Official Investment Letter of Intent Template

When considering an investment opportunity, clarity and commitment are essential. An Investment Letter of Intent (LOI) serves as a preliminary agreement between parties, outlining the key terms and intentions before finalizing a more detailed contract. This document typically includes crucial elements such as the amount of investment, the nature of the investment, and the intended timeline for completion. It may also specify the conditions under which the investment will be made, such as due diligence requirements or regulatory approvals. By providing a framework for negotiations, the Investment Letter of Intent helps to align the interests of both investors and entrepreneurs, fostering a mutual understanding of expectations and responsibilities. While it is not a legally binding contract, it reflects a serious intention to proceed and can pave the way for more formal agreements down the line. Understanding the components and implications of this document can significantly enhance the investment process, ensuring that both parties are on the same page as they move forward.

Similar forms

- Term Sheet: Similar to an Investment Letter of Intent, a term sheet outlines the key terms and conditions of a proposed investment. It serves as a preliminary agreement, guiding further negotiations.

- Memorandum of Understanding (MOU): An MOU details the intentions of the parties involved in a transaction. Like the Investment Letter of Intent, it establishes a framework for cooperation without creating binding obligations.

- Non-Disclosure Agreement (NDA): An NDA is used to protect confidential information shared during negotiations. Both documents often accompany investment discussions to ensure sensitive data remains secure.

- Purchase Agreement: This document formalizes the sale of assets or equity. While an Investment Letter of Intent expresses interest, a purchase agreement finalizes the terms of the transaction.

- Shareholders’ Agreement: A shareholders’ agreement governs the relationship between shareholders. It is similar in that it outlines rights and obligations, often following the intent expressed in an investment letter.

- Subscription Agreement: This agreement allows an investor to purchase shares in a company. It is akin to an Investment Letter of Intent, as both signify the investor's commitment to participate in the investment.

- Investment Proposal: An investment proposal provides detailed information about a potential investment opportunity. It shares similarities with an Investment Letter of Intent by conveying the investor's interest and the terms of the investment.

- Letter of Intent (LOI): A general letter of intent outlines the preliminary understanding between parties. Like an Investment Letter of Intent, it sets the stage for further negotiations and agreements.

- Engagement Letter: This document formalizes the relationship between a client and a service provider. It is similar in that it lays out the terms of engagement, akin to the intentions expressed in an Investment Letter of Intent.

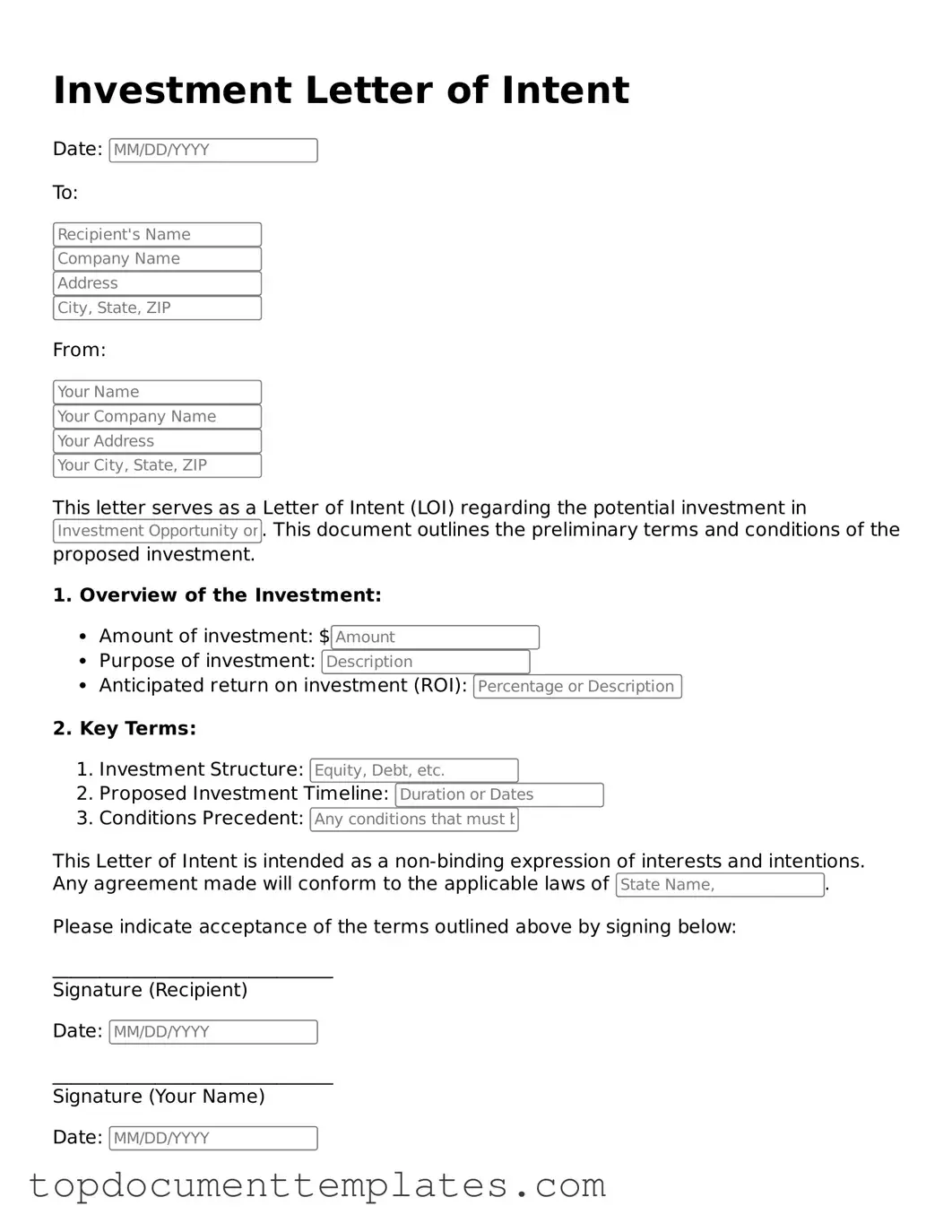

Guidelines on Writing Investment Letter of Intent

After obtaining the Investment Letter of Intent form, proceed to complete it accurately. Ensure that all required information is filled out before submitting the form to avoid delays in processing.

- Begin by entering the date at the top of the form.

- Provide your full name in the designated section.

- Fill in your contact information, including your address, phone number, and email address.

- Indicate the name of the investment opportunity you are interested in.

- State the amount you intend to invest in the specified field.

- Include any relevant details about your investment strategy or expectations.

- Sign the form at the bottom to confirm your intent.

- Review the completed form for accuracy and completeness.

- Submit the form as directed, either electronically or via mail.

File Information

| Fact Name | Description |

|---|---|

| Purpose | An Investment Letter of Intent outlines the preliminary terms and conditions for a potential investment deal. |

| Binding Nature | This document is generally non-binding, meaning it expresses intent but does not create enforceable obligations. |

| Key Components | Common elements include the investment amount, timeline, and any conditions that must be met before finalizing the deal. |

| Governing Law | The governing law may vary by state; for example, in California, it is governed by California Civil Code. |

| Confidentiality | Often, these letters include confidentiality clauses to protect sensitive information shared during negotiations. |

| Use in Negotiations | Investment Letters of Intent serve as a foundation for negotiations, helping both parties clarify their expectations. |

Find Other Types of Investment Letter of Intent Templates

Letter of Intent to Homeschool Template - Allows for flexibility in educational methods and materials used.

Grant Loi - This form is part of the necessary documentation for grant inquiries.