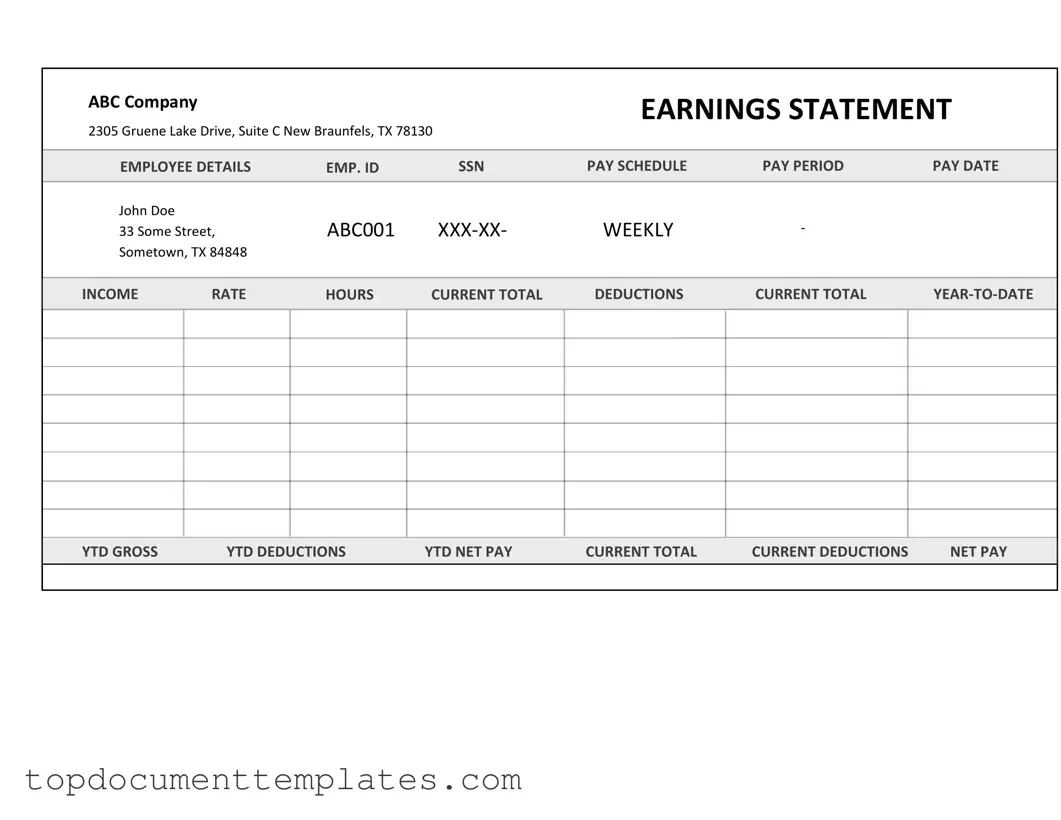

Blank Independent Contractor Pay Stub PDF Form

When it comes to managing finances as an independent contractor, having a clear understanding of your earnings is crucial. The Independent Contractor Pay Stub form serves as an essential tool in this process, providing a detailed breakdown of your income and any deductions. This form typically includes vital information such as the contractor’s name, payment date, and the total amount earned for the specified period. It also outlines any taxes withheld, expenses reimbursed, and other relevant deductions, ensuring transparency and clarity in financial dealings. By utilizing this pay stub, independent contractors can maintain accurate records for tax purposes and better track their earnings over time. Understanding the components of this form not only empowers contractors to manage their finances effectively but also fosters a sense of professionalism in their work. Whether you’re a seasoned contractor or just starting out, familiarizing yourself with the Independent Contractor Pay Stub form is a smart step toward financial organization and success.

Similar forms

W-2 Form: This document is issued by employers to report wages paid to employees and the taxes withheld. Like the Independent Contractor Pay Stub, it provides a summary of earnings for the year, but it is specific to traditional employees rather than independent contractors.

Hold Harmless Agreement: This legal document is crucial for protecting parties in Florida from liability for injuries or damages incurred during activities, helping to transfer risk and manage legal claims. For more information, visit https://onlinelawdocs.com.

1099-MISC Form: Used to report payments made to independent contractors, the 1099-MISC serves a similar purpose as the Independent Contractor Pay Stub. It details the total amount paid to the contractor, but it is typically issued at the end of the tax year rather than for each payment cycle.

Paycheck Stub: This document is given to employees with each paycheck, showing gross pay, deductions, and net pay. The Independent Contractor Pay Stub shares this format, providing a breakdown of earnings, but it does not include payroll taxes or benefits typically associated with employment.

Invoice: Independent contractors often submit invoices to clients for services rendered. An invoice outlines the work performed and the payment due, similar to how a pay stub summarizes earnings. However, invoices are issued by the contractor, while pay stubs are issued by the payer.

Statement of Earnings: This document summarizes an individual's income over a specific period, often used for loan applications or financial assessments. Like the Independent Contractor Pay Stub, it provides a clear view of earnings, but it may not include detailed deductions or breakdowns.

Guidelines on Writing Independent Contractor Pay Stub

Completing the Independent Contractor Pay Stub form is a straightforward process that requires attention to detail. Once you have gathered the necessary information, you can ensure that all required fields are filled out accurately, which will help maintain clear records of payments made for services rendered.

- Gather Your Information: Collect all necessary details, including your name, address, and tax identification number.

- Enter Contractor Information: Fill in your name and contact information in the designated sections of the form.

- Specify Payment Details: Clearly indicate the payment amount, the date of payment, and the period for which the payment is made.

- Include Hours Worked: If applicable, list the number of hours worked during the pay period.

- Deduct Taxes: If required, note any deductions for taxes or other withholdings.

- Review for Accuracy: Double-check all entries to ensure that there are no mistakes or missing information.

- Sign and Date: Provide your signature and the date to validate the pay stub.

Once you have completed the form, keep a copy for your records. This will serve as a reference for future payments and may be necessary for tax reporting purposes.

Form Data

| Fact Name | Description |

|---|---|

| Definition | An Independent Contractor Pay Stub form is a document that outlines the earnings and deductions for independent contractors. |

| Purpose | This form helps contractors keep track of their income and assists in tax preparation. |

| Components | The pay stub typically includes details such as gross pay, deductions, and net pay. |

| State Variations | Some states may have specific requirements for what must be included in the pay stub. |

| Governing Laws | In California, for example, Labor Code Section 226 governs the information that must be provided on pay stubs. |

| Frequency | Independent contractors may receive pay stubs on a per-project basis or according to a regular payment schedule. |

| Tax Implications | Pay stubs can help contractors report income accurately to the IRS and state tax authorities. |

| Record Keeping | It's important for contractors to keep copies of their pay stubs for at least three years for tax purposes. |

| Employee vs. Contractor | Unlike employees, independent contractors do not have taxes withheld from their pay, making accurate record-keeping essential. |

Other PDF Documents

Flying Internationally With Dog - You must provide the pet's rabies vaccination status on the form.

For those exploring financing options, the California Promissory Note serves as a vital tool, ensuring that both parties have a clear understanding of the terms involved. To learn more about this important document, check out the comprehensive guide to Promissory Note essentials available here.

Erc Forms - Homeowner information is integral to the broker’s market analysis.

Doctors Prescription Pad - Facilitates the communication of medical prescriptions between doctors and pharmacists.