Valid Deed Form for Illinois State

The Illinois Deed form plays a crucial role in real estate transactions within the state, serving as the legal instrument that facilitates the transfer of property ownership. This document is essential for ensuring that the rights of both the grantor, or seller, and the grantee, or buyer, are clearly outlined and protected. Typically, the form includes vital information such as the names of the parties involved, a detailed description of the property being transferred, and the type of deed being utilized, which can vary from warranty deeds to quitclaim deeds. Additionally, the Illinois Deed form must be executed with specific formalities, including signatures and notarization, to ensure its validity. Understanding the requirements and implications of this form is important for anyone engaged in buying or selling real estate in Illinois, as it lays the foundation for the legal transfer of property rights.

Similar forms

The Deed form is a crucial document in real estate and property transactions. It shares similarities with several other legal documents. Here are six documents that have comparable characteristics to the Deed form:

- Title: Like a Deed, a Title establishes ownership of a property. It provides proof that the seller has the right to transfer ownership to the buyer.

- Motor Vehicle Bill of Sale: This form is essential for documenting the sale of a vehicle in Illinois, providing proof of ownership transfer. For more information, visit documentonline.org/blank-illinois-motor-vehicle-bill-of-sale.

- Bill of Sale: This document serves to transfer ownership of personal property. Similar to a Deed, it must be signed by the seller to be valid.

- Lease Agreement: A Lease Agreement outlines the terms under which a tenant can occupy a property. Both documents require signatures and establish rights and responsibilities.

- Mortgage Agreement: This document secures a loan with the property as collateral. It is similar to a Deed in that it involves the transfer of interest in property and requires formal execution.

- Trust Agreement: A Trust Agreement can hold property for the benefit of another party. Like a Deed, it must clearly define the parties involved and the property in question.

- Quitclaim Deed: This specific type of Deed transfers any interest the grantor has in a property without warranties. It shares the fundamental characteristics of a standard Deed but with less assurance for the grantee.

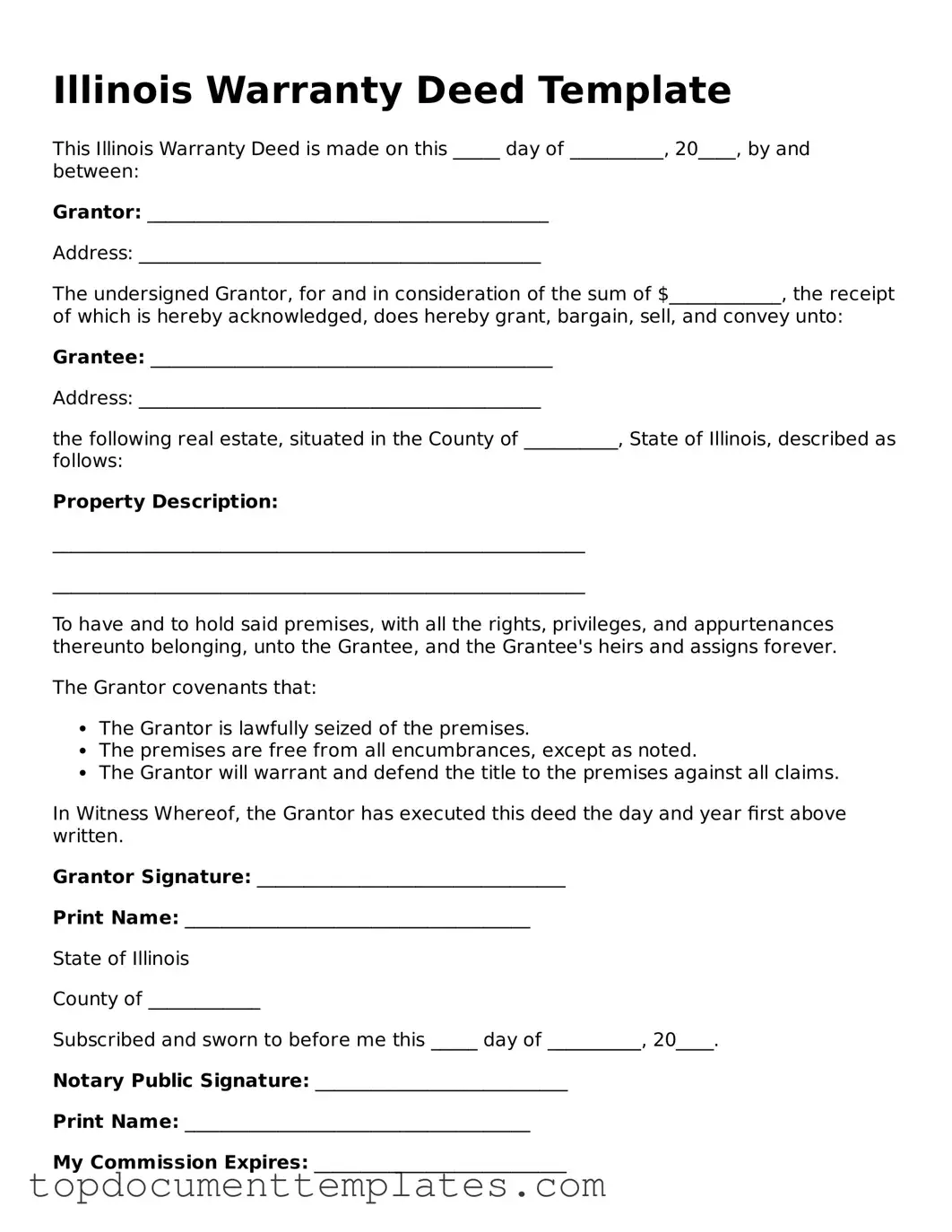

Guidelines on Writing Illinois Deed

After obtaining the Illinois Deed form, the next step involves filling it out accurately. This form is crucial for transferring property ownership. Ensure you have all necessary information at hand before starting the process.

- Begin by entering the date at the top of the form.

- Identify the grantor, the person or entity transferring the property. Provide their full name and address.

- Next, list the grantee, the person or entity receiving the property. Include their full name and address as well.

- Clearly describe the property being transferred. Include the legal description, which can usually be found in previous deeds or property tax documents.

- Indicate the consideration, or payment, for the property transfer. This can be a specific dollar amount or another form of compensation.

- Sign the form in the designated area. The grantor must sign, and it is advisable to have the signature notarized.

- Provide the date of the signature next to the grantor's signature.

- Finally, submit the completed form to the appropriate county office for recording.

File Information

| Fact Name | Details |

|---|---|

| Governing Law | The Illinois Deed form is governed by the Illinois Compiled Statutes, specifically 765 ILCS 1005. |

| Types of Deeds | Common types include warranty deeds, quitclaim deeds, and special warranty deeds. |

| Required Signatures | The deed must be signed by the grantor, the person transferring the property. |

| Notarization | A notary public must witness the signing of the deed for it to be valid. |

| Recording | To protect the interests of the grantee, the deed should be recorded with the local county recorder's office. |

| Legal Description | A complete legal description of the property must be included in the deed. |

| Consideration | The deed may include the consideration, or payment, made for the transfer of property. |

| Transfer Tax | Illinois imposes a transfer tax on the sale of real property, which must be paid at the time of recording. |

| Grantee Information | The name and address of the grantee, the person receiving the property, must be clearly stated. |

| Revocation | Once recorded, a deed cannot be revoked without the consent of the grantee, unless specific conditions are met. |

Other Popular Deed State Forms

Michigan House Deed - A vital step in selling or buying property.

The process of filling out the USCIS I-589 form can be daunting, but resources are available to assist applicants in navigating their way through it. For those looking for templates and guidance, TopTemplates.info offers valuable information that can help streamline the application process, ensuring that individuals present their case effectively and increase their chances of gaining the protection they seek.

Quick Claim Deeds Georgia - Contains information about the property’s legal description.