Valid Transfer-on-Death Deed Form for Illinois State

The Illinois Transfer-on-Death Deed (TOD) form offers a straightforward way for property owners to pass their real estate to beneficiaries without the need for probate. This legal tool allows individuals to retain full control of their property during their lifetime while designating who will inherit it upon their death. By completing and recording this deed, property owners can ensure a seamless transfer, avoiding the often lengthy and costly probate process. The form requires specific information, including the names of the beneficiaries and a clear description of the property. Importantly, the TOD deed can be revoked or changed at any time, providing flexibility as circumstances evolve. Understanding the nuances of this form is crucial for anyone looking to simplify their estate planning and secure their loved ones' future.

Similar forms

The Transfer-on-Death Deed (TOD) is a unique legal document that allows individuals to transfer property to beneficiaries upon their death without going through probate. However, there are several other documents that share similar characteristics. Here’s a list of ten documents that are comparable to the Transfer-on-Death Deed:

- Will: A will outlines how a person's assets will be distributed after their death. Like a TOD deed, it allows for the transfer of property, but it typically requires probate.

- Living Trust: This document holds assets during a person's lifetime and specifies how they should be distributed after death. It avoids probate, similar to a TOD deed.

- Beneficiary Designation: Commonly used for life insurance policies and retirement accounts, this allows individuals to name beneficiaries who will receive assets directly upon death, bypassing probate.

- Joint Tenancy: This form of ownership allows two or more people to own property together. When one owner passes away, the property automatically transfers to the surviving owner, akin to a TOD deed.

- Cracker Barrel Background Check Form: The Cracker Barrel Background Check form is essential for applicants to consent to necessary background verifications. For more information, visit OnlineLawDocs.com.

- Payable-on-Death (POD) Account: This bank account allows the account holder to designate a beneficiary who will receive the funds upon their death, avoiding probate similar to a TOD deed.

- Transfer-on-Death Registration: Used for securities, this allows the owner to designate a beneficiary who will receive the securities upon death, similar to the TOD deed's purpose for real estate.

- Life Estate Deed: This deed allows a person to retain the right to use property during their lifetime while transferring ownership to another party after their death, paralleling the TOD deed's function.

- Community Property with Right of Survivorship: In some states, this form of ownership allows spouses to own property together, automatically transferring ownership to the surviving spouse upon death, similar to a TOD deed.

- Health Care Proxy: While primarily focused on medical decisions, this document can also specify what happens to certain assets, similar to how a TOD deed handles property transfers.

- Durable Power of Attorney: This allows an individual to designate someone to manage their financial affairs. While it doesn't transfer property upon death, it can facilitate asset management similar to a TOD deed.

Each of these documents serves a unique purpose but shares the common goal of simplifying the transfer of assets and minimizing the complications that can arise after a person's passing.

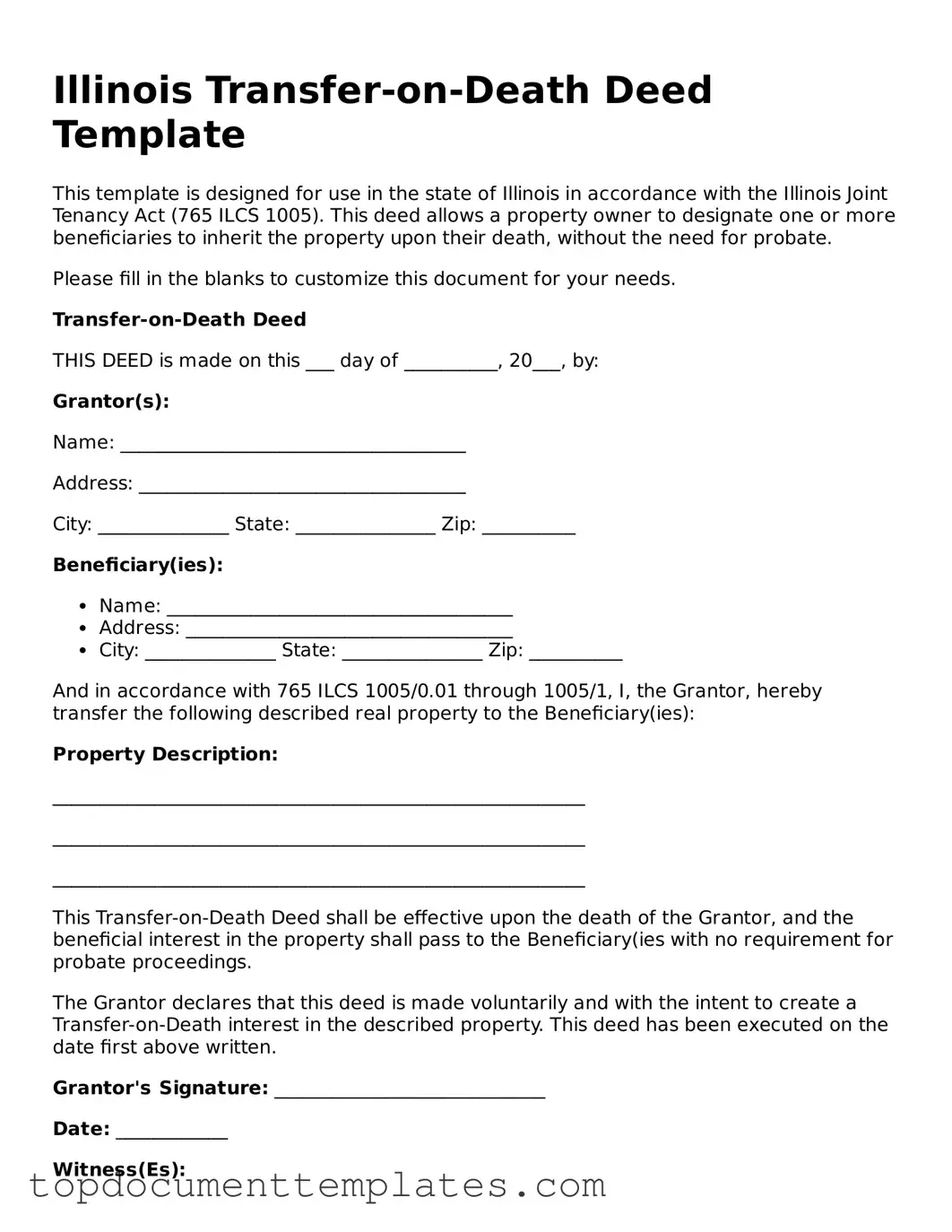

Guidelines on Writing Illinois Transfer-on-Death Deed

After you have gathered the necessary information, you can begin filling out the Illinois Transfer-on-Death Deed form. Make sure to have the details of the property and the beneficiaries ready. Following these steps will help ensure that the form is completed correctly.

- Begin by entering your name as the current owner of the property at the top of the form.

- Provide your address in the designated space below your name.

- Next, write the legal description of the property. This can usually be found on your property tax bill or deed.

- Indicate the county where the property is located.

- List the names of the beneficiaries who will inherit the property. Include their addresses as well.

- Sign and date the form at the bottom. Ensure that your signature matches the name you provided at the top.

- Have the form notarized. This step is important to validate the document.

- Finally, file the completed form with the county recorder’s office where the property is located.

File Information

| Fact Name | Details |

|---|---|

| Definition | An Illinois Transfer-on-Death Deed allows a property owner to transfer real estate to a beneficiary upon their death without going through probate. |

| Governing Law | The Transfer-on-Death Deed is governed by the Illinois Probate Act, specifically 755 ILCS 27. |

| Eligibility | Any individual who owns real estate in Illinois can create a Transfer-on-Death Deed. |

| Beneficiary Designation | Property owners can name one or more beneficiaries in the deed, and they can also specify alternate beneficiaries. |

| Revocation | The deed can be revoked at any time by the property owner, as long as they follow the proper legal procedures. |

| Execution Requirements | The deed must be signed by the property owner and notarized to be valid. |

| Filing | The Transfer-on-Death Deed must be recorded with the county recorder's office where the property is located. |

| Tax Implications | Beneficiaries may be subject to property taxes, but the transfer itself does not incur capital gains taxes until the property is sold. |

| Effectiveness | The deed becomes effective immediately upon the death of the property owner. |

| Limitations | Transfer-on-Death Deeds cannot be used for certain types of property, such as joint tenancy properties or properties held in trust. |

Other Popular Transfer-on-Death Deed State Forms

Survivorship Deed Vs Transfer on Death - It can be particularly beneficial for married couples looking to streamline asset distribution.

The IRS W-9 form is a document used by individuals and businesses to provide their taxpayer identification information to others, typically for tax reporting purposes. This form is essential for freelancers, contractors, and service providers who need to report their earnings to the IRS. By completing the W-9, individuals and entities ensure compliance with tax laws while facilitating clear communication of financial information. For more details, you can visit documentonline.org/blank-irs-w-9.

Transfer on Death Deed Florida Form - Use this deed to clarify your intentions with property ownership.

How to Avoid Probate in New Jersey - Property transferred by this deed does not count as part of your estate for tax purposes.