Blank Gift Letter PDF Form

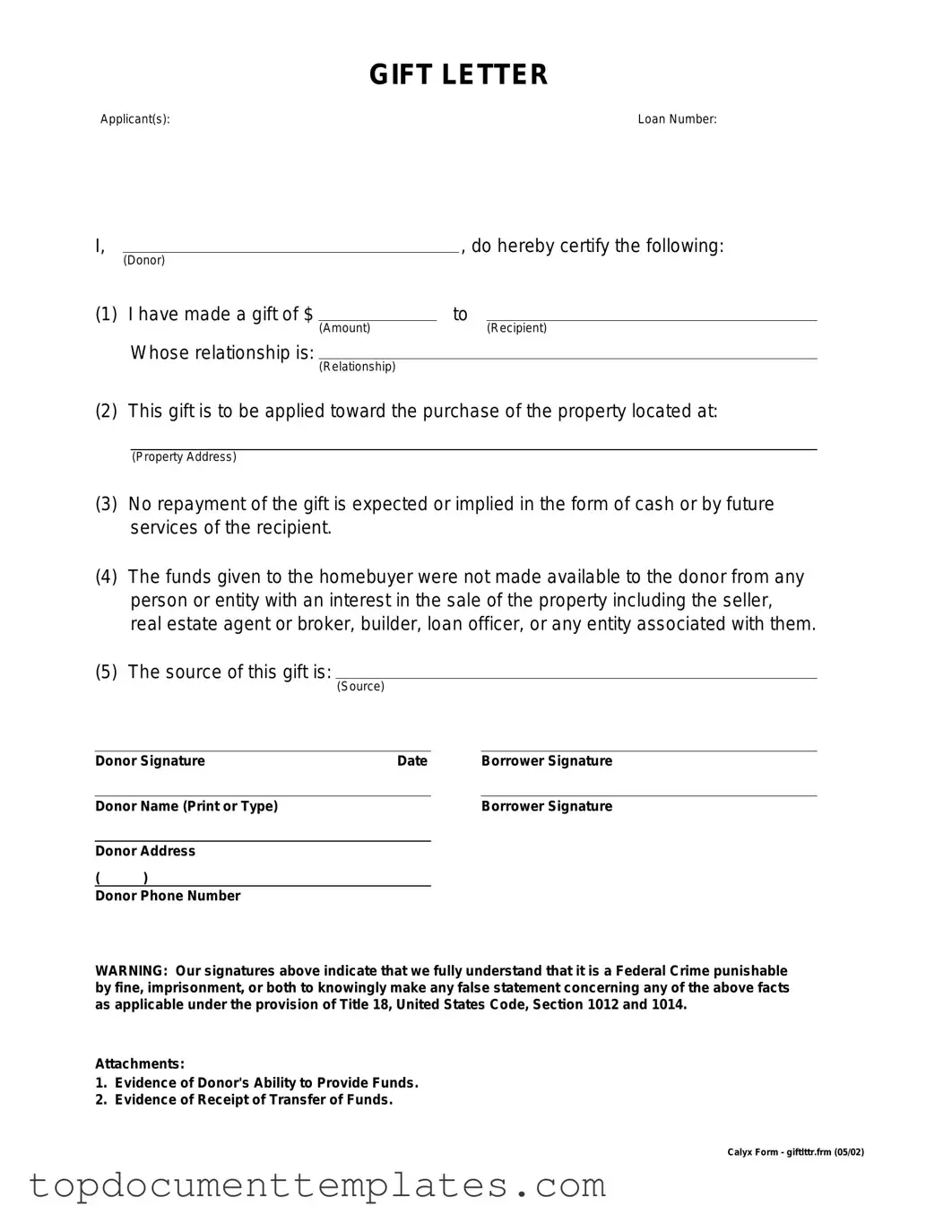

When navigating the complexities of real estate transactions, the Gift Letter form emerges as a crucial document, particularly for individuals receiving financial assistance from family or friends to purchase a home. This form serves as a formal declaration, affirming that the funds provided are indeed a gift and not a loan, thereby alleviating potential concerns from lenders about repayment obligations. Typically, the Gift Letter includes essential details such as the donor's name, the recipient's name, the amount of the gift, and a clear statement that the funds are a gift with no expectation of repayment. Furthermore, the form often requires the donor's signature, which adds an extra layer of authenticity and commitment. By clarifying the nature of the financial assistance, the Gift Letter helps streamline the mortgage approval process, ensuring that both parties understand the terms of the gift. In essence, this simple yet vital document plays a significant role in facilitating homeownership for many, making it an important topic for anyone involved in the buying process.

Similar forms

-

Affidavit of Support: This document is often used to demonstrate financial support from a family member or friend. It outlines the supporter's income and willingness to assist the recipient financially, similar to how a Gift Letter confirms the donor's intention to provide a gift for a specific purpose.

-

Loan Agreement: A Loan Agreement details the terms under which money is borrowed. While a Gift Letter states that funds are a gift with no repayment required, both documents establish the financial relationship between parties involved.

Florida Affidavit of Residency Form: To confirm residency in Florida for various legal purposes, refer to our essential Affidavit of Residency documentation to facilitate compliance with state requirements.

-

Financial Statement: This document provides an overview of an individual's financial situation. Like a Gift Letter, it may be used in loan applications to show financial stability, but it focuses more on overall assets and liabilities rather than specific gifts.

-

Promissory Note: A Promissory Note is a written promise to pay a specific amount of money at a future date. It is similar to a Gift Letter in that it involves a transfer of funds, but it requires repayment, contrasting the non-repayable nature of a gift.

-

Declaration of Gift: This document formally states that a gift has been made. It serves a similar purpose to a Gift Letter by confirming the donor's intention, but it may include additional details about the gift's value and purpose.

Guidelines on Writing Gift Letter

After obtaining the Gift Letter form, you will need to provide specific information to ensure it is filled out correctly. This form is essential for documenting any monetary gifts that may assist in financial transactions, such as home purchases. Follow these steps to complete the form accurately.

- Start by entering the date at the top of the form.

- Fill in the name of the donor, the person giving the gift.

- Provide the donor's address, including the city, state, and zip code.

- Next, include the recipient's name, the person receiving the gift.

- Fill in the recipient's address, ensuring accuracy in the city, state, and zip code.

- Indicate the amount of the gift in the designated space.

- Clearly state the relationship between the donor and the recipient.

- Sign and date the form at the bottom to validate the information provided.

Once completed, the Gift Letter form should be submitted as required for your financial process. Ensure all information is accurate to avoid any delays in processing.

Form Data

| Fact Name | Description |

|---|---|

| Purpose | A Gift Letter form is used to document a monetary gift, typically for a home purchase, ensuring that the funds do not need to be repaid. |

| Donor and Recipient | The form requires information about both the donor (the person giving the gift) and the recipient (the person receiving the gift). |

| Signature Requirement | Both the donor and the recipient must sign the form to validate the gift and confirm the terms. |

| Tax Implications | Gifts above a certain amount may have tax implications for the donor, potentially requiring them to file a gift tax return. |

| State-Specific Forms | Some states may have specific requirements or forms for gift letters. It’s important to check local regulations. |

| Loan Approval | Lenders often require a Gift Letter to ensure that the funds are a true gift and not a loan, which could affect loan approval. |

| Governing Laws | In the United States, gift transactions are generally governed by state laws, which can vary significantly. |

| Format Flexibility | While many lenders have their own Gift Letter templates, a simple written letter can also suffice if it includes all necessary information. |

Other PDF Documents

5 Wishes Document - Your Five Wishes can be updated or replaced as your healthcare needs evolve over time.

When dealing with financial transactions, a well-structured document is key; understanding the significance of the Promissory Note as part of your financial agreements can lead to smoother dealings. For further guidance, consider exploring more about the key elements of a thoughtful Promissory Note to ensure you cover all essential aspects.

Citi Bank Direct Deposit Form - Direct deposit helps you avoid banking waiting times.