Valid Loan Agreement Form for Illinois State

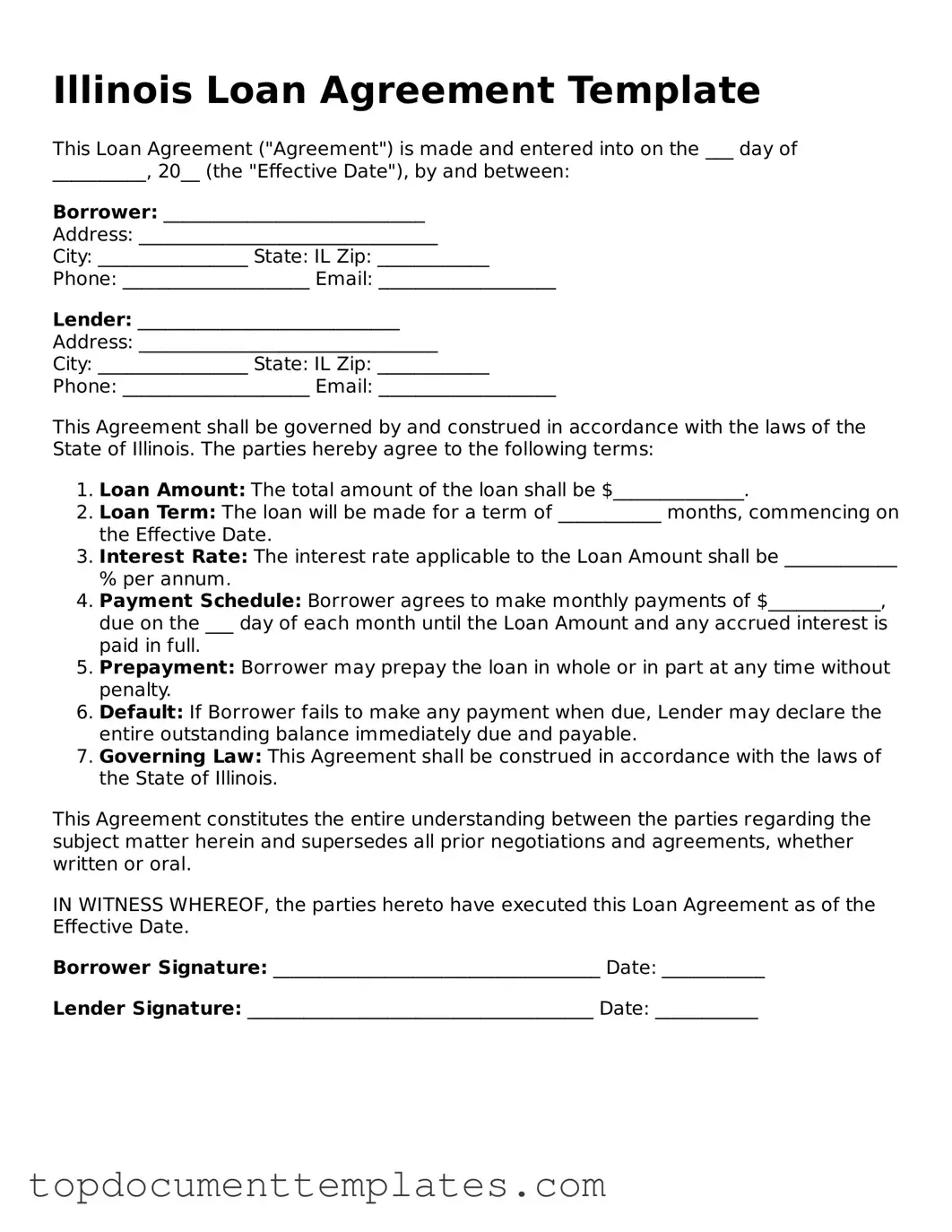

In the realm of personal and business financing, the Illinois Loan Agreement form serves as a crucial tool for establishing clear terms between lenders and borrowers. This document outlines the specifics of the loan arrangement, including the amount borrowed, interest rates, repayment schedules, and any applicable fees. By detailing the rights and responsibilities of both parties, the form aims to minimize misunderstandings and disputes that may arise during the loan period. It typically includes sections that address late payment penalties, collateral requirements, and provisions for default, ensuring that all parties are aware of the potential consequences of non-compliance. Furthermore, the Illinois Loan Agreement is designed to comply with state regulations, providing a framework that protects the interests of both lenders and borrowers. By utilizing this form, individuals and businesses can navigate the complexities of borrowing with greater confidence and clarity.

Similar forms

-

Promissory Note: This document outlines a borrower's promise to repay a loan under specified terms. Like a Loan Agreement, it includes details such as the loan amount, interest rate, and repayment schedule.

-

Mortgage Agreement: A Mortgage Agreement secures a loan with real property. Similar to a Loan Agreement, it defines the loan terms but also includes provisions about the property being used as collateral.

-

Credit Agreement: This document governs the terms of a line of credit. It shares similarities with a Loan Agreement in that it specifies the amount of credit available, interest rates, and repayment conditions.

Hold Harmless Agreement: This legally binding document ensures that one party agrees not to hold another liable for any damages or losses. It's essential for protecting against legal risks and can be crucial in various transactions. For more detailed information, visit onlinelawdocs.com/.

-

Security Agreement: A Security Agreement outlines the collateral provided for a loan. Like a Loan Agreement, it details the obligations of the borrower and the rights of the lender regarding the collateral.

Guidelines on Writing Illinois Loan Agreement

Filling out the Illinois Loan Agreement form is straightforward. This document is essential for clearly outlining the terms of a loan between a lender and a borrower. Follow the steps below to ensure that you complete the form correctly.

- Begin by entering the date at the top of the form. This is the date when the agreement is being made.

- Fill in the full name and address of the lender. Make sure to include any relevant contact information.

- Next, provide the full name and address of the borrower. Again, include contact details for clarity.

- Specify the total amount of the loan in the designated section. Be precise with the numbers.

- Indicate the interest rate applicable to the loan. This should be expressed as a percentage.

- State the repayment terms. This includes the duration of the loan and the schedule for repayments.

- Include any additional terms or conditions that both parties have agreed upon. This may cover late fees or prepayment options.

- Both the lender and borrower must sign and date the form at the bottom. Ensure that all signatures are clear.

Once you have completed these steps, review the form for any errors. It's important that all information is accurate before finalizing the agreement. Keep a copy for your records.

File Information

| Fact Name | Details |

|---|---|

| Purpose | The Illinois Loan Agreement form is used to document the terms and conditions of a loan between a lender and a borrower. |

| Governing Law | This agreement is governed by the laws of the State of Illinois. |

| Parties Involved | The form requires the identification of both the lender and the borrower, including their names and contact information. |

| Loan Terms | It outlines the loan amount, interest rate, repayment schedule, and any fees associated with the loan. |

| Signatures | Both parties must sign the agreement to make it legally binding. |

Other Popular Loan Agreement State Forms

Florida Promissory Note Template - This form includes any collateral securing the loan, if applicable.

When engaging in a transaction, it is important to utilize the Illinois Bill of Sale form, which acts as a formal record of ownership transfer for personal property. It helps protect both parties' rights by clearly documenting the sale details, and for further information, you can visit https://documentonline.org/blank-illinois-bill-of-sale/.

Promissory Note Template California Word - Include an acknowledgement of the borrower's ability to repay the loan.