiding the probate process.

- ATV Bill of Sale: The New York ATV Bill of Sale form is a crucial document proving the sale of an all-terrain vehicle (ATV). This form, which includes details such as the ATV’s identification number and the parties’ personal information, ensures clear documentation of the transaction, providing security for both the buyer and seller. For further details, you can refer to https://documentonline.org/blank-new-york-atv-bill-of-sale/.

- Transfer-on-Death Account (TOD Account): This type of account allows individuals to name a beneficiary to receive the account's assets upon their death. Both the TOD deed and TOD account facilitate a direct transfer to beneficiaries without the need for probate.

Guidelines on Writing Iowa Transfer-on-Death Deed

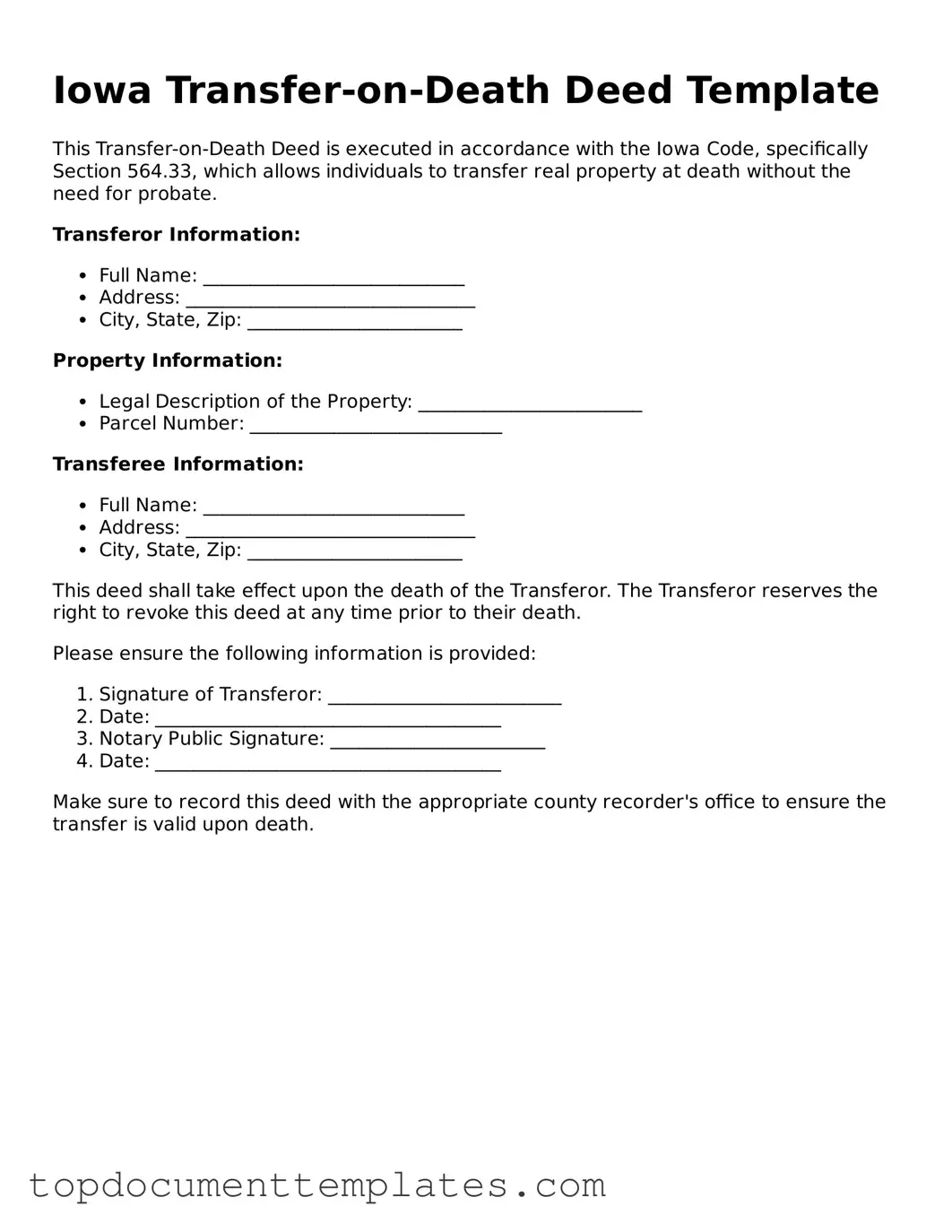

Filling out the Iowa Transfer-on-Death Deed form requires careful attention to detail. After completing the form, you will need to file it with the appropriate county recorder’s office to ensure that it is legally recognized. Below are the steps to guide you through the process.

- Begin by downloading the Iowa Transfer-on-Death Deed form from a reliable source or obtain a physical copy from your local county recorder’s office.

- In the top section of the form, clearly write the name of the property owner(s). Ensure that the names match those on the property’s title.

- Next, provide the current address of the property owner(s). This should include the street address, city, state, and zip code.

- Identify the property that will be transferred. Include a legal description of the property, which can typically be found on the property deed or tax statement.

- Designate the beneficiary or beneficiaries who will receive the property upon the owner's death. Include their full names and addresses.

- Include a statement indicating that the transfer is to occur upon the death of the owner(s). This is crucial for the deed to be valid.

- Both property owner(s) must sign and date the form in the designated areas. Signatures must be notarized to ensure authenticity.

- After signing, make copies of the completed form for your records.

- Finally, file the original Transfer-on-Death Deed with the county recorder’s office in the county where the property is located. Be prepared to pay any applicable filing fees.

Once the form is filed, it becomes part of the public record, and the transfer will be executed according to the terms specified in the deed. It is advisable to keep a copy of the filed deed for your personal records.

File Information

| Fact Name | Details |

|---|---|

| Definition | The Iowa Transfer-on-Death Deed allows property owners to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | This deed is governed by Iowa Code Chapter 557B. |

| Eligibility | Any owner of real property in Iowa can create a Transfer-on-Death Deed, including individuals and joint owners. |

| Revocation | The Transfer-on-Death Deed can be revoked at any time by the property owner through a written document that complies with Iowa law. |

| Recording Requirement | To be effective, the deed must be recorded with the county recorder's office before the owner's death. |

Other Popular Transfer-on-Death Deed State Forms

Transfer Upon Death Deed Texas - Recording a Transfer-on-Death Deed may come with specific fees depending on the jurisdiction.

In the context of legal agreements, a Hold Harmless Agreement is essential for parties engaged in activities where liability might be a concern. This document not only outlines the responsibilities of each party but also ensures that any potential claims are addressed upfront. To gain deeper insights into drafting such agreements, you can refer to resources like OnlineLawDocs.com, which provide valuable information tailored to Florida law.

Transfer on Death Deed Florida Form - This deed does not change your rights to manage or sell the property as long as you live.