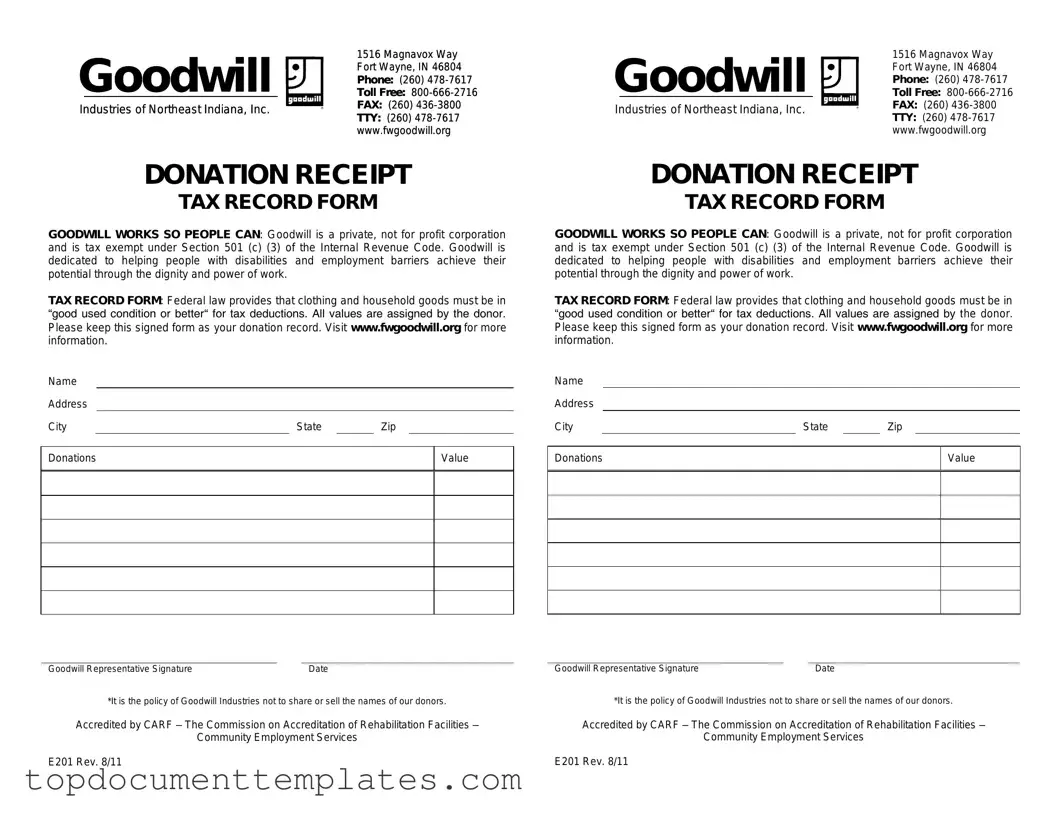

Blank Goodwill donation receipt PDF Form

When you donate items to Goodwill, you not only support a worthy cause but also have the opportunity to claim a tax deduction. Central to this process is the Goodwill donation receipt form, which serves as proof of your charitable contribution. This form typically includes essential details such as the date of the donation, a description of the items donated, and their estimated value. It's important to note that while the receipt acknowledges your generosity, it does not assign a specific dollar amount to your items; instead, it provides a space for you to assess their worth. Additionally, the form often includes information about Goodwill’s mission, reinforcing the impact of your donation on the community. Keeping this receipt is crucial for tax purposes, as it can help you substantiate your claims during tax season. Understanding the components of this form can streamline your donation experience and ensure that you receive the maximum benefit from your generosity.

Similar forms

- Charitable Contribution Receipt: This document serves as proof of a donation made to a charitable organization, similar to the Goodwill donation receipt. It typically includes the donor's name, the charity's name, and the value of the donated items.

- Tax Deduction Form: This form allows individuals to claim deductions for charitable donations on their tax returns. Like the Goodwill receipt, it requires details about the donation and the charity.

- Donation Acknowledgment Letter: Charities often send these letters to donors as confirmation of their contributions. They include information about the donation and serve a similar purpose to the Goodwill receipt.

- In-Kind Donation Receipt: This document is issued for non-cash donations, such as goods or services. It is similar to the Goodwill receipt in that it provides proof of the donation and its estimated value.

- Gift Receipt: When individuals give gifts to charities, they may receive a gift receipt. This document acknowledges the donation and can be used for tax purposes, just like the Goodwill receipt.

- Sales Receipt for Donated Goods: This receipt is provided when items are sold at a charity thrift store. It documents the sale and can serve a similar function to the Goodwill donation receipt.

- Volunteer Hours Log: While not a direct donation receipt, logging volunteer hours can sometimes be converted into a monetary value for tax purposes. This parallels the Goodwill receipt in recognizing contributions to a charitable cause.

- Nonprofit Organization Registration Form: This form is used by organizations to register as nonprofits. It shares a connection with the Goodwill receipt as both relate to charitable activities and tax-exempt status.

- Last Will and Testament: A crucial document that outlines your wishes regarding asset distribution after death. It also allows for the appointment of guardians for minor children and the designation of an executor to manage your estate. Understanding its importance is key to ensuring your desires are fulfilled and your loved ones are taken care of. For more information, visit https://documentonline.org/blank-last-will-and-testament/.

- Matching Gift Form: Employees may submit this form to their employer to match their charitable donations. It relates to the Goodwill receipt as both documents validate a donation for tax and matching purposes.

- End-of-Year Contribution Summary: Some charities provide a summary of all donations made throughout the year. This document is similar to the Goodwill receipt as it serves as a record for tax purposes.

Guidelines on Writing Goodwill donation receipt

Once you have gathered your items for donation to Goodwill, you will need to complete a donation receipt form. This form serves as a record of your contribution, which can be helpful for tax purposes. Follow these steps to ensure that you fill out the form correctly.

- Begin by locating the Goodwill donation receipt form. This form is typically available at the donation center or can be downloaded from the Goodwill website.

- Fill in your name in the designated space. Ensure that it is clearly written to avoid any confusion.

- Provide your address, including the city, state, and zip code. This information helps Goodwill keep accurate records of donations.

- Enter the date of your donation. This is important for tracking the timing of your charitable contribution.

- List the items you are donating. Be specific about each item, including the quantity and a brief description. This helps in establishing the value of your donation.

- If you have an estimated value for the items, write that down next to each item. If you are unsure, consider using a general guideline for valuation.

- Sign the form to certify that the information provided is accurate. Your signature indicates your agreement with the details listed.

- Keep a copy of the completed form for your records. This will serve as proof of your donation for tax purposes.

Form Data

| Fact Name | Description |

|---|---|

| Purpose | The Goodwill donation receipt form serves as a record for donors to document their charitable contributions for tax purposes. |

| Tax Deduction | Donors may be eligible to claim a tax deduction for the value of items donated to Goodwill, subject to IRS regulations. |

| Item Valuation | Donors are responsible for determining the fair market value of the donated items, as Goodwill does not assign values. |

| State-Specific Requirements | Some states may have specific requirements regarding the documentation of donations; for example, California law requires a written acknowledgment for donations over $250. |

| Record Keeping | It is advisable for donors to keep a copy of the receipt along with a list of donated items for their personal records and tax filings. |

Other PDF Documents

No Trespassing Letter to Neighbor - This letter must be regarded as an official warning regarding access to my location.

Utilizing a well-structured Dnd Character Sheet form is crucial for any player looking to navigate the intricacies of their character's journey, as it consolidates all vital aspects of gameplay. From tracking abilities to managing spells, this form acts as a comprehensive guide that enriches each session. For those seeking easy access to a user-friendly format, resources such as OnlineLawDocs.com can be immensely helpful.

P45 Uk - Employees must fill in their details with capital letters for clarity on the form.

Is Progressive Cheaper Than Geico - This process is essential to expedite claims for damages.