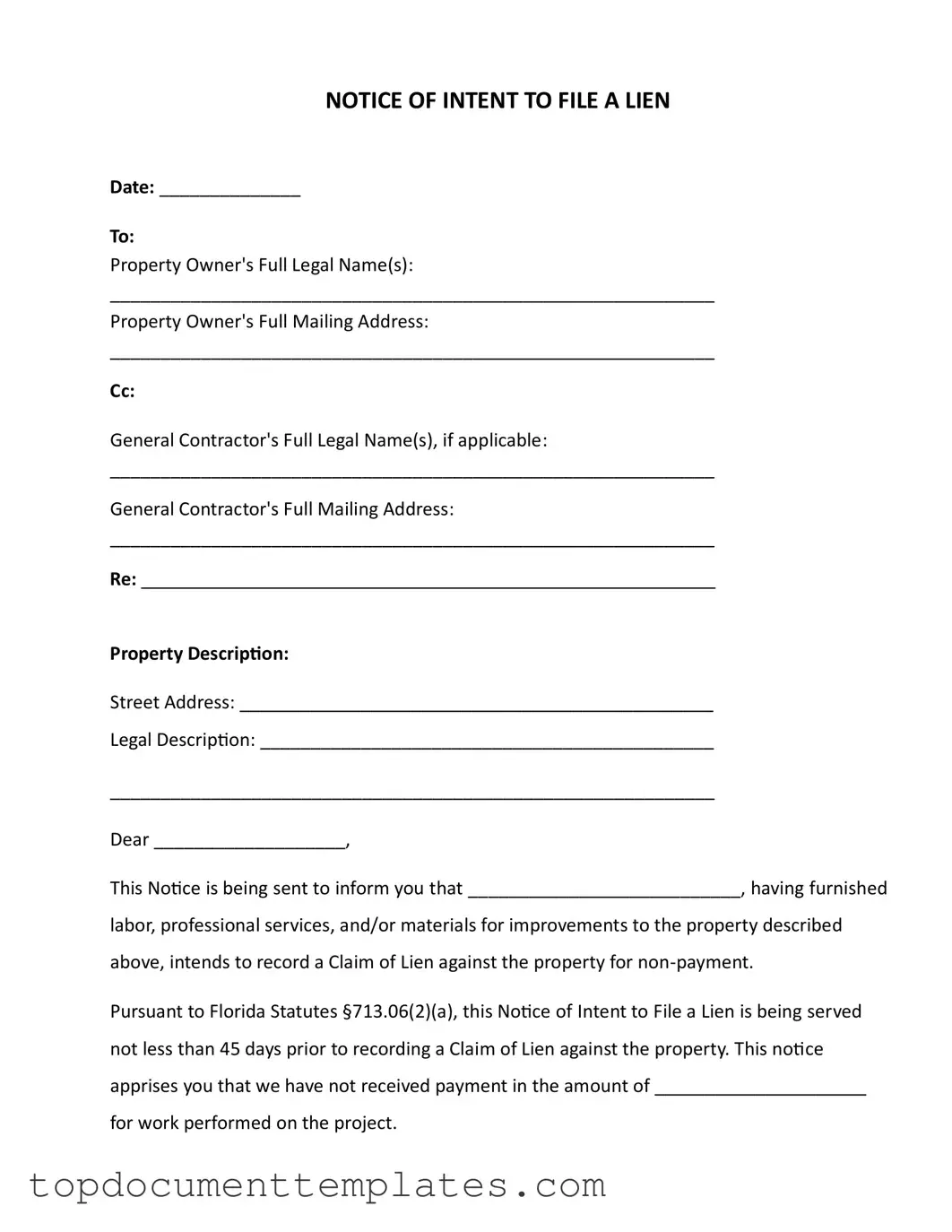

Blank Intent To Lien Florida PDF Form

The Intent to Lien form in Florida serves as a crucial document for contractors, subcontractors, and suppliers who have not received payment for their services or materials provided for property improvements. This form notifies property owners of the intent to file a lien, a legal claim against the property, if payment is not made. It includes essential details such as the date, the names and addresses of the property owner and general contractor, and a description of the property in question. The form emphasizes the importance of timely payment, stipulating that the notice must be sent at least 45 days before a lien is recorded. If the property owner fails to respond within 30 days, they risk having a lien placed on their property, which could lead to foreclosure proceedings and additional costs. The form also serves as a reminder that no waivers or releases have been received that would invalidate the lien claim. By addressing this matter promptly, property owners can avoid potential legal complications and ensure a smoother resolution.

Similar forms

The Intent to Lien Florida form shares similarities with several other legal documents that serve to protect the rights of those providing labor or materials for property improvements. Below are four documents that are comparable in purpose and function:

- Notice of Lien: This document is filed after the work has been completed and payment has not been received. It formally establishes a claim against the property, similar to the Intent to Lien, but occurs after the initial notice period has passed.

- Dirt Bike Bill of Sale: When engaging in a dirt bike transaction, it's important to access the comprehensive Dirt Bike Bill of Sale to ensure a smooth transfer of ownership and proper documentation.

- Preliminary Notice: Often sent at the beginning of a project, this document notifies property owners of the parties involved in the construction process. Like the Intent to Lien, it serves to inform the owner of potential claims against their property if payment issues arise later.

- Claim of Lien: This is the document that is actually recorded with the county clerk after the notice period has expired. It solidifies the claim against the property and is similar to the Intent to Lien in that both documents address payment issues and the potential for legal action.

- Waiver of Lien Rights: This document is used to relinquish the right to file a lien for work completed. It is similar to the Intent to Lien in that it relates to the rights of those providing services or materials, but it serves to prevent a lien from being filed instead of announcing an intent to do so.

Guidelines on Writing Intent To Lien Florida

Completing the Intent to Lien form in Florida is a straightforward process. This document serves as a formal notice to property owners about an impending lien due to non-payment for services or materials provided. After filling out the form, it’s essential to ensure that it is delivered properly to the property owner and any relevant parties to maintain compliance with state regulations.

- Date: Write the current date at the top of the form.

- Property Owner's Information: Fill in the full legal name(s) of the property owner(s) and their complete mailing address.

- General Contractor's Information: If applicable, enter the full legal name(s) of the general contractor and their mailing address.

- Property Description: Specify the street address of the property and include the legal description.

- Notice Content: In the blank space, write your name or the name of the entity intending to file the lien. Include the amount owed for the work performed.

- Signature Section: Sign the document, and provide your name, title, phone number, and email address.

- Certificate of Service: Fill in the date the notice was served, the name of the person it was served to, and their address. Indicate the method of delivery used (e.g., Certified Mail, Hand Delivery).

- Final Signature: Sign and print your name in the Certificate of Service section.

Form Data

| Fact Name | Details |

|---|---|

| Purpose | The Intent to Lien form serves as a formal notification to property owners that a claim of lien will be filed due to non-payment for services or materials provided. |

| Governing Law | This form is governed by Florida Statutes §713.06, which outlines the requirements and procedures for filing a lien in Florida. |

| Notice Period | According to Florida law, the notice must be served at least 45 days before the actual lien is recorded, ensuring the property owner is informed in advance. |

| Response Time | Property owners have 30 days to respond to the notice. If payment is not made or a satisfactory response is not provided, a lien may be recorded. |

Other PDF Documents

How to Make Payroll Checks - This form can vary according to company policies and state regulations regarding payroll.

For those navigating the complexities of military leave, understanding the DA Form 31 is essential, as this document, which can be accessed at https://onlinelawdocs.com/, streamlines the process of requesting various types of absences while ensuring compliance with established regulations.

Verizon Wireless Claim - This document ensures all relevant information is collected in one place.

Free Printable Daycare Receipt - Utilizing this receipt streamlines communication between parents and providers.