Valid Promissory Note Form for Iowa State

The Iowa Promissory Note form serves as a crucial financial instrument in lending transactions, providing a written promise from a borrower to repay a specified amount of money to a lender under agreed-upon terms. This form typically outlines essential details such as the principal amount, interest rate, repayment schedule, and any applicable fees. It is designed to protect the interests of both parties by clearly defining the obligations and rights involved in the loan agreement. In addition, the form may include provisions for default, which specify the consequences if the borrower fails to meet their repayment obligations. Understanding the structure and requirements of the Iowa Promissory Note is vital for individuals and businesses engaging in lending activities, as it ensures that all parties are on the same page regarding the terms of the loan. By utilizing this standardized form, borrowers and lenders can foster trust and clarity, thereby minimizing potential disputes in the future.

Similar forms

- Loan Agreement: Similar to a promissory note, a loan agreement outlines the terms of a loan, including the amount borrowed, interest rate, and repayment schedule. However, it often includes additional clauses regarding default and remedies.

- Mortgage: A mortgage secures a loan with real property. Like a promissory note, it involves a promise to repay, but it also grants the lender a legal claim to the property if the borrower defaults.

- IRS Form 2553 - This form is essential for small businesses electing S Corporation status, allowing income and deductions to pass through to shareholders. Completing the form accurately is crucial for compliance and optimizing tax benefits, and can be accessed here: https://documentonline.org/blank-irs-2553/.

- Installment Agreement: This document details a repayment plan for a debt. Similar to a promissory note, it specifies the total amount owed and the schedule for payments, but it may include terms for service agreements.

- Security Agreement: A security agreement provides the lender with a security interest in personal property. Like a promissory note, it involves a promise to repay, but it also describes the collateral involved.

- IOU (I Owe You): An informal document acknowledging a debt. While it lacks the formal structure of a promissory note, it serves a similar purpose by recognizing the borrower's obligation to repay.

- Debt Settlement Agreement: This document outlines the terms under which a debtor agrees to pay a reduced amount to settle a debt. It shares similarities with a promissory note in that it involves an agreement to repay, but it often includes negotiated terms.

- Lease Agreement: A lease outlines the terms for renting property. While it primarily focuses on rental payments, it can resemble a promissory note in terms of detailing payment obligations over time.

- Credit Card Agreement: This document outlines the terms of using a credit card, including repayment terms and interest rates. Like a promissory note, it establishes a borrower's obligation to repay borrowed funds.

Guidelines on Writing Iowa Promissory Note

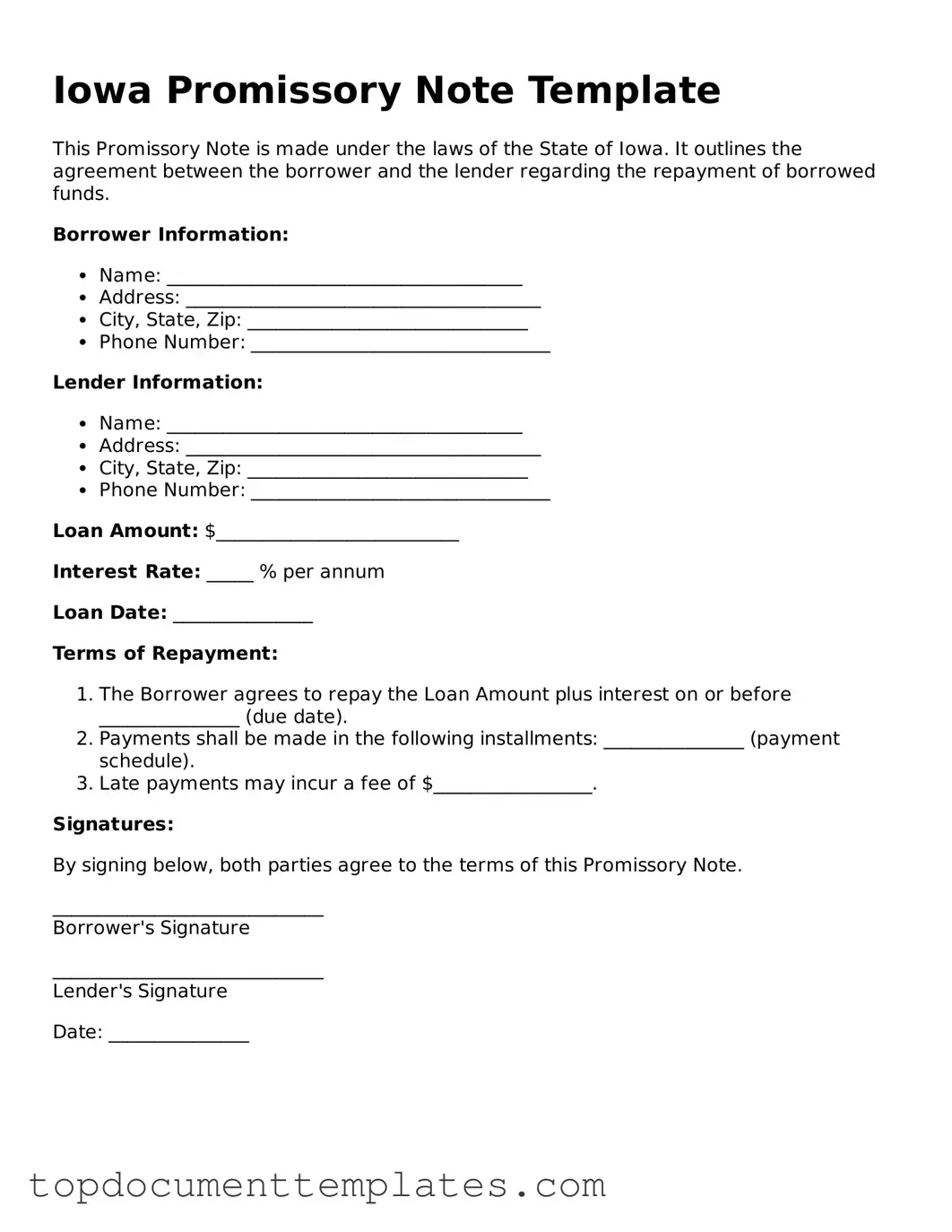

Filling out the Iowa Promissory Note form is straightforward. Once you have completed the form, it’s important to keep a copy for your records. This ensures that both parties have a clear understanding of the agreement. Here’s how to fill out the form step by step.

- Title the Document: At the top of the form, write "Promissory Note." This clearly states the purpose of the document.

- Fill in the Date: Write the date when the note is being created. This helps establish the timeline for the agreement.

- Enter Borrower Information: Write the full name and address of the person borrowing the money. Make sure the details are accurate.

- Enter Lender Information: Write the full name and address of the person lending the money. Double-check for accuracy.

- State the Loan Amount: Clearly write the amount of money being borrowed. Use numbers and words for clarity.

- Specify the Interest Rate: If applicable, write the interest rate on the loan. Make sure to indicate whether it’s fixed or variable.

- Define the Repayment Terms: Outline how and when the borrower will repay the loan. Include the payment schedule and any late fees.

- Include Signatures: Both the borrower and lender should sign the document. This makes the agreement official.

- Notarization (if required): If necessary, have the document notarized to add an extra layer of validity.

File Information

| Fact Name | Details |

|---|---|

| Definition | An Iowa Promissory Note is a written promise to pay a specific amount of money to a designated person or entity. |

| Governing Law | The Iowa Uniform Commercial Code (UCC) governs promissory notes in Iowa. |

| Parties Involved | It involves two parties: the maker (borrower) and the payee (lender). |

| Payment Terms | It specifies the amount to be paid, the interest rate, and the payment schedule. |

| Signature Requirement | The maker must sign the note for it to be legally binding. |

| Enforceability | If properly executed, the note is enforceable in a court of law. |

| Transferability | Promissory notes can be transferred to another party through endorsement. |

| Default Consequences | If the maker defaults, the payee may take legal action to recover the owed amount. |

Other Popular Promissory Note State Forms

Free Promissory Note Template Florida - Lenders can rely on this note as a legal remedy if repayment issues arise.

Having a California Power of Attorney form in place is essential for anyone wishing to protect their interests, as it designates a trusted individual to act on their behalf in crucial matters. For more information on setting up this important document, you can visit OnlineLawDocs.com, which provides resources and guidance to help navigate the process effectively.

Promissory Note California - Default on a promissory note can lead to serious financial repercussions.