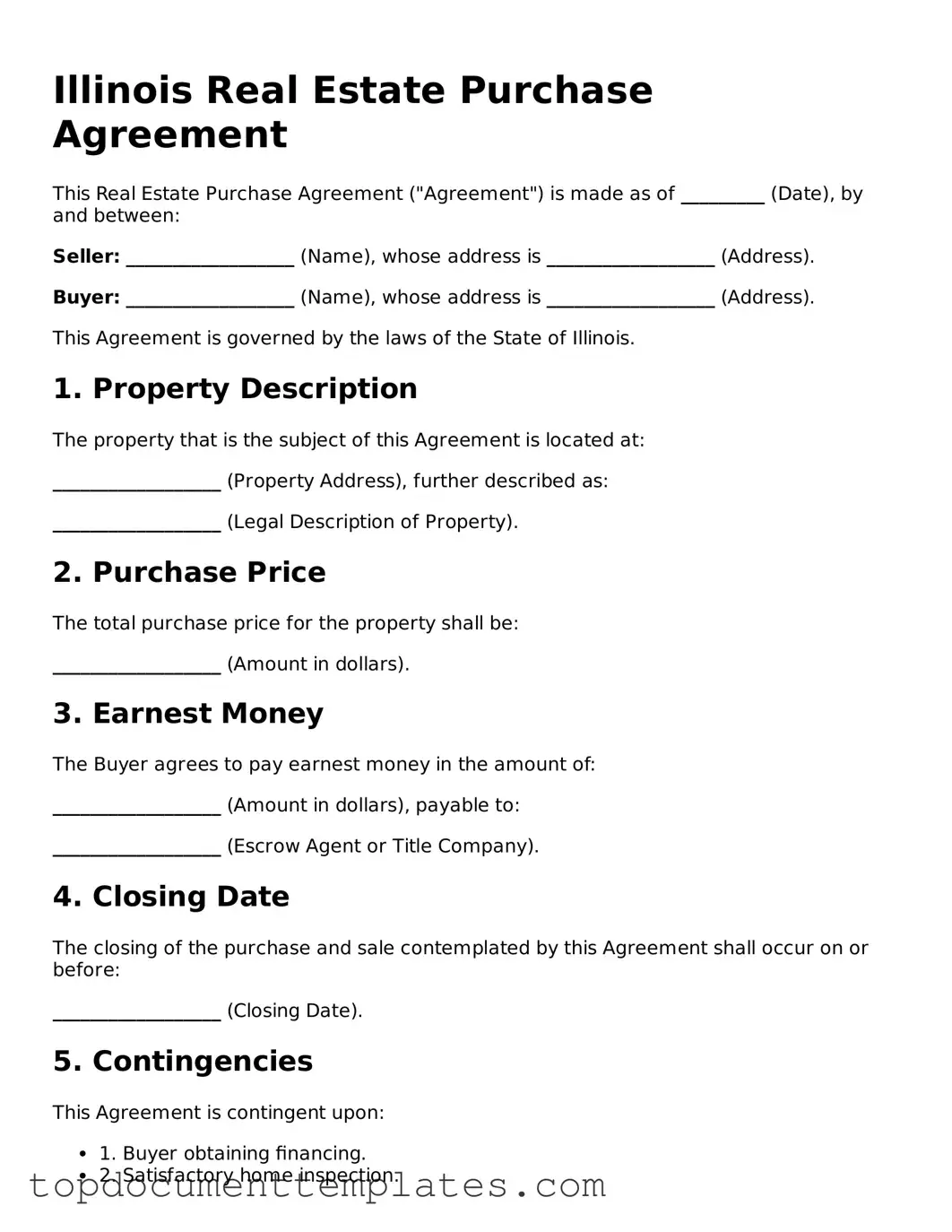

Valid Real Estate Purchase Agreement Form for Illinois State

The Illinois Real Estate Purchase Agreement form is a crucial document that facilitates the transaction process between buyers and sellers in real estate deals. This form outlines the terms and conditions under which a property is bought and sold, ensuring that both parties understand their rights and obligations. Key components of the agreement include the purchase price, property description, and closing date. Additionally, it addresses contingencies such as financing and inspections, which can affect the completion of the sale. The form also specifies earnest money deposits, which demonstrate the buyer's commitment to the transaction. By clearly stating the responsibilities of each party, the Illinois Real Estate Purchase Agreement aims to minimize misunderstandings and disputes, providing a structured approach to real estate transactions. Understanding this form is essential for anyone involved in buying or selling property in Illinois, as it serves as the foundation for a successful real estate deal.

Similar forms

The Real Estate Purchase Agreement (REPA) is a crucial document in the world of real estate transactions. However, it shares similarities with several other important documents. Here’s a look at five documents that resemble the REPA and how they relate to it:

- Lease Agreement: Like the REPA, a lease agreement outlines the terms under which one party can use another party's property. It specifies the duration, payment terms, and responsibilities of both the landlord and tenant, ensuring clarity in the rental relationship.

- Option to Purchase Agreement: This document gives a potential buyer the right to purchase a property within a specified timeframe. Similar to the REPA, it outlines the purchase price and conditions, providing a framework for the eventual sale of the property.

- Employee Handbook: An employee handbook is vital in delineating workplace policies and expectations, fostering a transparent environment where the guidelines are clear. For more information, visit OnlineLawDocs.com.

- Purchase and Sale Agreement: Often used interchangeably with the REPA, this document details the terms of a real estate transaction, including price, closing date, and contingencies. Both agreements aim to protect the interests of buyers and sellers in a property transfer.

- Escrow Agreement: An escrow agreement involves a neutral third party holding funds or documents until certain conditions are met. Like the REPA, it helps ensure that both parties fulfill their obligations before the transaction is completed, adding a layer of security to the process.

- Disclosure Statement: This document provides essential information about a property's condition, including any known defects or issues. While the REPA focuses on the terms of the sale, the disclosure statement complements it by ensuring buyers are informed about what they are purchasing.

Guidelines on Writing Illinois Real Estate Purchase Agreement

Completing the Illinois Real Estate Purchase Agreement form is a straightforward process that requires attention to detail. After filling out this form, the next steps typically involve reviewing the agreement with all parties involved and possibly consulting with a real estate attorney or agent to ensure everything is in order.

- Obtain the Form: Start by downloading the Illinois Real Estate Purchase Agreement form from a reliable source or request a copy from your real estate agent.

- Fill in Buyer Information: Enter the full name and contact details of the buyer(s) in the designated section.

- Fill in Seller Information: Provide the seller(s) name and contact information, ensuring accuracy.

- Property Description: Clearly describe the property being purchased, including the address and any relevant details like lot number or legal description.

- Purchase Price: State the agreed-upon purchase price for the property.

- Earnest Money: Specify the amount of earnest money the buyer will deposit, along with the terms of its return if the sale does not proceed.

- Financing Details: Indicate how the buyer plans to finance the purchase, whether through a mortgage, cash, or other means.

- Closing Date: Agree on a closing date and fill it in, allowing time for any necessary inspections or appraisals.

- Contingencies: List any contingencies that must be met before the sale can proceed, such as home inspections or financing approval.

- Signatures: Ensure that all parties sign and date the agreement at the bottom of the form.

File Information

| Fact Name | Description |

|---|---|

| Governing Law | The Illinois Real Estate Purchase Agreement is governed by the Illinois Compiled Statutes, specifically the Real Estate License Act of 2000. |

| Purpose | This form serves as a legally binding contract between a buyer and a seller for the purchase of real estate in Illinois. |

| Parties Involved | The agreement includes the names and contact information of both the buyer and the seller. |

| Property Description | A detailed description of the property being sold must be included in the agreement. |

| Purchase Price | The form specifies the agreed-upon purchase price for the property. |

| Earnest Money | The agreement typically outlines the amount of earnest money the buyer will provide to demonstrate their commitment. |

| Contingencies | Buyers and sellers can include contingencies, such as financing or inspection requirements, to protect their interests. |

| Closing Date | The form specifies the anticipated closing date, when the property transfer will take place. |

Other Popular Real Estate Purchase Agreement State Forms

Free Florida Real Estate Forms - A Real Estate Purchase Agreement may include clauses regarding financing disclosures.

Michigan Real Estate Forms - It usually contains information on property surveys and inspections.

When engaging in the purchase or sale of a horse, knowing the legal documents is crucial. The detailed Horse Bill of Sale requirements ensure that all necessary information is clearly stated, providing both parties with a reliable record of the transaction.

How to Make a Purchase Agreement - Understanding due diligence is essential before finalizing the purchase agreement.