Valid Deed in Lieu of Foreclosure Form for Illinois State

In the state of Illinois, homeowners facing the possibility of foreclosure have a valuable alternative known as the Deed in Lieu of Foreclosure. This legal process allows property owners to voluntarily transfer the ownership of their home back to the lender, effectively resolving their mortgage obligations without the lengthy and often stressful foreclosure process. By opting for this route, homeowners can minimize the impact on their credit scores and potentially avoid the public stigma associated with foreclosure. The Deed in Lieu of Foreclosure form outlines essential details, including the names of the parties involved, a description of the property, and the terms of the transfer. It serves as a formal agreement, ensuring that both the homeowner and the lender are clear on their rights and responsibilities. Additionally, this form may include provisions regarding any remaining debts, allowing for a smoother transition for the homeowner. Understanding the nuances of this form can empower individuals to make informed decisions during challenging financial times.

Similar forms

- Mortgage Release: This document formally releases the borrower from their mortgage obligations. It is similar to a deed in lieu because it signifies that the lender has agreed to forgive the debt, allowing the borrower to walk away from the property.

- Short Sale Agreement: In a short sale, the lender allows the homeowner to sell the property for less than what is owed. Both documents aim to avoid foreclosure and provide a solution for the borrower.

- Loan Modification Agreement: This document changes the terms of the original loan, such as interest rates or payment amounts. Like a deed in lieu, it seeks to help the borrower keep their home and avoid foreclosure.

- Forbearance Agreement: This agreement allows the borrower to temporarily stop making payments or reduce their payment amount. It provides a way to avoid foreclosure while giving the borrower time to recover financially.

- Bankruptcy Filing: Filing for bankruptcy can halt foreclosure proceedings. It offers the borrower a chance to reorganize their debts, similar to how a deed in lieu allows them to exit their mortgage obligation.

- California Power of Attorney: A California Power of Attorney form allows individuals to designate someone to make critical decisions on their behalf. This legal document is essential for ensuring that personal, financial, and health-related matters are managed according to the individual's preferences when they cannot make decisions themselves, as detailed on OnlineLawDocs.com.

- Release of Lien: This document removes a lender's claim on a property. Both it and a deed in lieu can free the borrower from financial obligations tied to the property.

- Quitclaim Deed: This document transfers ownership of a property without warranties. It can serve a similar purpose as a deed in lieu by transferring property back to the lender.

- Deed of Trust: This document secures a loan by placing a lien on the property. While it is typically used to establish a loan, it can be part of the process leading to a deed in lieu if the borrower defaults.

- Property Settlement Agreement: Often used in divorce, this document divides property between parties. Like a deed in lieu, it can help resolve ownership issues without foreclosure.

Guidelines on Writing Illinois Deed in Lieu of Foreclosure

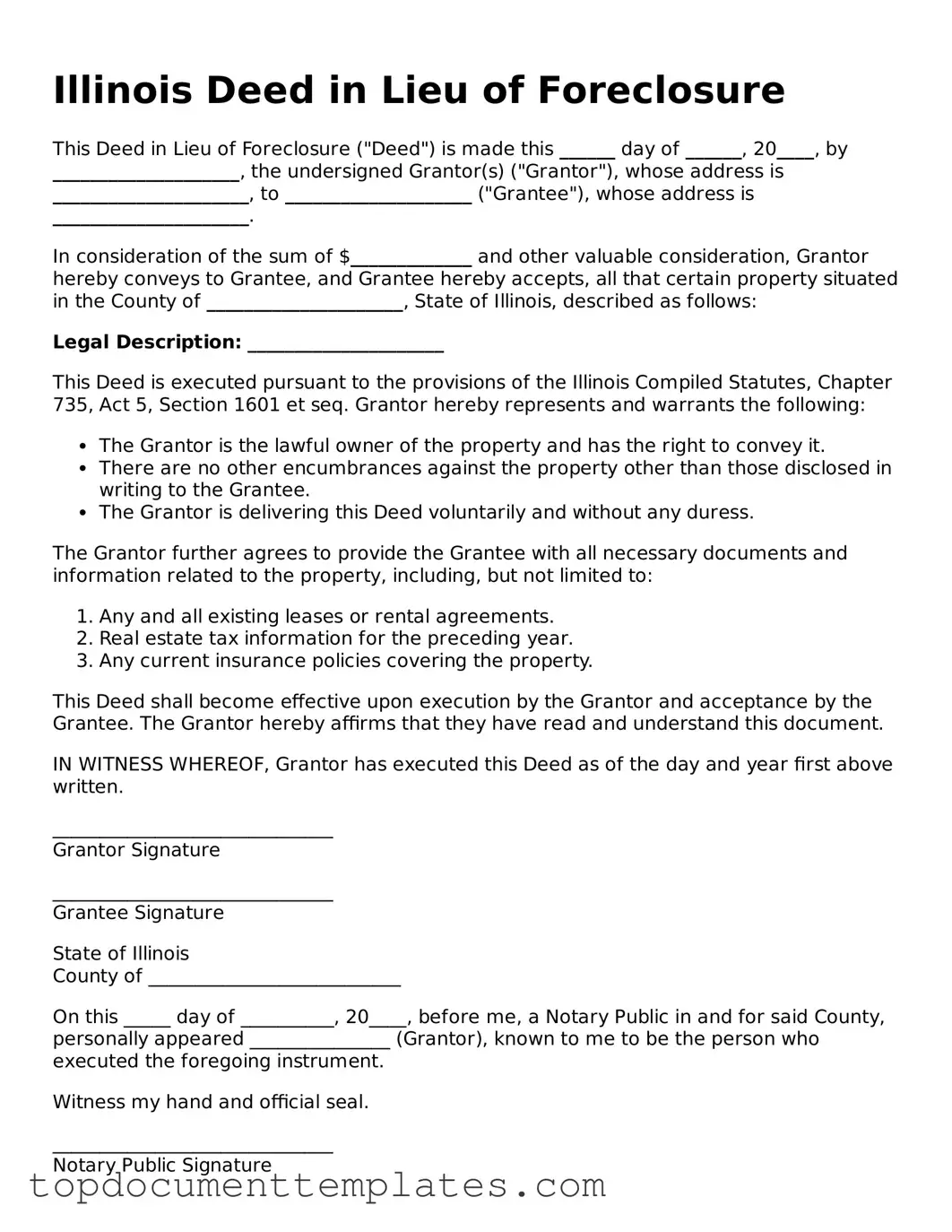

Once you have the Illinois Deed in Lieu of Foreclosure form, it’s important to complete it accurately. This document allows a homeowner to transfer their property back to the lender to avoid foreclosure. Following the correct steps will help ensure that the process goes smoothly.

- Start with the title of the document. At the top of the form, clearly write "Deed in Lieu of Foreclosure."

- Provide the name of the property owner(s). Include the full legal names as they appear on the property title.

- Next, enter the name of the lender or mortgage company. This should also be the full legal name.

- Fill in the property address. Include the street address, city, state, and ZIP code.

- State the legal description of the property. This can usually be found on the original deed or mortgage documents.

- Indicate the date of the transfer. This is the date when the deed is signed.

- Sign the document. The property owner(s) must sign the deed in front of a notary public.

- Have the deed notarized. A notary will verify the identity of the signers and witness the signing.

- Submit the completed deed to the county recorder's office. This step is crucial for the deed to be officially recognized.

After completing these steps, ensure that you keep a copy of the signed and notarized deed for your records. The lender will then process the deed, and you will receive confirmation of the transfer. It’s advisable to follow up with the lender to ensure everything is in order.

File Information

| Fact Name | Description |

|---|---|

| Definition | The Deed in Lieu of Foreclosure is a legal document where a borrower voluntarily transfers property ownership to the lender to avoid foreclosure. |

| Governing Law | This process is governed by the Illinois Compiled Statutes, specifically 735 ILCS 5/15-1401. |

| Purpose | The primary purpose is to allow borrowers to settle their mortgage obligations without going through the lengthy foreclosure process. |

| Benefits | Benefits include potentially less damage to the borrower's credit score and a quicker resolution compared to foreclosure. |

Other Popular Deed in Lieu of Foreclosure State Forms

Georgia Foreclosure Laws - Borrowers can negotiate the timeline for vacating the property after signing the deed.

The Loan Servicer Might Agree to Put the Foreclosure on Hold to Give You Some Time to Sell Your Home - Once completed, all parties should retain a copy of the deed for their records and future reference.

California Voluntary Foreclosure Deed - It's important for homeowners to understand the terms and conditions fully before proceeding with a Deed in Lieu.

Understanding the complexities of the application process is crucial, and resources like TopTemplates.info can provide invaluable guidance to applicants navigating the USCIS I-589 form and its requirements.

Deed in Lieu Vs Foreclosure - Clear guidelines typically accompany a Deed in Lieu to clarify each party's responsibilities.