Valid Promissory Note Form for Illinois State

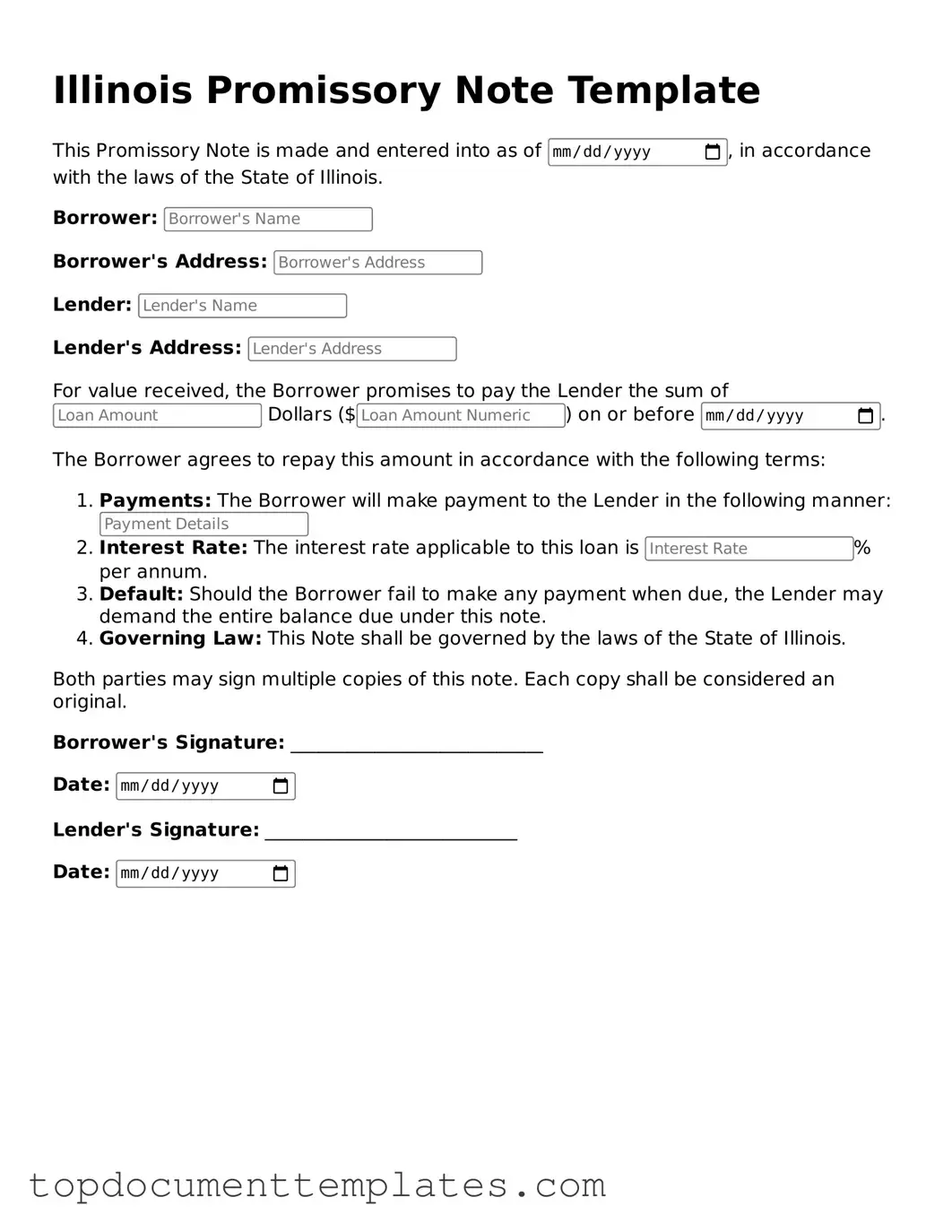

The Illinois Promissory Note form serves as a crucial document in financial transactions, establishing a clear agreement between a borrower and a lender. This legally binding instrument outlines the terms of a loan, including the principal amount, interest rate, repayment schedule, and any applicable fees. It is essential for both parties to understand their rights and obligations as specified in the note. The form typically includes provisions for default, allowing lenders to take necessary actions should the borrower fail to meet their repayment commitments. Additionally, the Illinois Promissory Note may require signatures from both parties to validate the agreement, ensuring that all terms are mutually acknowledged. By using this form, individuals and businesses can protect their interests while fostering transparent financial relationships.

Similar forms

- Loan Agreement: A loan agreement outlines the terms and conditions of a loan, similar to a promissory note. Both documents detail the amount borrowed, interest rates, and repayment terms.

- Mortgage: A mortgage is a specific type of loan used to purchase real estate. Like a promissory note, it includes the borrower's promise to repay the loan, but it also involves the property as collateral.

- Installment Agreement: An installment agreement allows a borrower to repay a debt in regular payments. This is akin to a promissory note, which also specifies repayment terms and schedules.

- Power of Attorney: This document is essential for empowering an individual to act on another's behalf in legal matters, ensuring their wishes are honored. For comprehensive templates, visit TopTemplates.info.

- Credit Agreement: A credit agreement governs the terms under which credit is extended. Similar to a promissory note, it details the obligations of the borrower and the lender regarding repayment.

- Secured Note: A secured note is a promissory note backed by collateral. Both documents include repayment obligations, but a secured note provides additional security for the lender.

- Personal Guarantee: A personal guarantee involves an individual agreeing to repay a debt if the primary borrower defaults. Like a promissory note, it establishes a legal obligation to pay.

- Lease Agreement: A lease agreement outlines the terms for renting property. While primarily for rental purposes, it includes payment terms similar to those found in a promissory note.

Guidelines on Writing Illinois Promissory Note

After you have obtained the Illinois Promissory Note form, you will need to complete it accurately. This document will serve as a record of the loan agreement between the borrower and the lender. Ensure that all information is filled out clearly to avoid any misunderstandings in the future.

- Begin by entering the date at the top of the form.

- Fill in the name and address of the borrower. This is the person or entity receiving the loan.

- Next, provide the name and address of the lender. This is the person or entity providing the loan.

- Specify the principal amount of the loan. This is the total amount being borrowed.

- Indicate the interest rate, if applicable. Clearly state whether the interest is fixed or variable.

- Outline the repayment terms. Include the due date for repayment and the schedule (monthly, quarterly, etc.).

- Include any additional terms or conditions that both parties have agreed upon.

- Have the borrower sign and date the document. This signifies their agreement to the terms outlined in the note.

- If required, have the lender sign and date the document as well.

- Make copies of the completed form for both the borrower and the lender for their records.

File Information

| Fact Name | Details |

|---|---|

| Definition | An Illinois Promissory Note is a written promise to pay a specific amount of money to a designated person or entity. |

| Governing Law | The Illinois Uniform Commercial Code (UCC) governs promissory notes in Illinois. |

| Parties Involved | The note typically involves a maker (the borrower) and a payee (the lender). |

| Interest Rate | The interest rate can be fixed or variable, and must be clearly stated in the note. |

| Payment Terms | Payment terms, including due dates and installment amounts, should be specified in the document. |

| Signature Requirement | The maker must sign the promissory note for it to be enforceable. |

| Notarization | Notarization is not required, but it may enhance the note’s credibility. |

| Default Clause | A default clause may be included to outline the consequences of non-payment. |

| Transferability | Promissory notes can be transferred to another party, subject to certain conditions. |

| State-Specific Considerations | Illinois law may impose additional requirements or restrictions on promissory notes. |

Other Popular Promissory Note State Forms

Georgia Promissory Note - This form can facilitate improved communication regarding loan terms and obligations.

Promissory Note California - Defaults can sometimes lead to foreclosure when real estate is used as collateral.

For anyone looking to create a California Non-disclosure Agreement (NDA), it's essential to understand its importance in maintaining confidentiality. As outlined by resources from OnlineLawDocs.com, this legally binding document ensures that all parties involved can share sensitive information without the risk of unauthorized disclosure, thereby protecting vital trade secrets and proprietary information in a competitive environment.

Iowa Promissory Note - It can create a formal record that supports financial accountability.

Texas Promissory Note Requirements - Standard terms often include the due date and any prepayment penalties or discounts.